Vancouver, British Columbia--(Newsfile Corp. - August 11, 2025) - Gladiator Metals Corp. (TSXV: GLAD) (OTCQB: GDTRF) (FSE: ZX7) ("Gladiator" or the "Company") has received assay results from its ongoing phase 2 drill program at Cowley Park (40 holes, 8,121m). Drilling was designed to target strike extensions to previously identified high-grade copper skarn mineralisation (CPG-047: 98m @ 1.49% Cu incl. 14m @ 7.67% Cu1) and has successfully extended high grade mineralisation more than 70m down dip.

First drill hole targeting depth extension of mineralisation below 200m encounters previously unobserved style of mineralisation within a 180m wide zone of disseminated bornite and chalcopyrite hosted in altered granodiorite. Results include:

-

CPG-092 returned 55m @ 0.70% Cu from 176m plus 0.01 g/t Au, 2.61 g/t Ag & 154 ppm Mo including:

-

21.90m @ 1.27% Cu from 199.1m plus 0.02 g/t Au, 5.27 g/t Ag & 300 ppm Mo

-

Mineralisation remains open along strike and at depth and is the focus of ongoing drilling with two rigs currently operating at Cowley Park. Significant mineralised intercepts from ongoing resource definition drilling include:

-

CPG-094 returned 70.5m @ 1.13% Cu from 95.5m plus 0.05 g/t Au, 4.22 g/t Ag & 470 ppm Mo including:

-

14.0m @ 2.05% Cu from 101m plus 0.12 g/t Au, 10.61 g/t Ag & 757 ppm Mo and:

-

20.0m @ 2.15% Cu from 128m plus 0.04 g/t Au, 4.80 g/t Ag & 357 ppm Mo including:

-

6.0m @ 5.36% Cu from 140m plus 0.04 g/t Au, 7.13 g/t Ag & 33 ppm Mo

-

-

CPG-074D2 returned 12.35m @ 2.66% Cu from 50.0m plus 0.12 g/t Au, 20.75 g/t Ag & 46 ppm Mo

-

CPG-080D2 returned 14.5m @ 1.01% Cu from 31.5m plus 0.04 g/t Au, 5.44 g/t Ag & 193 ppm Mo plus:

-

12.0m @ 0.67% Cu from 64m plus 0.00 g/t Au, 2.20 g/t Ag & 26 ppm Mo

-

-

CPG-082D1 returned 51.8m @ 0.80% Cu from 9m plus 0.08 g/t Au, 5.70 g/t Ag & 432 ppm Mo including:

-

25.3m @ 1.24% Cu from 32.7m plus 0.13 g/t Au, 7.62 g/t Ag & 651 ppm Mo

-

-

CPG-090 returned 29.5m @ 1.21% Cu from 94.5m plus 0.15 g/t Au, 8.46 g/t Ag & 425 ppm Mo

-

CPG-091 returned 24.5m @ 1.06% Cu from 71.5m plus 0.15 g/t Au, 9.08 g/t Ag & 1,115 ppm Mo plus:

-

34.0m @ 0.90% Cu from 110m plus 0.15 g/t Au, 7.34 g/t Ag & 518 ppm Mo and:

-

14.0m @ 1.30% Cu from 130m plus 0.23 g/t Au, 9.99 g/t Ag & 574 ppm Mo

-

Gladiator CEO, Jason Bontempo, commented: "Gladiator's first drillhole targeting mineralisation below 200m at Cowley Park highlights the significant upside potential of the deposit which has still only been explored at relatively shallow levels. Significantly a new style of mineralisation was observed with disseminated bornite observed over more than 180m within the granodiorite, outside of the skarn. Further drilling is in progress to assess the full potential of this new zone of mineralisation.

"In conjunction with this new discovery, ongoing resource definition drilling focussed on the copper skarn mineralisation at Cowley Park continues to deliver consistent high copper grades from near surface and confirms the exciting potential of the Cowley Park prospect.

"Gladiator currently has two rigs operating at Cowley Park and a third conducting exploration on regional targets. We look forward to presenting further results from resource definition and exploration drilling in the coming months."

1 Refer News Release Dated 18th November 2024 "Gladiator Intersects 14m @ 7.67% Cu Within 98m @ 1.49% Cu down dip from 26m @ 3.31% Cu at Cowley Park".

COWLEY PARK DRILLING

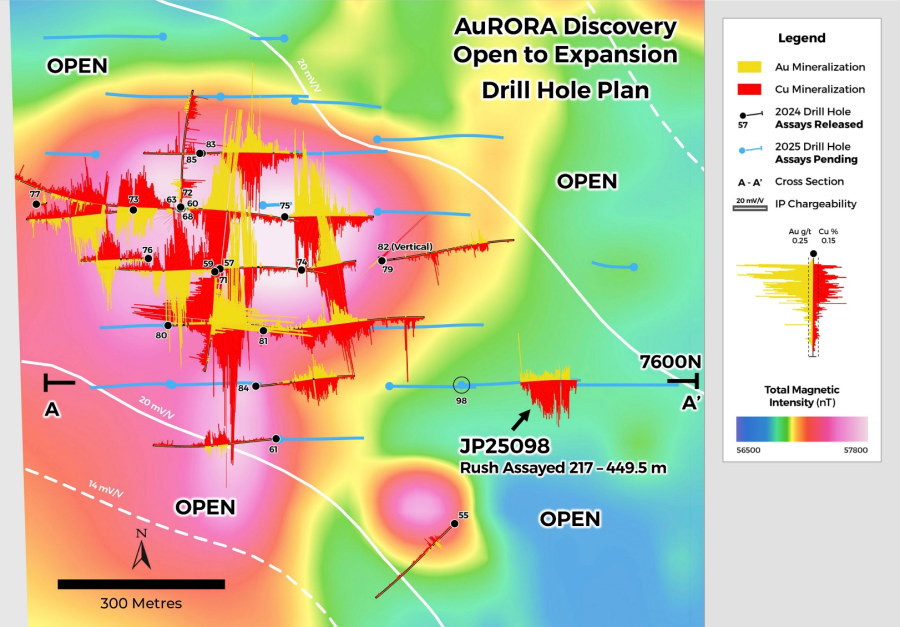

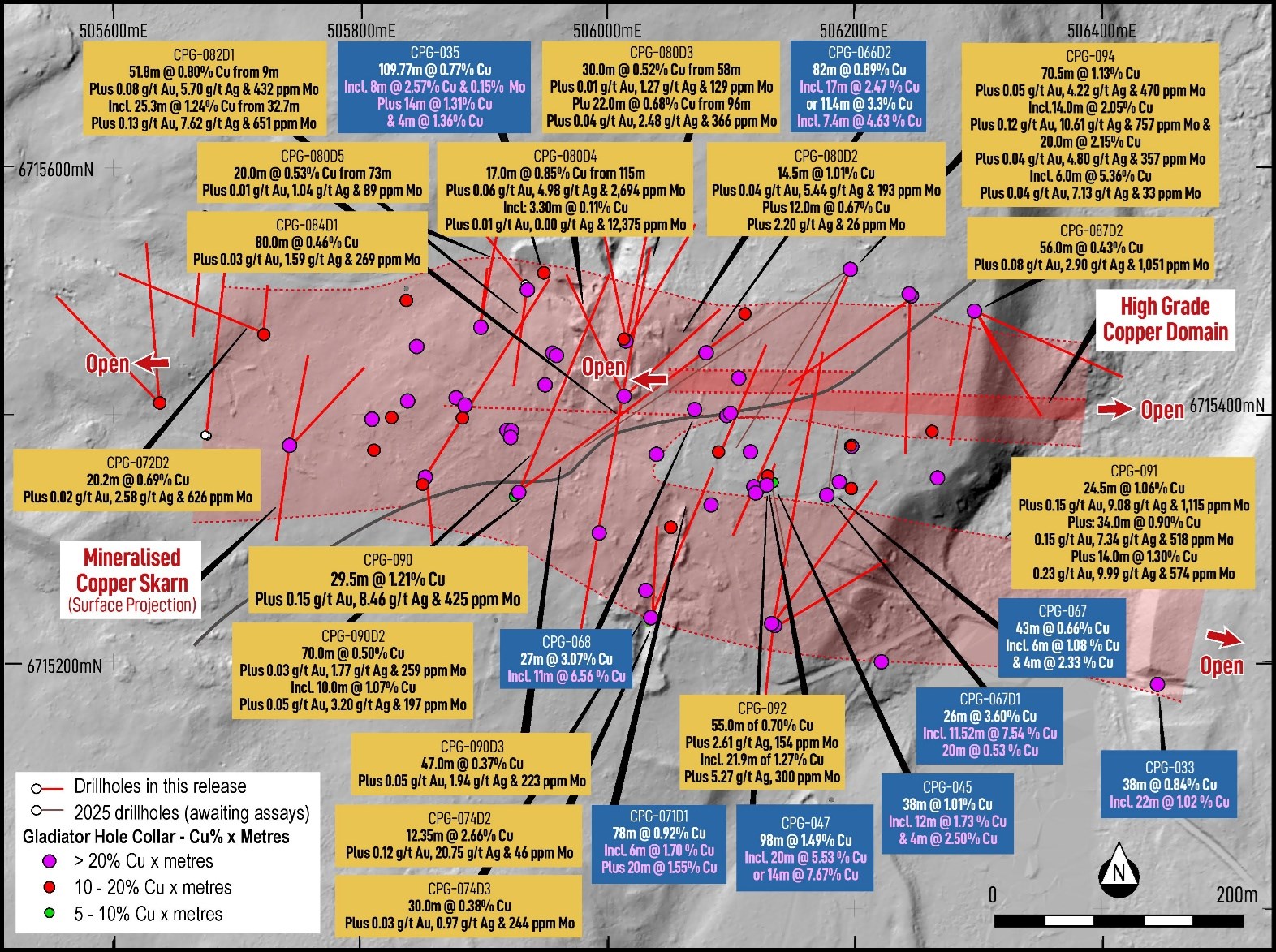

Results from the ongoing Phase 2 drilling at the Cowley Park prospect (40 holes, 8,121m) have now been received. Please refer to Figure 1 for drillhole locations and to Table 1 for all recently returned drill results. Drilling is ongoing with two rigs in operation at Cowley Park.

The drilling is designed to:

- Confirm and test the continuity of near surface, high-grade copper mineralisation for future high-grade copper resource definition (Figure 1).

- Confirm high-grade domain continuity encountered within the Cowley Park prospect and explore exploration upside and potential for repeated zones.

- Test significant exploration upside including extensions to known high-grade copper skarn mineralisation and test sub-parallel trends recently identified in drilling.

- Test the previously unrecognized resource potential of the endoskarn copper mineralisation at Cowley Park which has not been systematically targeted or sampled in historic drilling.

- Test the economic potential of complimentary co-products to copper mineralisation including molybdenum, gold, and silver.

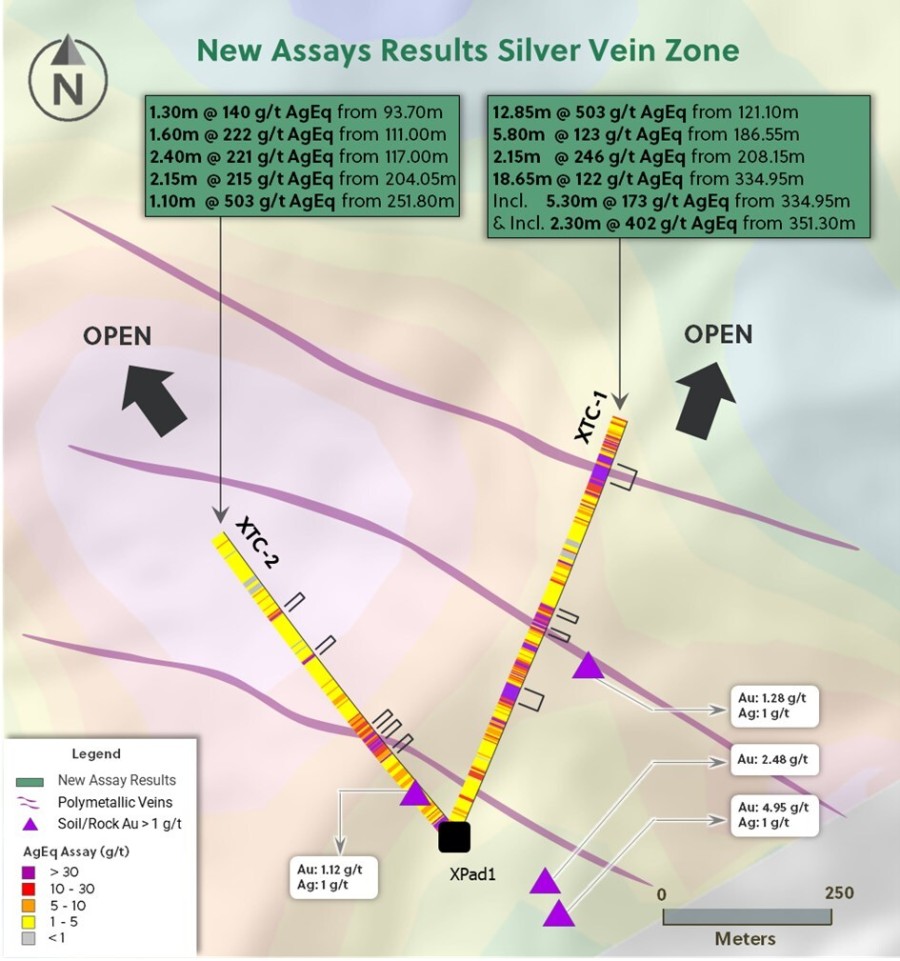

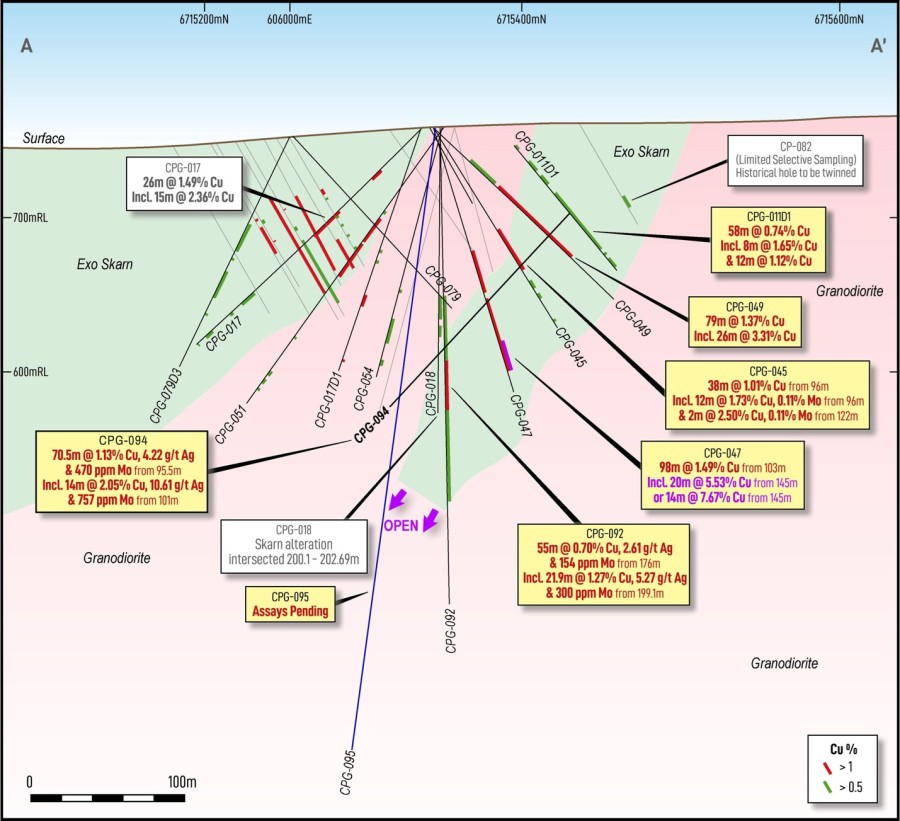

Drill Hole CPG-092 was designed as the first test of mineralisation below 200m from surface targeting the down plunge extension of high-grade copper-skarn mineralisation previously observed on the section where previously reported results included CPG-047: 98m @ 1.49% Cu incl. 14m @ 7.67% Cu1 (refer to Figure 1 below). The hole confirmed the continuity of high-grade copper mineralisation with mineralisation now extending from surface more than 250m down plunge. Results include:

-

CPG-092 returned 55m @ 0.70% Cu from 176m plus 0.01 g/t Au, 2.61 g/t Ag & 154 ppm Mo including:

-

21.9m @ 1.27% Cu from 199.1m plus 0.02 g/t Au, 5.27 g/t Ag & 300 ppm Mo

-

Figure 1: Section through Cowley Park showing location of CPG-092 down plunge of previously reported drillhole intercepts. Results from CPG-095 anticipated in the following weeks. Refer to plan map, Figure 3 for location of section.

Figure 1: Section through Cowley Park showing location of CPG-092 down plunge of previously reported drillhole intercepts. Results from CPG-095 anticipated in the following weeks. Refer to plan map, Figure 3 for location of section.

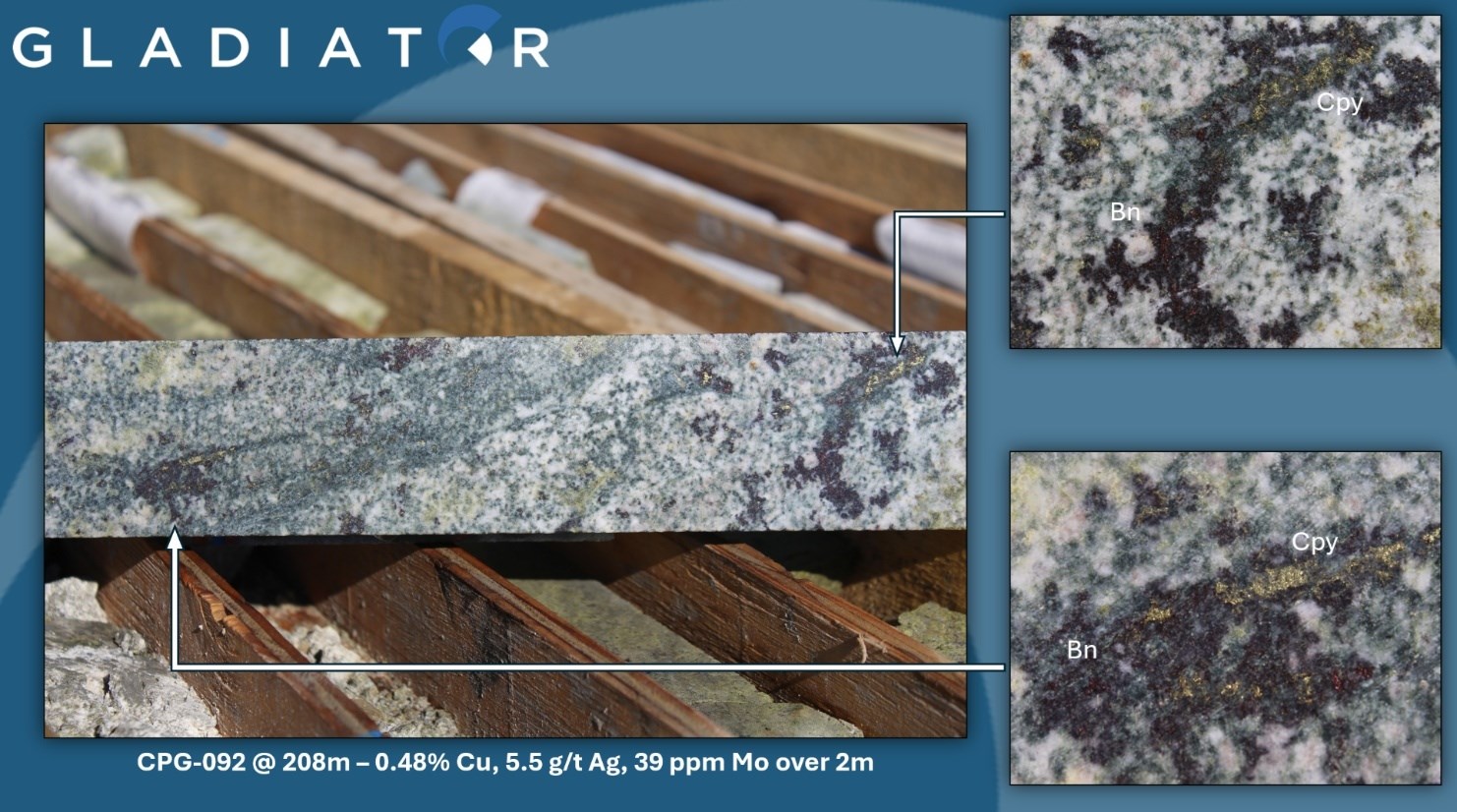

Mineralisation encountered in CPG-092 is of a previously unobserved style corresponding to a wide zone (~180m) of variably disseminated bornite and chalcopyrite hosted within granodiorite (refer to Figure 2 below). Bornite and chalcopyrite are observed replacing the chlorite altered mafic mineral component of the granodiorite often in conjunction with trace epidote alteration of feldspars. Locally weak potassic alteration of the grandiorite is also observed corresponding to lower observed grades of mineralisation.

Figure 2: Granodiorite hosted mineralisation in CPG-092 showing disseminated and blebby bornite and chalcopyrite mineralisation replacing chlorite altered mafic mineral component. Patchy epidote alteration also visible.

Figure 2: Granodiorite hosted mineralisation in CPG-092 showing disseminated and blebby bornite and chalcopyrite mineralisation replacing chlorite altered mafic mineral component. Patchy epidote alteration also visible.

Follow up drilling to CPG-092 is now in progress with CPG-095 completed targeting mineralisation 70m further down dip (refer to Figure 1). Further holes planned for the coming month will be focussed on 150m lateral step outs at the same depth to define the extents of the disseminated bornite-chalcopyrite mineralisation at depth.

COWLEY PARK RESOURCE DRILLING

Continuity of mineralisation within throughout the prospect area continues to be further defined by significant widths of copper-skarn mineralisation encountered in resource drilling throughout the Cowley Park deposit with results including (refer to plan map Figure 3 and Table 1 for details):

-

CPG-080D2 returned 14.5m @ 1.01% Cu from 31.5m plus 0.04 g/t Au, 5.44 g/t Ag & 193 ppm Mo plus:

-

12.0m @ 0.67% Cu from 64m plus 0.00 g/t Au, 2.20 g/t Ag & 26 ppm Mo

-

-

CPG-080D3 returned 30.0m @ 0.52% Cu from 58m plus 0.01 g/t Au, 1.27 g/t Ag & 129 ppm Mo plus:

-

22.0m @ 0.68% Cu from 96m plus 0.04 g/t Au, 2.48 g/t Ag & 366 ppm Mo

-

-

CPG-080D4 returned 17.0m @ 0.85% Cu from 115m plus 0.06 g/t Au, 4.98 g/t Ag & 2,694 ppm Mo including:

-

3.30m @ 0.11% Cu from 125m plus 0.01 g/t Au, 0.00 g/t Ag & 12,375 ppm Mo

-

-

CPG-080D5 returned 20.0m @ 0.53% Cu from 73m plus 0.01 g/t Au, 1.04 g/t Ag & 89 ppm Mo

-

CPG-082D1 returned 51.8m @ 0.80% Cu from 9m plus 0.08 g/t Au, 5.70 g/t Ag & 432 ppm Mo including:

-

25.3m @ 1.24% Cu from 32.7m plus 0.13 g/t Au, 7.62 g/t Ag & 651 ppm Mo

-

-

CPG-084D1 returned 80.0m @ 0.46% Cu from 41m plus 0.03 g/t Au, 1.59 g/t Ag & 269 ppm Mo

-

CPG-087D2 returned 56.0m @ 0.43% Cu from 74m plus 0.08 g/t Au, 2.90 g/t Ag & 1,051 ppm Mo

-

CPG-090 returned 29.5m @ 1.21% Cu from 94.5m plus 0.15 g/t Au, 8.46 g/t Ag & 425 ppm Mo

-

CPG-090D2 returned 70.0m @ 0.50% Cu from 119m plus 0.03 g/t Au, 1.77 g/t Ag & 259 ppm Mo including:

-

10.0m @ 1.07% Cu from 135m plus 0.05 g/t Au, 3.20 g/t Ag & 197 ppm Mo

-

-

CPG-090D3 returned 47.0m @ 0.37% Cu from 91m plus 0.05 g/t Au, 1.94 g/t Ag & 223 ppm Mo

-

CPG-091 returned 24.5m @ 1.06% Cu from 71.5m plus 0.15 g/t Au, 9.08 g/t Ag & 1,115 ppm Mo plus:

-

34.0m @ 0.90% Cu from 110m plus 0.15 g/t Au, 7.34 g/t Ag & 518 ppm Mo and:

-

14.0m @ 1.30% Cu from 130m plus 0.23 g/t Au, 9.99 g/t Ag & 574 ppm Mo

-

-

CPG-094 returned 70.5m @ 1.13% Cu from 95.5m plus 0.05 g/t Au, 4.22 g/t Ag & 470 ppm Mo including:

-

14.0m @ 2.05% Cu from 101m plus 0.12 g/t Au, 10.61 g/t Ag & 757 ppm Mo and:

-

20.0m @ 2.15% Cu from 128m plus 0.04 g/t Au, 4.80 g/t Ag & 357 ppm Mo including:

-

6.0m @ 5.36% Cu from 140m plus 0.04 g/t Au, 7.13 g/t Ag & 33 ppm Mo

-

-

CPG-072D2 returned 20.2m @ 0.69% Cu from 58.8m plus 0.02 g/t Au, 2.58 g/t Ag & 626 ppm Mo

-

CPG-074D2 returned 12.35m @ 2.66% Cu from 50.0m plus 0.12 g/t Au, 20.75 g/t Ag & 46 ppm Mo

-

CPG-074D3 returned 30.0m @ 0.38% Cu from 23.0m plus 0.03 g/t Au, 0.97 g/t Ag & 244 ppm Mo

Figure 3: Plan map of Cowley Park over LIDAR DTM. Gladiator drill collars colored by sum Cu% x length (m), historical collars not shown. New drill results subject to this release highlighted in yellow.

Figure 3: Plan map of Cowley Park over LIDAR DTM. Gladiator drill collars colored by sum Cu% x length (m), historical collars not shown. New drill results subject to this release highlighted in yellow.

This drilling will be included in the maiden resource estimate for Cowley Park, planned for Q2 2026. Results from ongoing drilling is expected in the coming weeks along with results from regional drilling at the Valerie and Little Chief prospect areas.

EXPLORATION STRATEGY

The ongoing drilling at Cowley Park is part of a planned 29,000m drill program targeting high-grade copper skarns throughout the Whitehorse Copper Belt before the end of Q4 2025. Drilling is designed with the following objectives:

-

Advancing Cowley Park to resource definition and expansion:

-

Cowley Resource Target: Establish initial drilling framework for an inferred resource at Cowley Park.

-

Cowley Exploration: Targeting upside potential for further copper-skarn mineralization at Cowley Park.

-

-

Exploration drilling at:

-

Chiefs Trend: Highlight further high-grade, near-term copper resource potential by testing near historic mine exploration upside.

-

Best Chance: Drill test of outcropping high-grade, magnetite-copper skarn mineralization and broader widths of copper-silicate skarn and test continuity of mineralization between the Best Chance and Arctic Chief prospects.

-

Arctic Chief: Highlight continuity of high-grade near surface copper and gold mineralization for future resource drilling.

-

Cub Trend Exploration: Highlight continuity of high-grade, near surface, copper and gold mineralization for future resource drilling.

-

Drilling will be supported by planned geophysical programs including Induced Polarization (ongoing), Electromagnetic and Gravity surveys to help refine drill targeting in the prospect areas and highlight undiscovered areas of exploration potential.

THE WHITEHORSE COPPER PROJECT

The Whitehorse Copper Project is an advanced-stage high grade copper (Cu), molybdenum (Mo), silver (Ag) and gold (Au) skarn exploration project in the Yukon Territory, Canada.

Copper mineralization was first discovered in 1897 on the Whitehorse Copper Belt and comprises over 30 copper-related, primarily skarn occurrences covering an area of 35km long by 5 km wide on the western margin of Whitehorse City, Yukon.

Exploration and mining development have been carried out intermittently since 1897 with the main production era lasting between 1967 and 1982 where production from primarily the Little Chief deposit totalled 267,500,000 pounds copper, 225,000 ounces of gold and 2,838,000 ounces of silver from 10.5 million tons of mineralized material milled (Watson, 1984). The Whitehorse Copper Project is accessible by numerous access roads and trails located within 2 km of the South Klondike Highway and the Alaska Highway. An extensive network of historical gravel exploration and haul roads exists throughout the project area, providing excellent access to the claim package. Access to existing electric power facilities is available through the main Yukon power grid.

Project Highlights

- Advanced 35km long high-grade copper belt.

- Located on western margin of infrastructure rich Whitehorse City, Yukon Territory.

- More than 14,000m completed to date in 2025 at the cornerstone Cowley Park project (assays pending) and more than 3,000 at the Chiefs Trend and Arctic Chief Trend.

- Gladiator plans to complete at least a further 20,000m of diamond drilling in 2025 with three diamond drill rigs currently operating.

- Targeting to report maiden high-grade copper NI 43-101 compliant resources, Q2 2026.

- The Project area was a previous producer at Little Chief deposit and other deposits.

- Between 1967-82 Hudson Bay Mining & Smelting, mined 10.5mt at 1.5% Cu plus 0.75g/t Au (Watson P.H. (1984) The Whitehorse Copper Belt - A Compilation. Yukon Geological Survey, Open File 1984-1).

- Key Institutional Investors - Dynamic, Mackenzie, Macquarie Bank and Orimco.

| Hole ID | Depth | East | North | Dip | Azim | Note | From | To | Interval (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

| CPG-072D1 | 182.88 | 505,725 | 6,715,466 | -46 | 291 | 78.40 | 82.00 | 3.60 | 1.06 | 0.30 | 10.34 | 1,940 | |

| 96.00 | 104.00 | 8.00 | 0.31 | 0.22 | 2.05 | 156 | |||||||

| CPG-072D2 | 202.69 | 505,722 | 6,715,464 | -79 | 4 | 58.80 | 79.00 | 20.20 | 0.69 | 0.02 | 2.58 | 626 | |

| Incl. | 67.00 | 79.00 | 12.00 | 1.04 | 0.03 | 3.25 | 438 | ||||||

| Incl. | 67.00 | 77.00 | 10.00 | 1.19 | 0.03 | 3.66 | 524 | ||||||

| 127.00 | 131.00 | 4.00 | 0.34 | 0.05 | 1.75 | 49 | |||||||

| CPG-074D2 | 320.04 | 506,035 | 6,715,236 | -42 | 23 | 50.00 | 62.35 | 12.35 | 2.66 | 0.12 | 20.75 | 46 | |

| 102.40 | 107.00 | 4.60 | 0.99 | 0.02 | 0.70 | 84 | |||||||

| CPG-074D3 | 251.46 | 506,034 | 6,715,235 | -73 | 5 | 23.00 | 53.00 | 30.00 | 0.38 | 0.03 | 0.97 | 244 | |

| CPG-079D2 | 160.02 | 506,137 | 6,715,227 | -50 | 59 | 114.00 | 120.00 | 6.00 | 0.39 | 0.02 | 3.97 | 116 | |

| 132.00 | 142.00 | 10.00 | 0.74 | 0.07 | 4.06 | 449 | |||||||

| CPG-079D3 | 201.17 | 506,134 | 6,715,226 | -65 | 187 | No Significant Assays | |||||||

| CPG-080D2 | 203.35 | 506,015 | 6,715,414 | -60 | 47 | 31.50 | 46.00 | 14.50 | 1.01 | 0.04 | 5.44 | 193 | |

| 64.00 | 76.00 | 12.00 | 0.67 | 0.00 | 2.20 | 26 | |||||||

| Incl. | 70.00 | 74.00 | 4.00 | 1.31 | 0.00 | 4.50 | 52 | ||||||

| 86.00 | 94.30 | 8.30 | 0.58 | 0.03 | 1.30 | 618 | |||||||

| 102.00 | 106.00 | 4.00 | 0.75 | 0.01 | 3.05 | 464 | |||||||

| CPG-080D3 | 350.52 | 506,014 | 6,715,414 | -88 | 311 | 40.00 | 46.00 | 6.00 | 0.50 | 0.02 | 3.03 | 44 | |

| 58.00 | 88.00 | 30.00 | 0.52 | 0.01 | 1.27 | 129 | |||||||

| 96.00 | 118.00 | 22.00 | 0.68 | 0.04 | 2.48 | 366 | |||||||

| Incl. | 102.80 | 108.00 | 5.20 | 1.75 | 0.10 | 7.09 | 589 | ||||||

| CPG-080D4 | 329.18 | 506,012 | 6,715,413 | -44 | 190 | 103.00 | 107.00 | 4.00 | 0.57 | 0.08 | 5.70 | 80 | |

| 115.00 | 132.00 | 17.00 | 0.85 | 0.06 | 4.98 | 2,694 | |||||||

| Incl. | 123.00 | 128.30 | 5.30 | 0.13 | 0.01 | 0.87 | 8,188 | ||||||

| Incl. | 125.00 | 128.30 | 3.30 | 0.11 | 0.01 | 0.00 | 12,375 | ||||||

| 144.00 | 148.00 | 4.00 | 0.55 | 0.02 | 1.55 | 373 | |||||||

| 151.00 | 156.50 | 5.50 | 0.47 | 0.07 | 1.46 | 94 | |||||||

| CPG-080D5 | 201.17 | 506,012 | 6,715,413 | -59 | 190 | 73.00 | 93.00 | 20.00 | 0.53 | 0.01 | 1.04 | 89 | |

| Incl. | 89.00 | 93.00 | 4.00 | 1.24 | 0.01 | 2.55 | 76 | ||||||

| 120.00 | 132.00 | 12.00 | 0.51 | 0.01 | 2.12 | 58 | |||||||

| CPG-081 | 208.79 | 505,458 | 6,715,561 | -59 | 10 | 39.00 | 44.00 | 5.00 | 0.22 | 0.05 | 1.51 | 210 | |

| CPG-081D1 | 150.88 | 505,457 | 6,715,555 | -46 | 189 | No Significant Assays | |||||||

| CPG-082 | 115.82 | 505,934 | 6,715,505 | -40 | 321 | No Significant Assays | |||||||

| CPG-082D1 | 136.55 | 505,935 | 6,715,500 | -55 | 188 | 9.00 | 60.80 | 51.80 | 0.80 | 0.08 | 5.70 | 432 | |

| Incl. | 24.00 | 58.00 | 34.00 | 1.09 | 0.11 | 7.44 | 566 | ||||||

| Incl. | 32.70 | 58.00 | 25.30 | 1.24 | 0.13 | 7.62 | 651 | ||||||

| 72.00 | 79.40 | 7.40 | 0.38 | 0.01 | 1.57 | 317 | |||||||

| 87.00 | 101.00 | 14.00 | 0.32 | 0.01 | 1.00 | 47 | |||||||

| CPG-083 | 505,675 | 6,715,561 | -73 | 191 | Hole Not Sampled - Abandoned | ||||||||

| CPG-083D1 | 80.47 | 505,675 | 6,715,557 | -45 | 186 | 63.60 | 69.00 | 5.40 | 0.39 | 0.02 | 1.27 | 100 | |

| CPG-084 | 134.14 | 505,897 | 6,715,470 | -49 | 10 | 58.50 | 67.10 | 8.60 | 0.59 | 0.03 | 2.37 | 596 | |

| CPG-084D1 | 142.00 | 505,897 | 6,715,470 | -75 | 8 | 41.00 | 121.00 | 80.00 | 0.46 | 0.03 | 1.59 | 269 | |

| 185.93 | Incl. | 57.44 | 59.10 | 1.66 | 3.69 | 0.12 | 10.30 | 16 | |||||

| CPG-085 | 505,853 | 6,715,348 | -44 | 32 | 5.75 | 8.00 | 2.25 | 0.54 | 0.01 | 1.00 | 24 | ||

| 263.00 | 25.10 | 27.00 | 1.90 | 1.37 | 0.08 | 26.40 | 1 | ||||||

| 76.00 | 78.00 | 2.00 | 2.72 | 0.29 | 36.70 | 1 | |||||||

| 84.00 | 94.00 | 10.00 | 0.38 | 0.03 | 2.25 | 140 | |||||||

| 121.40 | 131.00 | 9.60 | 0.41 | 0.04 | 1.62 | 145 | |||||||

| 212.00 | 221.00 | 9.00 | 0.45 | 0.04 | 1.44 | 590 | |||||||

| CPG-085D1 | 505,850 | 6,715,342 | -71 | 32 | 88.00 | 92.00 | 4.00 | 0.51 | 0.03 | 2.31 | 236 | ||

| 178.31 | 99.00 | 112.20 | 13.20 | 0.45 | 0.04 | 2.52 | 233 | ||||||

| 121.85 | 128.00 | 6.15 | 0.56 | 0.05 | 3.24 | 162 | |||||||

| CPG-085D2 | 505,854 | 6,715,347 | -66 | 175 | 67.00 | 71.00 | 4.00 | 1.01 | 0.08 | 5.70 | 649 | ||

| 150.88 | 79.00 | 95.00 | 16.00 | 0.41 | 0.04 | 1.49 | 359 | ||||||

| CPG-086 | 505,743 | 6,715,374 | -63 | 44 | 48.47 | 58.00 | 9.53 | 0.22 | 0.02 | 1.03 | 49 | ||

| 192.02 | 104.00 | 120.00 | 16.00 | 0.28 | 0.03 | 2.19 | 150 | ||||||

| CPG-086D1 | 505,744 | 6,715,377 | -69 | 11 | 72.00 | 76.00 | 4.00 | 0.71 | 0.10 | 6.90 | 164 | ||

| 199.64 | 102.00 | 114.00 | 12.00 | 0.58 | 0.01 | 1.93 | 403 | ||||||

| CPG-086D2 | 505,743 | 6,715,375 | -64 | 188 | 38.00 | 40.00 | 2.00 | 0.74 | 0.19 | 7.40 | 43 | ||

| CPG-087 | 179.83 | 506,296 | 6,715,483 | -45 | 147 | 81.00 | 83.30 | 2.30 | 0.95 | 0.04 | 40.50 | 18 | |

| CPG-087D1 | 146.91 | 506,298 | 6,715,480 | -78 | 151 | No Significant Assays | |||||||

| CPG-087D2 | 207.26 | 506,296 | 6,715,483 | -59 | 190 | 54.00 | 130.00 | 76.00 | 0.37 | 0.07 | 2.61 | 831 | |

| 214.88 | Incl. | 74.00 | 130.00 | 56.00 | 0.43 | 0.08 | 2.90 | 1,051 | |||||

| Incl. | 74.00 | 82.00 | 8.00 | 1.09 | 0.17 | 8.33 | 2,253 | ||||||

| CPG-087D3 | 506,296 | 6,715,483 | -55 | 114 | No Significant Assays | ||||||||

| CPG-088 | 228.60 | 505,675 | 6,715,382 | -44 | 7 | No Significant Assays | |||||||

| CPG-088D1 | 199.64 | 505,676 | 6,715,382 | -70 | 6 | 32.00 | 35.00 | 3.00 | 0.27 | 0.02 | 0.96 | 778 | |

| 150.88 | 83.00 | 85.00 | 2.00 | 1.08 | 0.18 | 7.70 | 126 | ||||||

| CPG-089 | 505,636 | 6,715,413 | -45 | 356 | 84.00 | 87.00 | 3.00 | 1.18 | 0.01 | 4.96 | 73 | ||

| 174.74 | 109.00 | 111.00 | 2.00 | 0.00 | 5.02 | 0.00 | 16 | ||||||

| CPG-089D1 | 505,638 | 6,715,409 | -65 | 355 | 30.00 | 40.00 | 10.00 | 0.57 | 0.01 | 1.90 | 64 | ||

| 70.71 | 57.00 | 59.70 | 2.70 | 0.55 | 0.01 | 2.03 | 45 | ||||||

| EOH | 65.00 | 70.71 | 5.71 | 0.54 | 0.01 | 1.29 | 276 | ||||||

| CPG-089D2 | 505,634 | 6,715,411 | -40 | 316 | 65.50 | 71.00 | 5.50 | 0.41 | 0.02 | 1.15 | 169 | ||

| 152.70 | 109.00 | 111.00 | 2.00 | 0.72 | 0.01 | 2.30 | 34 | ||||||

| CPG-090 | 505,928 | 6,715,337 | -45 | 53 | 20.00 | 24.00 | 4.00 | 0.40 | 0.00 | 3.15 | 4 | ||

| 321.56 | 68.00 | 80.00 | 12.00 | 0.22 | 0.01 | 0.70 | 75 | ||||||

| 94.50 | 124.00 | 29.50 | 1.21 | 0.15 | 8.46 | 425 | |||||||

| 142.00 | 158.00 | 16.00 | 0.58 | 0.01 | 1.33 | 89 | |||||||

| Incl. | 144.00 | 148.00 | 4.00 | 1.55 | 0.03 | 2.80 | 152 | ||||||

| 166.00 | 172.00 | 6.00 | 2.54 | 0.03 | 0.97 | 122 | |||||||

| 250.00 | 254.00 | 4.00 | 0.37 | 0.03 | 1.55 | 76 | |||||||

| 294.00 | 316.00 | 22.00 | 0.22 | 0.04 | 0.80 | 97 | |||||||

| CPG-090D1 | 505,928 | 6,715,337 | -63 | 54 | 71.50 | 85.00 | 13.50 | 0.44 | 0.04 | 4.14 | 22 | ||

| 181.36 | Incl. | 72.90 | 79.00 | 6.10 | 0.80 | 0.07 | 7.31 | 17 | |||||

| CPG-090D2 | 505,927 | 6,715,336 | -43 | 23 | 69.00 | 75.00 | 6.00 | 0.34 | 0.04 | 3.10 | 50 | ||

| 262.13 | 87.00 | 99.00 | 12.00 | 0.32 | 0.01 | 1.08 | 141 | ||||||

| 119.00 | 189.00 | 70.00 | 0.50 | 0.03 | 1.77 | 259 | |||||||

| Incl. | 135.00 | 145.00 | 10.00 | 1.07 | 0.05 | 3.20 | 197 | ||||||

| And | 159.00 | 165.00 | 6.00 | 1.02 | 0.07 | 4.57 | 979 | ||||||

| CPG-090D3 | 505,928 | 6,715,337 | -68 | 23 | 35.00 | 39.00 | 4.00 | 0.84 | 0.06 | 7.10 | 46 | ||

| 199.64 | 91.00 | 138.00 | 47.00 | 0.37 | 0.05 | 1.94 | 223 | ||||||

| CPG-091 | 506,243 | 6,715,497 | -45 | 181 | 71.50 | 96.00 | 24.50 | 1.06 | 0.15 | 9.08 | 1,115 | ||

| 182.58 | Incl. | 84.00 | 94.00 | 10.00 | 1.85 | 0.23 | 16.58 | 1,920 | |||||

| 110.00 | 144.00 | 34.00 | 0.90 | 0.15 | 7.34 | 518 | |||||||

| Incl. | 114.00 | 118.00 | 4.00 | 1.40 | 0.21 | 13.05 | 1,259 | ||||||

| And | 130.00 | 144.00 | 14.00 | 1.30 | 0.23 | 9.99 | 574 | ||||||

| CPG-092 | 506,132 | 6,715,346 | -88 | 14 | 116.00 | 297.00 | 181.00 | 0.34 | 0.01 | 1.66 | 108 | ||

| 376.43 | Incl. | 118.00 | 122.00 | 4.00 | 0.46 | 0.03 | 1.45 | 372 | |||||

| And | 140.00 | 152.00 | 12.00 | 0.42 | 0.02 | 1.18 | 252 | ||||||

| And | 176.00 | 231.00 | 55.00 | 0.70 | 0.01 | 2.61 | 154 | ||||||

| Incl. | 190.00 | 225.00 | 35.00 | 0.99 | 0.02 | 3.78 | 206 | ||||||

| Incl. | 190.00 | 221.00 | 31.00 | 1.05 | 0.02 | 4.10 | 232 | ||||||

| Incl. | 199.10 | 221.00 | 21.90 | 1.27 | 0.02 | 5.27 | 300 | ||||||

| 241.00 | 245.00 | 4.00 | 0.41 | 0.01 | 4.20 | 34 | |||||||

| 259.00 | 285.00 | 26.00 | 0.27 | 0.03 | 3.02 | 71 | |||||||

| CPG-093 | 330.71 | 506,178 | 6,715,335 | Assays Pending | |||||||||

| CPG-094 | 330.71 | 506,196 | 6,715,516 | -45 | 204 | 33.00 | 37.00 | 4.00 | 0.35 | 0.01 | 3.30 | 14 | |

| 45.00 | 64.80 | 19.80 | 0.47 | 0.03 | 1.46 | 379 | |||||||

| 95.50 | 166.00 | 70.50 | 1.13 | 0.05 | 4.22 | 470 | |||||||

| Incl. | 101.00 | 115.00 | 14.00 | 2.05 | 0.12 | 10.61 | 757 | ||||||

| And | 128.00 | 148.00 | 20.00 | 2.15 | 0.04 | 4.80 | 357 | ||||||

| Or | 140.00 | 146.00 | 6.00 | 5.36 | 0.04 | 7.13 | 33 | ||||||

| 184.00 | 196.00 | 12.00 | 0.51 | 0.06 | 3.92 | 482 | |||||||

| 202.00 | 218.00 | 16.00 | 0.43 | 0.03 | 2.61 | 505 | |||||||

| CPG-094D1 | 456.89 | 506,196 | 6,715,516 | -68 | 213 | Assays Pending | |||||||

| CPG-094D2 | 349.00 | 506,194 | 6,715,517 | -43 | 236 | Assays Pending | |||||||

| CPG-095 | 485.20 | 506,133 | 6,715,343 | -82 | 170 | Assays Pending | |||||||

| 202.00 | 206.00 | 4.00 | 0.62 | 0.02 | 3.25 | 183.50 | |||||||

Table 1: Recently returned drill assay results from Cowley Park. Note that the quoted Intersections are reported as interval widths and not true width. True widths of the intersected mineralised skarn system at Cowley Park is complex, with different grade distributions present related to the form of the contact between the granodiorite and sedimentary units as well different vein generations and orientations within the various intervals.

QA / QC

Drilling completed by Gladiator is irregularly spaced to test parts of the mineralised systems, holes were directionally surveyed utilising a North Seeking Gyro direction tool. Drill collars are subsequently surveyed utilising a high-accuracy RTK DGPS or DeviSite system. Diamond drilling is usually cased, then cored utilising HTW diameter before reducing at shallow depth in stable ground to NTW diameter drill core.

Mineralised quoted intersections are reported as interval widths and not true width. True widths of the intersected mineralised skarn system is complex making an estimate of the true width unreliable. This is due to different grade distributions and angle geometries present related to the form or outline of the contact between the granodiorite and sedimentary units as well different vein paragenesis and orientations within the various intervals. Where possible, drilling is conducted perpendicular to interpreted mineralisation.

Upon drilling of diamond core, Gladiator undertakes geological logging, marking up of lineal length of the core, recording core recovery, and Geotech measurements such as RQD's and taking core photographs.

Based on the geological logging, core is then marked up for sampling with a new sampling ticket that matches the submitted sample for analysis at the start of the sample interval, the drill core is then cut in half utilizing a core saw equipped with a diamond saw blade. The core samples are then sent for analysis and the remaining half core retained for future reference. Certified Reference Materials (CRMs) or known blank material is placed within the sampling sequence at a nominal sampling rate of at least 1 in 25 samples to monitor the Laboratory.

Samples are submitted to the Whitehorse based prep facility of ALS Global Laboratory (Canada). Samples subject to this release were crushed to 70% less than 2mm before pulverizing to better than 85% passing <75 microns. Assay pulps are then transported by ALS to the Vancouver (Langley) facility to be analysed. On occasions where the Whitehorse prep facility has reduced capacity to complete preparation of the samples within a timely manner, samples may be forwarded by ALS Global to their Langley facility for preparation utilising the same method as described above.

Samples were then analysed by ALS method ME-ICP61 (34 Element Aqua Regia with ICP-MS finish), with over limits for Cu analysed by method CU-OG62 (Aqua Regia with ICP-MS finish). Au is analysed by ALS method AU-AA25 (Ore Grade Au 30g Fire Assay AA Finish). As part of this process, Gladiator also captures the required sampling metadata to potentially utilize the core and analysis for any future requirements if deemed acceptable. The QA/QC meets the current required standards under reporting instruments, such as National Instrument 43-101. At this point, Gladiator regards the data collected from this exercise as reliable for the purposes of identifying future exploration targets and may be used to inform future drilling and exploration campaigns.

As part of this process, Gladiator also captures the required sampling metadata to potentially utilize the core and analysis for any future requirements if deemed acceptable. Further drilling will need to be completed by Gladiator at some stage to confirm the reliability or usability of this data in the future including but not limited to twinning of reported mineralisation. This may be required as Gladiator may not be able to confirm the accuracy of the stated drill collar location or be able to re-enter the holes to confirm depths and undertake directional surveys, or that the QA/QC might not meet the current required standards under reporting instruments, such as National Instrument 43-101. At this point, the Company is treating the data collected from this exercise as reliable for the purposes of identifying future exploration targets and may be used to inform future drilling and exploration campaigns.

References:

Watson P.H. (1984) The Whitehorse Copper Belt - A Compilation. Yukon Geological Survey, Open File 1984-1.(https://data.geology.gov.yk.ca/Reference/42011#InfoTab)

Tenney D. (1981) - The Whitehorse Copper Belt: Mining, Exploration and Geology (1967-1980). (https://ia802508.us.archive.org/18/items/whitehorsecopper00tenn/whitehorsecopper00tenn.pdf)

Qualified Person

All scientific and technical information in this news release has been prepared or reviewed and approved by Kell Nielsen, the Company's Vice President Exploration, a "qualified person" as defined by NI 43-101.

ON BEHALF OF THE BOARD

"Jason Bontempo"

Jason Bontempo

President and CEO

For further information contact:

Caitlin Cheadle, Investor Relations

+1-778-403-5139

This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Certain of the statements and information in this news release constitute "forward-looking statements" or "forward-looking information". Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "believes", "plans", "estimates", "intends", "targets", "goals", "forecasts", "objectives", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) that are not statements of historical fact may be forward-looking statements or information..

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, the need for additional capital by the Company through financings, and the risk that such funds may not be raised; the speculative nature of exploration and the stages of the Company's properties; the effect of changes in commodity prices; regulatory risks that development of the Company's material properties will not be acceptable for social, environmental or other reasons; availability of equipment (including drills) and personnel to carry out work programs; and that each stage of work will be completed within expected time frames. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company's forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information.