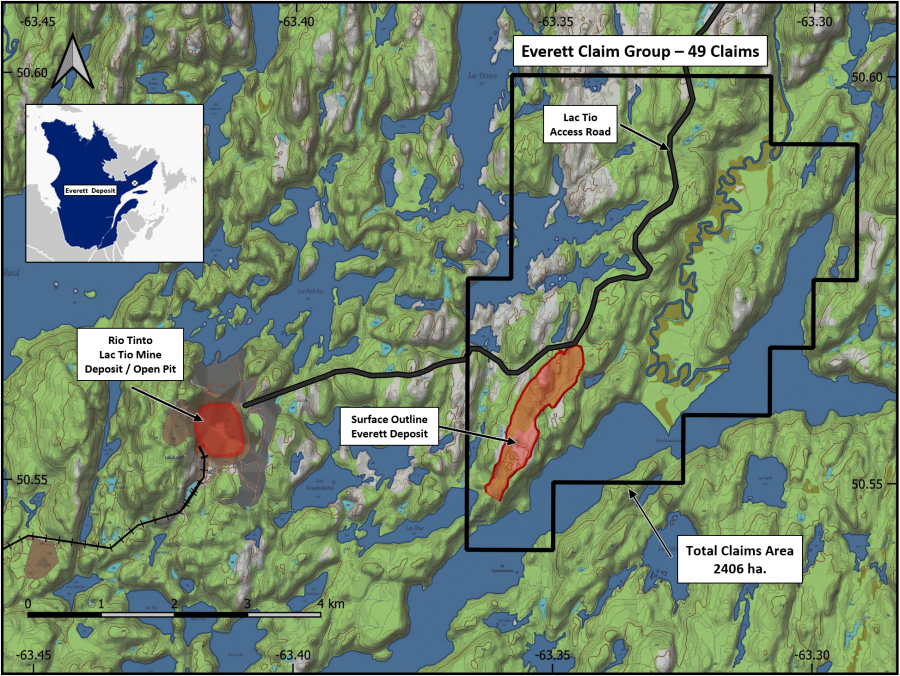

Vancouver, BC – TheNewswire - June 2, 2025 - Muzhu Mining Ltd. (CSE: MUZU) (“Muzhu”) is pleased to announce that it has entered into non-binding Letter of Intent with Romaine River Titanium Inc. (“Romaine”) of Georgetown, ON to acquire an initial 50% Option of the Romaine’s Everett titanium-iron property (the “Property”) located 40 km from the port city of Havre-Saint-Pierre, Quebec. The Everett Property comprises 49 mineral tenures covering 2,406 ha (5,946 acres) and is owned 100% by Romaine. See Figure 1.

Romaine, which is a private, federally-incorporated holding company, is presently active on the Property with surface sampling and metallurgical testing over the surface outcrop of the Everett deposit. Early in the Property's history, 34 diamond drill holes defined a significant historical mineral resource. Later, 71 closely-spaced sites and two bulk sample sites were sampled on the surface of the Everett deposit, with assay and metallurgical samples obtained over a 3.5 km of outcrop.

The Property spans the eastern margin of the Proterozoic Havre-Saint-Pierre anorthosite massif. Anorthosite massif deposits are of significant economic interest for critical mineral commodities, including Fe–Ti oxide minerals (for titanium, vanadium, and iron), and apatite minerals (for phosphorus, often including rare earth elements).

The Everett deposit is recognized by the USGS and the Quebec Geological Sciences Service as one of the most significant hard-rock ilmenite (FeTiO3) deposits in the world, alongside producing deposits at Lac Tio, Quebec (Rio Tinto Fer et Titane Inc.) and Tellnes, Norway (Kronos Worldwide Inc.). The Everett deposit is situated 3 km east of the world's largest hard-rock ilmenite deposit, Lac Tio. The deposit at Lac Tio is not necessarily indicative of the grades and tonnes of the adjacent Everett deposit. Still, the two deposits share a closely similar mineralogy and are both hosted by mafic intrusions of the Havre-Saint-Pierre anorthosite massif.

Figure 1: Location of the Everett claim group and the Everett deposit, Quebec.

Figure 1: Location of the Everett claim group and the Everett deposit, Quebec.

Muzhu seeks to significantly increase its critical metal and precious metal exploration in Quebec. By partnering with Romaine, Muzhu benefits from numerous historical mineralogical studies and metallurgical process tests. Respected commercial and university research laboratories conducted these tests, demonstrating very high recoveries of Ti, Fe, and P to the concentrates.

Muzhu’s due diligence review demonstrates that the Everett deposit is “drill-ready.” Muzhu plans a one-year, focused program of verification of historical drilling and metallurgy, as follows:

-

Collect bulk samples for metallurgical testing.

-

Verify the historical analytical results with twinning of sampling and drilling.

-

Conduct a two-stage diamond drilling program, focusing on defining mineral resources in the northern portions of the Everett deposit.

-

Conduct step-out diamond drilling to test the tenor of mineralization in the mid- and southern portions of the exposed Everett deposit.

-

Report on the drill-indicated mineral resources from the first two stages of definition drilling under the current NI43-101 standards of practice by July 2026.

Under the non-binding Letter of Intent, once such Option interest is earned, Muzhu and Romaine will enter a 50-50 Joint Venture agreement. The exercise of the Option shall occur after Muzhu has paid $800,000 in cash, issued 3 million common shares, and expended $10 million on eligible exploration and development on or before 2029. Thereafter, if Muzhu fully finances the exploration and development of the Joint Venture, Muzhu will hold 100% of the Property, and Romaine's share will be reduced to its Gross Royalty of 3.5%. Muzhu can purchase 0.5% and 1.0% of that royalty by paying Romaine $500,000 and $2.5 million, respectively, before commercial production. Muzhu will promptly advance funds to join Romaine’s active metallurgical testing regime. Any advanced funds are to be credited to the eligible exploration expenditures of the intended Option agreement.

Dwayne Yaretz, CEO, stated,

"Critical minerals will increasingly define the future of mining and sustainable development. By partnering with Romaine River Titanium Inc., Muzhu can enter this sphere by focusing on verifying the historical programs. Muzhu has “drill-ready” targets and can immediately proceed with drilling and confirmation metallurgical testing, with reduced risk compared to typical critical mineral exploration programs. The Everett deposit is well-located adjacent to road access, hydroelectric power, an active mining town, and full port facilities."

Qualified Person

Information contained in this press release was reviewed and approved by Paul McGuigan, P. Geo., who is a Qualified Person as defined under National Instrument 43-101 and is responsible for the technical information provided in this news release.

About Muzhu Mining Ltd.

Muzhu Mining Ltd. is a Canadian publicly traded exploration company with a portfolio of highly prospective projects at various stages of development. Muzhu currently holds 100% interest in the Sleeping Giant South Project, located in the Abitibi Greenstone Belt, approximately 75 km South of Matagami, Quebec. Additionally, in China, Muzhu has executed two option agreements to acquire up to 80% of the Silver, Zinc, Lead XWG and LMM Properties in Henan Province and is currently conducting an exploration program at the nearby WLG gold mine.

ON BEHALF OF THE BOARD OF DIRECTORS

Dwayne Yaretz, CEO

Muzhu Mining Ltd.

Phone: 778-709-3398

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.