- $40 million for 80% of the La Pepa Project that Mineros does not already own

- Estimated Mineral Resources at the La Pepa Project, effective October 31, 2021:

- Measured Mineral Resources: 58,816 thousand tonnes (kt) averaging 0.61 g/t Au, containing 1,150 thousand ounces (koz) Au.

- Indicated Mineral Resources: 65,405 kt averaging 0.49 g/t, containing 1,039 koz Au.

- Inferred Mineral Resources: 25,024 kt averaging 0.46 g/t, containing 366 koz Au.

All dollar amounts are expressed in U.S. dollars.

MEDELLIN, Colombia / Aug 11, 2025 / Business Wire / Mineros S.A. (TSX:MSA, MINEROS:CB) (“Mineros” or the “Company”) is pleased to announce that it will acquire from Pan American Silver Corp. (“Pan American”) an 80% interest in the La Pepa Project for $40 million (the “La Pepa Project Purchase”), bringing its interest in the La Pepa Project to 100%. The La Pepa Project Purchase is structured as a transaction between subsidiaries of Mineros and Pan American for the purchase and sale of all shares of Minera Cavancha SpA not currently owned by Mineros. Minera Cavancha SpA currently holds the La Pepa Project pursuant to a joint venture between Mineros and Pan American. In connection with the La Pepa Project Purchase, that joint venture will be terminated.

The La Pepa Project Purchase is expected to close on or before September 30, 2025.

“We are pleased to add the balance of the La Pepa Project not already owned by us to our portfolio of organic growth projects,” stated David Londoño, President and CEO of Mineros. “While we remain focused on acquiring producing gold assets or late-stage development assets, we are expanding our strategy to include acquiring earlier-stage projects to enable Mineros to develop a pipeline of growth projects as we mature as a mid-tier gold producer. Additionally, the acquisition of La Pepa Project exposes us to Chile, an additional jurisdiction with a long and well-established mining history.”

La Pepa Project, Chile

The La Pepa Project is an advanced gold exploration project located in the Maricunga Gold Belt of the Atacama Region, Chile, approximately 800 km north of Santiago and 110 km east of Copiapó, at 4,200 metres above sea level in the Andes Mountains. It is 100% owned by Minera Cavancha SpA, a joint venture entity that is owned 20% by Mineros and 80% by Pan American.

The La Pepa Project represents a significant exploration-stage opportunity for Mineros in Chile, with promising mineralization and plans for further development. Key details about the project include:

- Exploration and Development:

- The project targets a porphyry-style gold system with two types of auriferous mineralization: gold disseminated in stockwork and high-sulphidation epithermal replacement veins.

- Envisioned as an open-pit mining and heap-leaching operation.

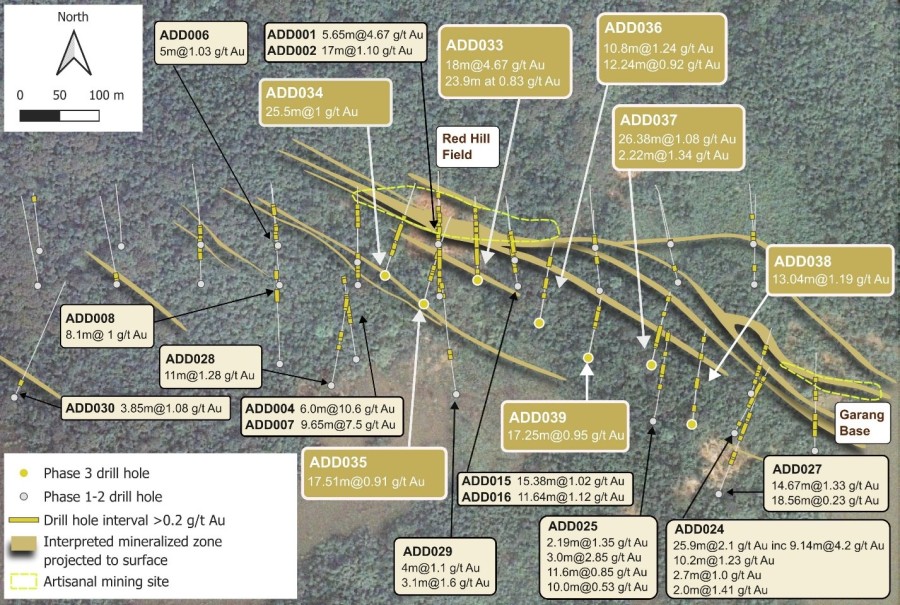

- Drilling and Results:

- A 6,342-metre drilling program (2019-2020) confirmed lateral continuity and potential expansion at depth. For further information, see Mineros’ annual information form for the year ended December 31, 2021, dated March 31, 2022.

- Future Plans:

- Mineros plans to use the Mineral Resource estimate effective October 31, 2021 as the basis for a preliminary economic assessment (PEA) to evaluate feasibility as a heap-leaching operation.

Mineral Resources reported in this press release were estimated by Geoestima Spa. (GeoEstima), inside an optimized pit envelope with cut-off grades of 0.20 g/t Au for oxides and 0.26 g/t Au for sulphides, which corresponds to the marginal cut-off grade, assuming a long-term gold price of $1,650 per ounce. All figures are rounded to reflect the relative accuracy of the estimate, and numbers may not add up due to rounding. The qualified person is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the potential development of the Mineral Resources.

ABOUT MINEROS S.A.

Mineros is a Latin American gold mining company headquartered in Medellin, Colombia. The Company has a diversified asset base, with mines in Colombia and Nicaragua and a pipeline of development and exploration projects throughout the region.

The board of directors and management of Mineros have extensive experience in mining, corporate development, finance and sustainability. Mineros has a long track record of maximizing shareholder value and delivering solid annual dividends. For almost 50 years Mineros has operated with a focus on safety and sustainability at all its operations.

Mineros’ common shares are listed on the Toronto Stock Exchange under the symbol “MSA”, and on the Colombia Stock Exchange under the symbol “MINEROS”.

Election of Directors – Electoral Quotient System

The Company has been granted an exemption from the individual voting and majority voting requirements applicable to listed issuers under Toronto Stock Exchange policies, on grounds that compliance with such requirements would constitute a breach of Colombian laws and regulations which require the directors to be elected on the basis of a slate of nominees proposed for election pursuant to an electoral quotient system. For further information, please see the Company’s most recent annual information form, available on the Company’s website at https://www.mineros.com.co/ and from SEDAR+ at www.sedarplus.com.

QUALIFIED PERSON

Scientific and technical information contained in this news release has been approved by Orlando Rojas, MAIG, Principal Consultant and Director at GeoEstima, who is a qualified person within the meaning of NI 43-101, and who is independent of the Company.

CAUTIONARY NOTE REGARDING MINERAL RESOURCE ESTIMATES

In accordance with applicable Canadian securities regulatory requirements, all Mineral Resource estimates disclosed in this news release have been prepared in accordance with NI 43-101 and are classified in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Standards”).

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. Pursuant to the CIM Standards, Mineral Resources have a higher degree of uncertainty than Mineral Reserves as to their existence as well as their economic and legal feasibility. Inferred Mineral Resources, when compared with Measured or Indicated Mineral Resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Pursuant to NI 43-101, Inferred Mineral Resources may not form the basis of any economic analysis, including any feasibility study. Accordingly, readers are cautioned not to assume that all or any part of a Mineral Resource exists, will ever be converted into a Mineral Reserve, or is or will ever be economically or legally mineable or recovered.

FORWARD-LOOKING STATEMENTS

This news release contains “forward looking information” within the meaning of applicable Canadian securities laws. Forward looking information includes statements that use forward looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward looking information includes, without limitation, statements with respect to completion of the La Pepa Project Purchase; the estimate of Mineral Resources; exploration plans; and mining techniques that may be suitable for the La Pepa Project.

Forward looking information is based upon estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this news release. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

For further information of these and other risk factors, please see the “Risk Factors” section of the Company’s annual information form dated March 31, 2025, available on SEDAR+ at www.sedarplus.com.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking information contained herein is made as of the date of this news release and the Company disclaims any obligation to update or revise any forward-looking information, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.