Calgary, Alberta – TheNewswire - July 29, 2025 - Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) is pleased to announce a closing of tranche 1 for gross proceeds of $136,890.00 anchored by President Noah Komavli.

“I want to thank our shareholders for their continued support, as well as welcome new shareholders to our developing story.

As of today our field crew has been mobilized to the Howie Property to execute phase 1 work, which will focus on washing and channel sampling of the Twilight Zone, as well as more detailed sampling of the Creek Showing. The program is expected to take just under two weeks.

While boots hit the ground, simultaneous desktop consolidation of Esso drill logs will proceed. This study will generate a lithology model, which will be critical in finalizing drill pad locations, combined with additional data from channel samples and our completed IP survey.

The Esso logs are historic in nature, but extremely detailed, with assays redacted. Esso returned for a second field and drilling season prior to divesting all mineral exploration assets and focusing solely on oil and gas.

With permits in hand for diamond drilling at our highly prospective Howie property, an immediate focus will be validation of historic channel cut values on the Twilight zone.

Tranche 2 proceeds will be used exclusively for diamond drilling.” stated Noah Komavli.

Project History - Howie Property

-

May 1987:

-

Esso Minerals conducts a two year program on Howie (known as Snake Bay). Historic drilling logs from 1987 detail wide zones of mineralization. Assays redacted. Mining Data Ontario

-

-

November 2022:

-

Initial surface prospecting and sampling at Main Katisha Shear Zone yielded assay results up to 52.80 g/t Au, validating the zone’s gold potential*. Junior Mining Network, November 28, 2022

-

-

January 2023:

-

Planned high-resolution drone magnetics survey to target deeper mineralized zones, inspired by Dynasty Gold’s Thundercloud Project results. Junior Mining Network, January 23, 2023

-

-

April 2024:

-

Secured exploration permit and Ontario Junior Exploration Program funding, enabling advanced geophysical surveys and sampling. Junior Mining Network, April 2, 2024

-

-

October 2024:

-

Completed induced polarization (IP) survey over 2 km of lines to define 2025 drill targets for subsurface mineralization. Ashley Gold Corporation website, October 15, 2024

-

-

March 2025:

-

Reviewed IP survey data, expanded the project by two claims, and identified new targets along strike for further exploration. The Newswire, March 19, 2025

-

-

May 2025:

-

Conducted mechanical stripping, outcrop washing, and channel sampling at Katisha Zone, with channel cut assay results up to 20.2 g/t Au, confirming continuity of gold mineralization in a 5-10m-wide deformation zone. Expanded strike with discovery of 1.6 g/t Au sample based on IP data*. Junior Mining Network, May 16, 2025, Junior Mining Network, May 26, 2025

-

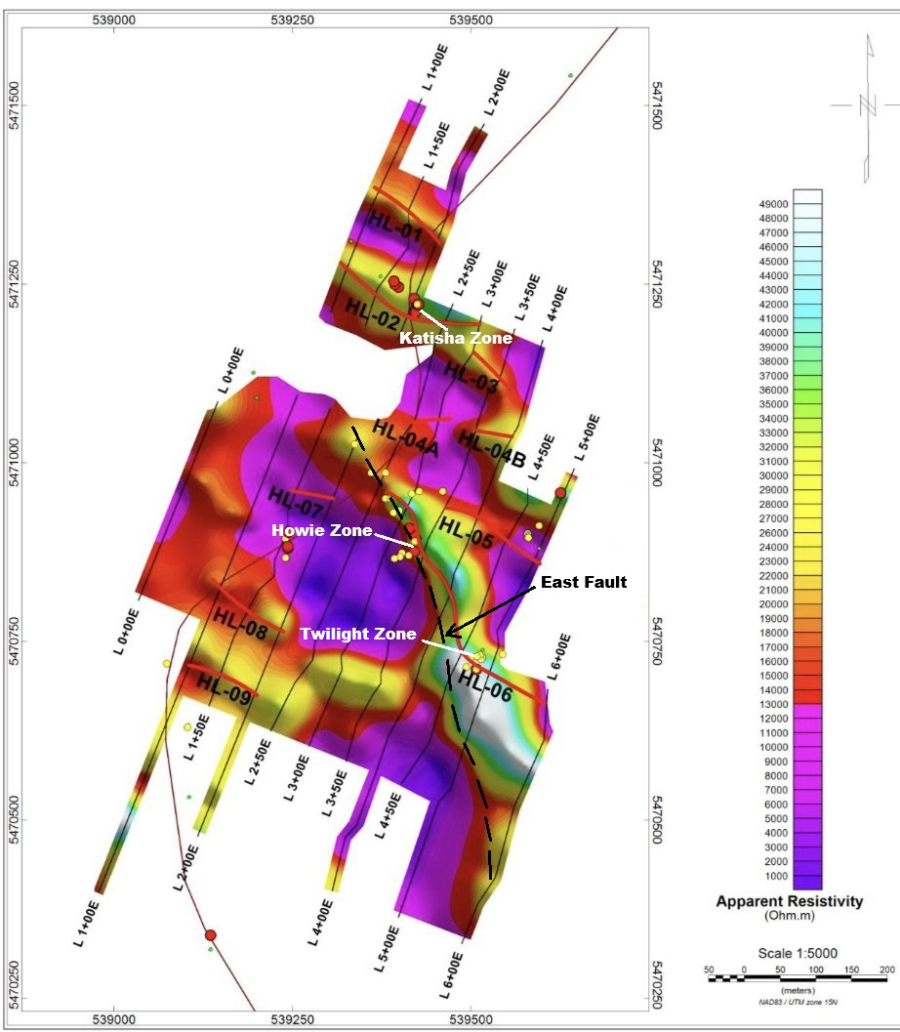

Figure 1: Howie Project Resistivity and Chargeability (Respectively). HL-06 emerges as a top drill target, with width and strike. HL-02, HL-04 and HL-05 are also strong anomalies. Grid expansion recommended in future work program. Phase 1 washing and channels will target the edge of the mineralized horizon in the Twilight Zone.

The first tranche consisted of the issuance of 2,040,000 FT shares and 775,333 NFT shares for gross proceeds of $136,890.00.

Each NFT unit consists of one common share and one-half a transferrable common share purchase warrant, enabling the holder to purchase one common share at an exercise price of $0.12, expiring in two years. The proceeds from the NFT Offering will be allocated towards the exploration of the Company's mineral properties and general operational expenses.

Each FT Unit (FT) consists of one flow-through common share of the Company and one half a non-flow-through common share purchase warrant with each FT Warrant exercisable to purchase one non-flow-through common share of the Company at $0.12 for two years from the date of issue.

The Company intends to use the gross proceeds of the FT Offering to incur "Canadian exploration expenses" as defined in the Income Tax Act (Canada) and proposed amendments thereto.

Finders' fees of $2,722.50 in cash plus 60,500 broker warrants were paid to arm's length parties. Shares issued pursuant to the Financing will be subject to a statutory hold period of four months plus a day from the date of issuance, according to the applicable security laws of Canada.

The Financing constitutes a "related party transaction" within the meaning of OSC Policy 61-101, Multilateral Instrument 61–101 Protection of Minority Security Holders in Special Transactions ("MI 61–101") because an Insider of the Company, Noah Komavli, participated in the Financing and have acquired FT Units as is equal to $80,000 in connection with the Financing. The Company has relied on exemptions from the formal valuation and minority shareholder approval requirements of MI 61–101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61–101 in respect of the Financing as the fair market value (as determined under MI 61-101) of the Insider participation in the Financing is below 25% of the Company's market capitalization (as determined in accordance with MI 61-101).

FINANCING TERMS AND USE OF PROCEEDS

The Company announces a non-brokered private placement financing (the “Offering”) for aggregate proceeds of up to $275,000 (CDN) to advance exploration on Ashley’s Ontario and British Columbia gold properties, as well as for general working capital.

The Offering consists of a Non-Flow-Through (NFT) Unit at a price of $0.045. Each Unit is comprised of one common share and one-half of one share purchase warrant. Each full warrant is exercisable for one non-flow through common share, at an exercise price of $0.12 for a term of 24 months after the closing (“Closing Date”).

The Offering also consists of a Flow-Through (FT) Unit at a price of $0.05. Each Unit is comprised of one common share and one-half of one share purchase warrant. Each full warrant is exercisable for one non-flow through common share, at an exercise price of $0.12 for a term of 24 months after the closing (“Closing Date”).

In connection with the issue and sale of the Units under the Offering, the Company may pay finder fees and finder warrants to eligible finders at the discretion of the Board of Directors.

THE EXISTING SHAREHOLDER EXEMPTION AND INVESTMENT DEALER EXEMPTION

The Offering will be made available to existing shareholders of the Company who, as of the close of business on July 3, 2025, held common shares of the Company (and who continue to hold such common shares as of the closing date), pursuant to the prospectus exemption set out in B.C. Instrument 45-534 — Exemption From Prospectus Requirement for Certain Trades to Existing Security Holders and in similar instruments in other jurisdictions in Canada. The existing shareholder exemption limits a shareholder to a maximum investment of $15,000 in a 12-month period unless the shareholder has obtained advice regarding the suitability of the investment and, if the shareholder is resident in a jurisdiction of Canada, that advice has been obtained from a person that is registered as an investment dealer in the jurisdiction. If the Company receives subscriptions from investors relying on the existing shareholder exemption exceeding the maximum amount of the financing, the Company intends to adjust the subscriptions received on a pro rata basis.

The Company has also made the Offering available to certain subscribers pursuant to B.C. Instrument 45-536 – Exemption Form Prospectus Requirement for Certain Distributions Through an Investment Dealer. In accordance with the requirements of the investment dealer exemption, the Company confirms that there is no material fact or material change about the Company that has not been generally disclosed.

The Offering is subject to all necessary regulatory approvals including acceptance from the Canadian Securities Exchange. All securities issued in connection with the Offering will be subject to a four-month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada.

*Grab samples are selective samples, and the assay results may not necessarily represent true underlying mineralization.

References

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Darcy Christian, P.Geo., CEO of Ashley, who is a Qualified Person as defined by NI 43-101.

About Ashley Gold Corp.

Ashley Gold Corp. is a focused exploration company targeting high-potential gold and polymetallic deposits in Canada’s top mining regions. We aim to deliver strong returns for shareholders through smart exploration and strategic growth.

Our Assets

• Ontario (Dryden Area): 100% ownership in Burnthut, Tabor, Howie, Alto-Gardnar, plus an option on Sakoose claims.

• British Columbia: Icefield Portfolio with three promising claim packages.

For more information, visit: www.ashleygoldcorp.com.

Contact Information

On behalf of the Board of Directors,

Noah J. Komavli, President, Director

C: (647) 567-9840

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

X: KKomavli

-Or-

Darcy Christian, P.Geo, CEO

C: (587) 777-9072

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

Connect With Ashley:

X: https://x.com/AshleyGoldCorp

Forward-Looking Statements

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR+ (www.sedarplus.ca) (www.sedarplus.ca). Undue reliance should not be placed on “forward-looking statements.”