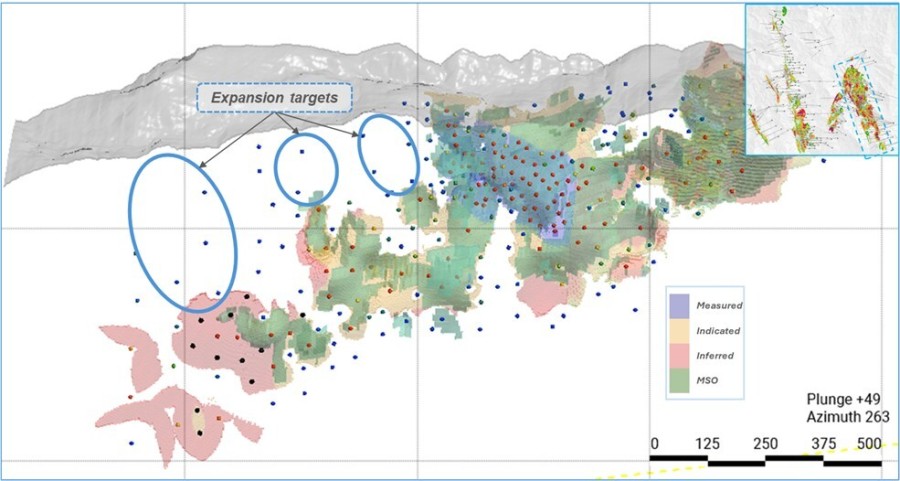

VANCOUVER, British Columbia and JOHANNESBURG, South Africa, Dec. 11, 2017 (GLOBE NEWSWIRE) -- Platinum Group Metals Ltd. (TSX:PTM) (NYSE American:PLG) (“Platinum Group” “PTM” or the “Company”) is pleased to announce that the ongoing Definitive Feasibility Study (“DFS”) for the Waterberg Project is now being advanced under the direction of the Technical Committee appointed by Waterberg JV Resources (Pty) Ltd. (“Waterberg JV Co.”). Seventeen drill rigs are on site and have commenced drilling with the objectives of defining the shallowest areas of the current 102 million tonne reserve (details below) for increased confidence and detailed mine planning and to upgrade a portion of the indicated resources to measured resources for reserve consideration in the DFS. Immediate areas for in-fill drilling include the Northern and Boundary Super F zones.

The Scope of Work and plans for the DFS during 2017 and 2018 have been agreed in detail by the Technical Committee. Members of the committee represent the Company and all other Waterberg Project partners; Impala Platinum Holdings Ltd. (“Implats”), Japan Oil, Gas and Metals National Corporation (“JOGMEC”) and Mnombo Wethu Consultants (Pty) Ltd. (“Mnombo”);

Stantec Consulting International LLC (“Stantec”) and DRA Projects SA (Proprietary) Limited (“DRA”) have been selected as the lead independent project engineers based on a detailed, professionally supervised tendering process. Stantec will focus on underground mining engineering and design and reserve estimation. DRA will focus on metallurgy, plant design, infrastructure and cost estimation.

The Waterberg Project has a number of highly attractive characteristics, which indicate it will be a low-cost, shallow, bulk mineable project with significant scale and growth potential. The recent participation of Implats, the world’s second largest platinum producer with fully integrated mine to market operations, represents a significant step in the advancement of the Waterberg Project towards potential development and production.

R. Michael Jones, CEO of Platinum Group said, "We are very pleased with the work completed by the Technical Committee. The mine building and operating experience of the technical team, including Implats and the newly appointed engineers, alongside our own discovery team, are working with an excellent “best for value of the Project” attitude. In our joint venture we have perspectives ranging from geology to metals marketing, including contributions from South Africa, the USA, Canada and Japan. Waterberg, which is palladium dominant, is modelled for fully mechanized production and has the potential to be amongst the lowest operating cost mines in the PGM sector.”

Current Platinum Group Element (“PGE”) probable reserves at the Waterberg Project (100%) are 12.3 million ounces, comprising 61% palladium, 30% platinum, 8% gold and 1% rhodium plus 191 million and 333 million pounds of copper and nickel respectively and will be updated as part of the DFS. (See the technical report dated October 19, 2016 and filed on SEDAR titled “Independent Technical Report on the Waterberg Project Including Mineral Resource Update and Pre-Feasibility Study”.) Much of the Waterberg Project area remains to be drilled and assessed. The Waterberg deposit remains open down dip and along strike.

The detailed scope of work for the DFS will investigate two options – Option 1; a 600,000 tonne per month mine (744,000 ounces PGEs per year) as outlined in the PFS, and Option 2; a lower capital option at 250,000 to 350,000 tonnes per month. Early optimization work by the project team to detail the potential for Option 2 using the three decline mechanized mining modules in sequence are encouraging with the potential to optimize the mine plan.

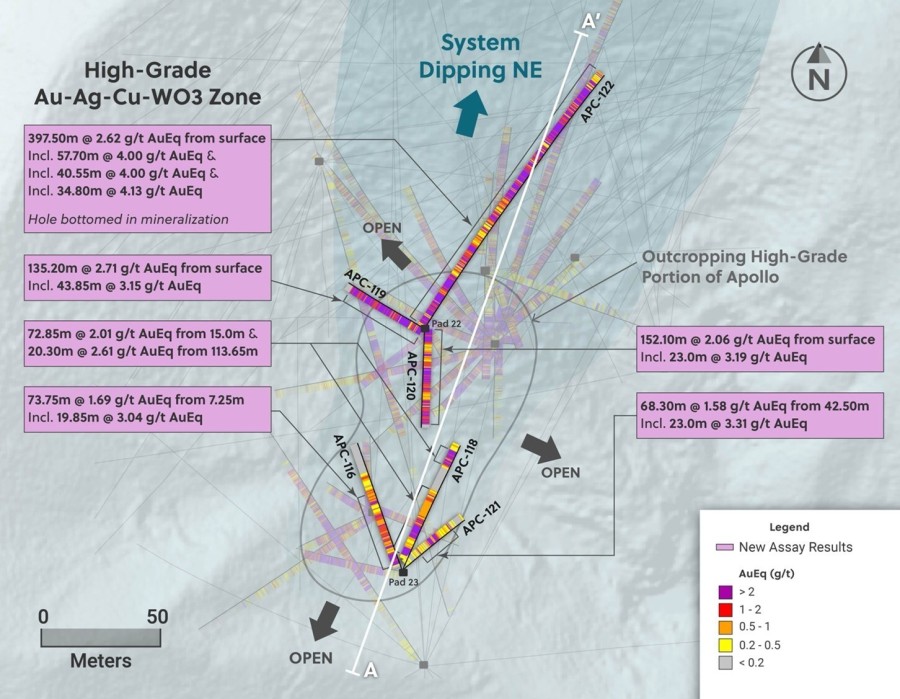

Current drilling at Waterberg is focused on the higher-grade areas of the large-scale deposit.

Waterberg Resource and Reserve Details

Reserve Details (100% Project Basis)

| Prill Split | Grade | |||||

| Zone | Pt | Pd | Au | Rh | Cu | Ni |

| % | % | % | % | % | % | |

| T-Zone | 29 | 49 | 21 | 1 | 0.16 | 0.08 |

| F-Zone | 30 | 64 | 5 | 1 | 0.07 | 0.16 |

Probable Mineral Reserve at 2.5 g/t 4E Cut-off– Tonnage and Grades

| Waterberg Probable Mineral Reserve – Tonnage and Grades | |||||||||

| Zone | Mt | Cut-off grade (g/t) | Pt (g/t) |

Pd (g/t) | Au (g/t) | Rh (g/t) | 4E (g/t) | Cu (%) | Ni (%) |

| T-Zone | 16.5 | 2.5 | 1.14 | 1.93 | 0.83 | 0.04 | 3.94 | 0.16 | 0.08 |

| F-Zone | 86.2 | 2.5 | 1.11 | 2.36 | 0.18 | 0.04 | 3.69 | 0.07 | 0.16 |

| Total | 102.7 | 2.5 | 1.11 | 2.29 | 0.29 | 0.04 | 3.73 | 0.08 | 0.15 |

Probable Mineral Reserve at 2.5 g/t 4E Cut-off– Contained Metal

| Waterberg Probable Mineral Reserve – Contained Metal | |||||||||

| Zone | Mt | Pt (Moz) | Pd (Moz) | Au (Moz) | Rh (Moz) | 4E (Moz) | 4E content (kg) |

Cu (Mlb) | Ni (Mlb) |

| T-Zone | 16.5 | 0.61 | 1.03 | 0.44 | 0.02 | 2.09 | 65,097 | 58.21 | 29.10 |

| F-Zone | 86.2 | 3.07 | 6.54 | 0.51 | 0.10 | 10.22 | 318,007 | 132.97 | 303.94 |

| Total | 102.7 | 3.67 | 7.57 | 0.95 | 0.12 | 12.32 | 383,103 | 191.18 | 333.04 |

Reasonable prospects of economic extraction were determined with the following assumptions: Metal prices used in the reserve estimate are as follows based on a 3-year trailing average (as at July 31/2016) in accordance with U.S. Securities and Exchange Commission ("SEC") guidance for the assessment of resources and reserves; US$1,212/oz Pt, US$710/oz Pd, US$1229/oz Au, US$984/oz Rh, US$6.10/lb Ni, US$2.56/lb Cu, US$/ZAR15. Smelter payability of 85% was estimated for 4E and 73% for Cu and 68% for Ni. The effective date is October 17, 2016. A 2.5 g/t Cut-off was used and checked against a pay-limit calculation. Independent Qualified Person for the Statement of Reserves is Mr. RL Goosen (WorleyParsons RSA (Pty) Ltd Trading as Advisian). The mineral reserves may be materially affected by changes in metals prices, exchange rates, labor costs, electricity supply issues or many other factors. See Risk Factors in Independent Technical Report 43-101 Effective Date: October 17, 2016 on www.sedar.com and the Company’s Annual Information Form. The reserves are estimated under SAMREC with no material difference to the CIM 2014 definitions in this case.

The estimation of mineral reserves has taken into account environmental, permitting and legal, title, taxation, socio-economic, marketing and political factors. Based on the cut-off grade and a maximum depth cut-off of 1,250 metres the probable reserve will support an 18-year mine life.

About Platinum Group Metals Ltd.

Platinum Group, based in Johannesburg, South Africa and Vancouver, Canada. Platinum Group and its partners JOGMEC and Mnombo originated the grass-roots exploration that discovered the Waterberg deposit and a new portion of the Bushveld PGM complex in 2011.

Formed in 2002, Platinum Group holds significant mineral rights and large-scale reserves of platinum and palladium in the Bushveld Igneous Complex of South Africa, which is host to over seventy percent of the world's primary platinum production.

Qualified Person

R. Michael Jones, P.Eng., the Company’s President, Chief Executive Officer and a shareholder of the Company, is a non-independent qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and is responsible for preparing technical information contained in this news release. He has verified the data by reviewing the detailed information of the geological and engineering staff and the Independent Qualified Person reports as well as visiting the site regularly.