Shallow, High Grade, Copper-Silver at Valentina

- Exceptional grades at shallow depth from the Valentina copper-silver deposit, part the Company's low-altitude, Costa Fuego senior copper development in Chile

- Drill hole VALMET0002 returned 3m @ 12.1% CuEq from 29m depth down-hole (11.8% copper (Cu) & 52.6g/t silver (Ag))

- The new diamond drill result lies within a broader 12m intersection grading 4.6% CuEq from 25m depth down-hole (4.5% Cu & 16.5g/t Ag)

- Mineralisation in VALMET0002 is dominantly sulphide and amenable to sulphide flotation, thus potential high grade early ore feed to Costa Fuego

- Assay results pending for a further six drill holes at Valentina and twelve drill holes from the San Antonio high grade copper resource

|

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average fresh rock metallurgical recoveries used for Valentina reporting were Cu=83%, Au=56%, Mo=82%, and Ag=37%. |

APPLECROSS, Western Australia, Aug. 24, 2022 /CNW/ - Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) ("Hot Chili" or "Company") is pleased to announce a new, shallow high grade, copper-silver drill intersection from its Valentina copper deposit in Chile.

The new drill result represents exceptional near-surface grades, providing an exciting potential additional front-end ore source for the Company's Costa Fuego coastal range copper-gold development.

Assays results returned for VALMET0002, a twin Diamond Drill (DD) hole of Reverse Circulation (RC) drill hole VAP0009 (see announcement dated 8th August 2022), recorded 3m grading 12.1% CuEq (11.8% Cu & 52.6g/t Ag) within a broader drilling intersection of 12m grading 4.6% CuEq (4.5% Cu & 16.5g/t Ag) from 25m depth down-hole.

The result confirms a significant 120m extension of high grade, copper-silver mineralisation to the south of the historical Valentina underground mine and provides material for development-related metallurgical testwork, key to the inclusion of the Valentina Resource in the Costa Fuego combined prefeasibility study (PFS) due in Q1 2023.

Copper soluble analysis has confirmed that mineralisation is principally sulphide (chalcocite, chalcopyrite, covellite) and amenable to flotation recovery, thus key to Valentina's potential to contribute to early sulphide cash flow generation.

Valentina Shaping as a High Grade Ore Source Addition at Costa Fuego

Mineralisation at Valentina is now defined over approximately 300m strike, and is open at depth and along strike. In addition to VALMET0002, new significant intersections from the phase-2 drill programme also include:

- 5m grading 1.5% CuEq (1.5% Cu, 7.8g/t Ag) from 179m (VAP0017)

including 2m @ 3.3% CuEq (3.2% Cu, 16.4g/t Ag) - 2m @ 2.0% CuEq (1.9% Cu, 6.7g/t Ag) from 45m (VAP0016)

- 2m @ 1.5% CuEq (1.5% Cu, 9.3g/t Ag) from 68m depth (VAP0013)

- 3m @ 1.5% CuEq (1.4% Cu, 8.2g/t Ag) from 24m (VAP0015)

Results have been returned for eleven of the seventeen phase-2 drillholes with assays pending for six drill holes. Of the eleven drill holes returned, four drill holes recorded significant drill intersections (outlined above), three drill holes intersected the mineralised structure (0.2% to 0.5% Cu), one drill hole intersected historical workings (ineffective), and three drill holes did not intersect mineralisation.

Phase-two drilling at Valentina has focussed on proving continuity of the mineralised trend along-strike and at-depth below the historical shallow underground mine.

The results of VAP0017 (5m grading 1.5% Cu, 7.8g/t Ag, including 2m grading 3.2% Cu, 16.4g/t Ag) confirm continuity of the steeply dipping mineralised host-structure, 100m below historical mine workings.

Importantly, high grade results recorded in VAP0009 and VALMET0002 lie on the southern extent of drilling in an area previously masked at-surface by a shallow horizon of Atacama gravels. Significant extensional potential remains untested in this area.

Mineralisation is interpreted to be fault-hosted, dipping steeply towards the east within a sequence of volcanic- sedimentary units, similar to the deposit setting of the neighbouring San Antonio resource (Inferred resource of 4.2Mt grading 1.2% CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287koz Ag, reported March 2022).

The Company looks forward to announcing next assay results from Valentina (six drill holes pending) and San Antonio (sixteen drill holes pending) shortly.

Hot Chili is on-track to deliver its next resource upgrade for Costa Fuego later this year followed by a PFS for in Q1 2023.

About Costa Fuego

Costa Fuego is strongly positioned amongst a slim field of senior global copper developments and is set to be one of the nearest-term, new, material copper mines in the world, and a significant contributor to the global decarbonisation effort.

Hot Chili is studying a multi-decade, 100ktpa copper and 70koz gold production base for Costa Fuego. The project will employ central processing to combine multiple ore sources and take advantage of significant infrastructure advantage (water, power roads, port) and strong environmental credentials (sea water processing and access to 100% renewable power contributions).

Costa Fuego is the only advanced senior copper development in the America's located at low-altitude (less than 1,000m elevation), 50km from an existing port.

This announcement is authorised by the Board of Directors for release to ASX. For more information please contact:

|

Christian Easterday Managing Director – Hot Chili |

Tel: +61 8 9315 9009 Email: admin@hotchili.net.au |

|

Penelope Beattie Company Secretary – Hot Chili |

Tel: +61 8 9315 9009 Email: admin@hotchili.net.au |

|

ASX Investor Investor & Public Relations (Australia) |

Email: eliza@asxinvestor.com.au |

|

Harbor Access Investor & Public Relations (Canada) |

|

|

or visit Hot Chili's website at www.hotchili.net.au |

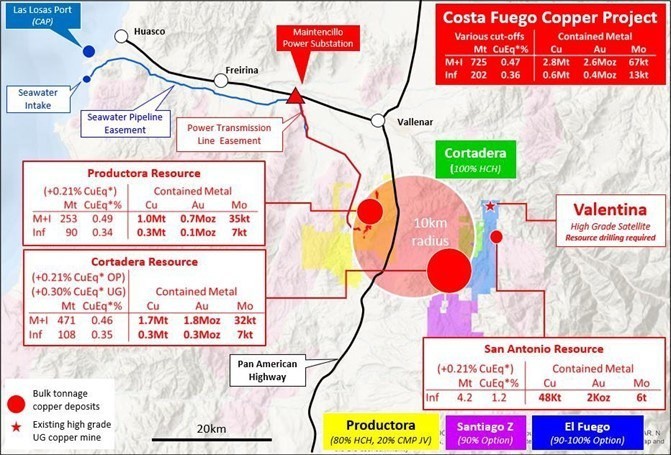

Figure 1 Location of Cortadera, Productora, San Antonio and Valentina in relation to coastal range infrastructure of Hot Chili's combined Costa Fuego copper-gold project, located 600km north of Santiago in Chile

|

Reported on a 100% Basis - combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground. Refer to Announcement "Hot Chili Delivers Next Level of Growth" (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates. |

|

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average metallurgical recoveries were Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average metallurgical recoveries were Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were Cu=83%, Au=51%, Mo=67% and Ag=23%. |

Table 1 New Significant Drill Results at Valentina

|

Hole_ID |

Coordinates |

Azim |

Dip |

Hole Depth |

Intersection |

Interval |

Copper |

Gold |

Silver |

Moly |

Cu Eq |

|||

|

North |

East |

RL |

From |

To |

(m) |

( %) |

(g/t) |

(g/t Ag) |

(ppm) |

( %) |

||||

|

VALMET0002 |

6823435 |

342914 |

952 |

90 |

-60 |

70.3 |

27 |

37 |

10 |

5.3 |

0.0 |

19.7 |

2.2 |

5.4 |

|

or |

25 |

37 |

12 |

4.5 |

0.0 |

16.5 |

2.2 |

4.6 |

||||||

|

Including |

29 |

32 |

3 |

11.8 |

0.1 |

52.6 |

4.2 |

12.1 |

||||||

|

46 |

48 |

2 |

0.9 |

0.0 |

5.6 |

0.5 |

1.0 |

|||||||

|

VAP0014 |

6823505 |

342957 |

927 |

286 |

-57 |

150 |

68 |

70 |

2 |

1.5 |

0.0 |

9.3 |

2.0 |

1.5 |

|

VAP0015 |

6823551 |

342932 |

910 |

105 |

-60 |

150 |

0 |

4 |

4 |

0.7 |

0.0 |

3.3 |

1.3 |

0.8 |

|

24 |

27 |

3 |

1.4 |

0.0 |

8.2 |

0.7 |

1.5 |

|||||||

|

VAP0016 |

6823431 |

342920 |

945 |

130 |

-57 |

80 |

28 |

30 |

2 |

1.2 |

0.0 |

0.4 |

5.0 |

1.2 |

|

41 |

43 |

2 |

0.7 |

0.0 |

0.3 |

3.0 |

0.7 |

|||||||

|

45 |

47 |

2 |

1.9 |

0.0 |

6.7 |

1.0 |

2.0 |

|||||||

|

VAP0017 |

6823545 |

342836 |

947 |

270 |

-60 |

220 |

179 |

184 |

5 |

1.5 |

0.0 |

7.8 |

0.8 |

1.5 |

|

Including |

179 |

181 |

2 |

3.2 |

0.0 |

16.4 |

1.0 |

3.3 |

||||||

|

189 |

191 |

2 |

0.9 |

0.0 |

3.7 |

0.8 |

0.9 |

|||||||

|

196 |

198 |

2 |

1.0 |

0.0 |

4.2 |

1.0 |

1.0 |

|||||||

|

Significant intercepts are calculated above a nominal cut-off grade of 0.5% Cu, with a minimum estimated true thickness of 1.5m. These parameters are aligned with marginal economic cut-off grades for narrow, high-grade polymetallic copper deposits of similar grade in Chile and elsewhere in the world. |

|

Down-hole significant intercept widths are estimated to be at or around 70 per cent of true-widths of mineralisation |

|

* Copper Equivalent (CuEq) reported for the drill holes at Valentina used Cortadera averages (as no metallurgical testwork has been completed at Valentina) using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average fresh rock metallurgical recoveries were Cu=83%, Au=56%, Mo=82%, and Ag=37%. |

Figure 2. Location of drill holes and new significant drill results at the Valentina high grade copper deposit. Valentina is open at depth, as well as along strike to the north and to the south (underneath a 10 to 15m deep cover of gravel).

Qualifying Statements

Costa Fuego Combined Mineral Resource (Reported 31st March 2022)

|

Reported on a 100% Basis - combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground. Refer to Announcement "Hot Chili Delivers Next Level of Growth" (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates. |

|

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) +(Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) |

|

/ (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%. |

|

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate |

Competent Person's Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full- time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday has reviewed, approved and consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement- Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered rofessional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Ms Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled "Resource Report for the Costa Fuego Technical Report", dated December 13, 2021, which is available for review under Hot Chili's profile at www.sedar.com.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+ (Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains "forward-looking statements". All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any "forward-looking statement" to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Section 1 Sampling Techniques and Data

Section 2 Reporting of Exploration Results