TORONTO, May 28, 2025 (GLOBE NEWSWIRE) -- Churchill Resources Inc. ("Churchill") is extremely pleased to announce that due-diligence sampling at the historical Frost Cove Antimony and Stewart Gold mines on the Black Raven property returned assays of >10% antimony and >10g/t gold, respectively. These samples exceeded the detection limit for those elements, and further assay work is underway to determine their precise metal contents. The Frost Cove Antimony Veins and host felsic dyke have been traced over 800m on surface, with numerous historical samples grading >1% Sb (the upper detection limit of the historical assays), and has never been drilled.

"These exceptional results further validate the Company’s strategic pivot to antimony and gold at Black Raven’s past-producing mines, and underscores the entire property’s significant potential. They confirm and expand upon historical records from the property reported in our news release of April 14th, 2025. Further successful exploration at Frost Cove confirming these grade tenors along strike would place it among the highest-grade antimony projects globally. Finally, Churchill is very pleased to announce the execution of the definitive agreement dated May 6th, 2025 to acquire a 100% undivided interest in the Black Raven Antimony Property, from property owners Eddie and Roland Quinlan." said Paul Sobie, Chief Executive Officer of Churchill.

The Black Raven property encloses the two small-scale past producing mines which operated between 1890 and 1918 exploiting stibnite, gold and arsenopyrite. The mines and numerous related occurrences constitute an extensive high-grade hydrothermal system carrying gold, antimony and silver in veins and stockworks. The historical mines and other occurrences are located within close proximity to each other, in a larger-scale geological environment defined by intense veining and alteration associated with felsic intrusions. For the first time in the project’s history, the entire mineralized system has been consolidated for systematic, state-of-the-art exploration.

Highlights:

- Frost Cove Antimony Mine adits are in excellent condition for systematic sampling, CRI grab samples from the two known veins in upper adit assayed >10% Sb

- Detailed sampling of both adits, and ~800m of known surface strike extent, with trenching and channel sampling, will commence in June

- Numerous other historical high-grade gold-silver veins confirmed including the past-producer Stewart Gold Mine – large hydrothermal system confirmed which is also to be evaluated with trenching/stripping/channel sampling

- Additional high-grade Au-Ag-Sb prospects not yet re-sampled

The Black Raven Property is located approximately 60km northwest of Gander, Newfoundland and Labrador, and hosts two past-producing mines dating back to the late 1800’s, the Frost Cove Antimony Mine, and the Stewart Gold-Antimony Mine. The Black Raven Property is located approximately 100km north of the Beaver Brook Antimony Mine, which is currently under care and maintenance. It is reported that the owners are actively exploring for more deposits to feed the mill. (Click Here)

Black Raven, like all of Churchill’s projects, is strategically located in Newfoundland and Labrador, which boast access to North American and European markets, proximity to deep water ports, exceptional power infrastructure and transportation networks. Like all of Churchill’s projects, Black Raven also benefits from Newfoundland & Labrador’s large and diversified minerals industry, which includes world class mines and processing facilities, and a well-developed mineral exploration sector with locally based drilling and geological expertise.

Antimony: A Critical Mineral in High Demand

Antimony is a critical mineral essential for national security and modern technology, with over 90% of global production controlled by China, Russia and other non-Western jurisdictions. The metal is a vital component in military applications, while also being crucial for certain flame retardants, strengthening alloys in batteries, and emerging energy storage technologies. Recent Chinese export restrictions have driven prices to record levels exceeding $50,000 per tonne, highlighting antimony’s strategic importance to a “Fortress North America” approach to critical mineral supply chains and making domestic North American sources increasingly important for economic and national security.

Due-Diligence Sampling Program

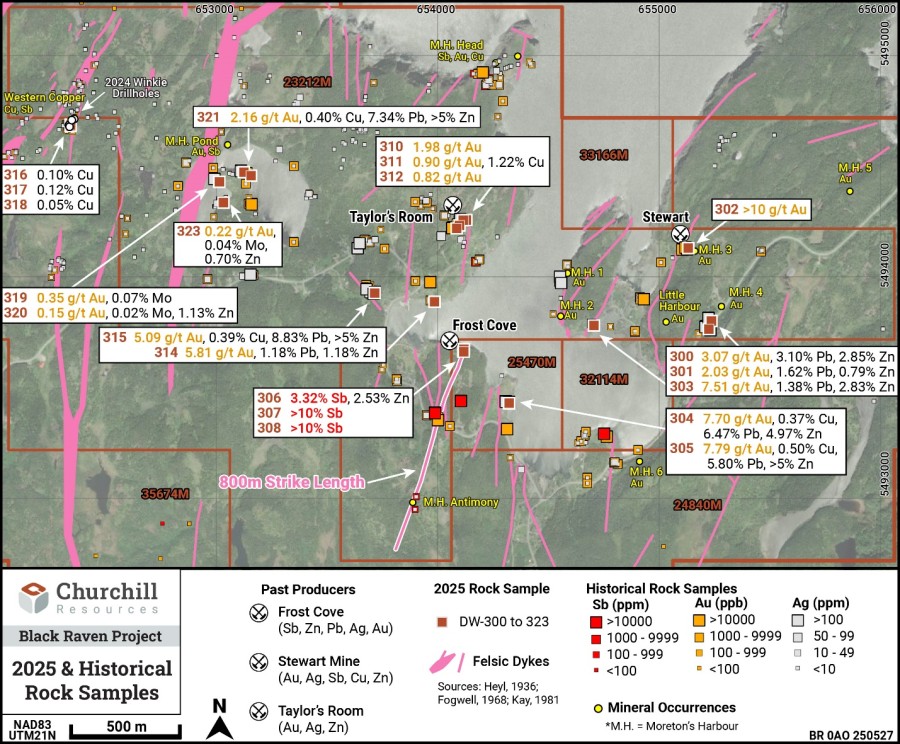

Antimony, gold and silver assay data from historical surface grab samples are presented in the figure below along with the 2025 Wilton due-diligence sample assays. Due-dilligence samples from several of the other prospects on the property returned high gold, lead, and zinc values per the figure and table below, with silver assays still pending. Importantly, reportedly high-grade occurrences at M.H. (Morton Harbour) Head, M.H.1 and M.H.2 were not able to be sampled during this first tour of the property.

All samples were selected by Dr. Derek Wilton, independent QP to Churchill, during field visits on April 24th and 25th in the company of Mr. Sobie and two senior field technicians, and led by vendor Roland Quinlan. All samples were labelled and securely bound and delivered to the prep laboratory of SGS Canada Inc. in Grand Falls-Windsor, for crushing and pulverizing. Splits were couriered to Burnaby, B.C. by SGS for assay work with analytical methods per the table below. Over-limit samples are currently receiving ore-grade assay work to determine precise metal contents. All due-diligence samples described in this news release were grab samples and are selective by nature and are unlikely to represent average grades of the property.

Frost Cove Antimony Mine – the historical workings are intact and as described by Heyl (1936), with a lower adit just above sea-level on the coast, and the upper adit commencing ~50m to the south, ~15m above the lower adit. It was not possible to examine the lower adit due to ice blockage, but the upper adit was accessible per the photos below and extends ~15m to a face where the antimony veins and host quartz feldspar dyke are exposed. The mine exploited two quartz-antimony veins intruded along the margins of the dyke over a stope width of ~2.5m. A considerable amount of material has been mined out between the surface and the entrances to the two adits. The host dyke and associated quartz-antimony veins have been mapped and sampled over ~800m per the figure with several pits reporting elevated historical sampling results.

Samples DW 307 and 308 are from the massive sulphide portions of the two quartz-antimony veins (HW and FW veins) and both assayed above the detection limit of >10% Sb. The foot wall vein is ~50cm in width, and the hanging wall vein ~15cm in width at the sample site in the upper adit, with impressive massive stibnite zones within the veins, per photos below.

Sample 306 was quartz-carbonate-qfp (quartz-feldspar-porphyry)-antimony vein material from rubble at the mouth of the lower adit, and it assayed 3.32% Sb (with modest Zn).

Follow-up work has commenced as CRI crews have completed clearing away trees from the mined-out stope to provide safe access and better exposure. Plans are in place to collect several channel samples from both adits, as well as systematically sample at surface along the known 800m strike through mechanical trenching/stripping/channel samples. Several affiliated veins to the main one, based on the Heyl’s (1936) mapping will be investigated.

The table below provides assays received to-date for all 24 due-diligence samples.

Stewart Gold Mine – the site has been rehabilitated with the shaft and all pits covered and filled with gravel. Sample 302 quartz-arsenopyrite vein material from a very lean rubble pile (virtually all waste) assayed >10g/t. Follow-up planning for a trenching and drilling program at Stewart is commencing.

Nearby Gold Veins to Stewart Mine – Sample 303 assayed 7.51 g/t Au (plus modest Pb and Zn). In samples 304-305 from veins across the harbour and along trend –both samples returned 7.7g/t Au (plus modest Cu, higher tenor Pb and Zn). Arsenopyrite is the predominant sulphide within these narrow <0.5m veins.

Taylor’s Room Gold Prospect – only rubble piles were located thus far, as overburden and forest cover obscure the veins and pits have been filled in. CRI sampling didn’t confirm previously reported high values, with the best sample DW-310 grading 1.98 g/t Au from weathered arsenopyrite vein material. The CRI crew has completed cutting down the very thick trees and bush cover over these veins for better sampling access. The historical shaft is still present albeit full of water.

Nearby Veins to Taylor’s Room Veins – two different narrow quartz-carbonate-arsenopyrite veins (samples DW-314 and DW-315) graded 5.81 and 5.09 g/t Au respectively with DW-315 returning very high Pb and Zn assays.

Morton’s Harbour Pond/Western Copper – collectively these two prospects exhibit characteristics of a large-scale (~1km diameter) porphyry mineralization target based on wide-spread, intense stockwork veining carrying modest gold, copper, silver and molybdenum contents based on historical work. Low but encouraging values in Au, Mo, Zn were returned for samples DW-319 to 321 and 323 with one quartz vein sample (DW-321) grading 2.16 g/t Au (plus low copper, high Pb and Zn). At Western Copper – low Cu values were returned from three samples collected at past surface channel sampling, DW-316 to 318. CRI has compiled the results from the four Winkie holes drilled by Eddie Quinlan in 2024 which intersected mineralized Cu-Au-Ag stockwork in altered felsic volcanic rocks (0.1-0.3% Cu, 50-350ppb Au plus Ag) from collar to their end of holes at ~60m. CRI also has compiled 2012 Induced Polarization survey work over the larger porphyry target to plan follow-up trenching and drilling for the summer.

Black Raven Antimony-Gold Property

The Black Raven Property comprises nine map-staked licenses constituting a single contiguous block of 125 claims that in total cover 3,125ha or 31.25km2. Churchill and the vendors have agreed to a 4km wide area of interest around the property boundaries as part of their agreement.

Churchill intends to immediately commence its sampling program on the surface showings and any accessible historical workings following compilation of all historical data is complete. The entire property will be surveyed with LiDAR and orthophotos as soon as the Government permit has been received. Follow-up prospecting and systematic trenching, with channel sampling work as required, are being planned for initiation in June based on the compiled database. The derived geological and geochemical data will used to outline drill targets along strike and at depth to the historical workings.

The past sampling data reported in this News Release is historic in nature and does not meet NI43-101 standards. Churchill has relied on the information supplied in the Government of Newfoundland field assessment reports and from information found in the Mineral Occurrence Database System operated by the Newfoundland Department of Industry, Energy and, Technology. Natural Resources.

The technical and scientific information in this news release has been reviewed and approved by Dr. Derek H.C Wilton, P.Geo., FGC, who is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Dr. Wilton is an honorary research professor of Economic Geology at Memorial University in St. John’s and is independent of the Company for the purposes of NI 43-101.

References:

Heyl, George R., 1936. Geology and Mineral Deposits of the Bay of Exploits Area. Newfoundland Department of Natural Resources, Geological Section, Bulletin No 3. 65 pages.

Fogwill, W.D., 1968. Report on a copper prospect at Western Head, Moreton’s Harbour in the Notre Dame Bay Area, Newfoundland. Newfoundland and Labrador Geological Survey, Assessment File 2E/10/0350, 1968, 48 pages

Kay, E.A. 1981. A geochemical and fluid inclusion study of the arsenopyrite-stibnite-gold mineralization, Moreton’s Harbour, Notre Dame Bay, Newfoundland. Master Thesis, Memorial University of Newfoundland, St. John’s, Canada, 1981. Newfoundland and Labrador Geological Survey, Assessment File 002E/10/1075, 1981, 209 pages.

Quinlan E, 2013. First Year Assessment Report for 019872M, Ninth Year Assessment Report for 015553M, and Third Year Assessment Report for 017787M for Exploration within the Black Raven Property, NTS Map Sheet 2E/10. Newfoundland and Labrador Geological Survey Assessment Report, 69 pages

Quinlan, E. 2025. 21st, 8th & 4th Year Assessment Report of Diamond Drilling & Prospecting On Black Raven Property, License 023212M (21st Year), License 02840m (8th Year), License 35674m (4th Year) NTS 02E/10, North-Central Newfoundland. Property centered at approximately 49°57’N, 54°87’ W. 34 pages.

About Churchill Resources

Churchill Resources Inc. is a Canadian exploration company focused on strategic, critical minerals in Canada, principally at its prospective Taylor Brook, Florence Lake, and Black Raven properties in Newfoundland & Labrador. The Churchill management team, board, and advisors have decades of combined experience in mineral exploration and in the establishment of successful publicly listed mining companies, both in Canada and around the world. Churchill’s Newfoundland and Labrador projects have the potential to benefit from the province’s large and diversified minerals industry, which includes world class nickel mines and processing facilities, and a well-developed mineral exploration sector with locally based drilling and geological expertise.

Churchill’s Taylor Brook Nickel-Copper-Cobalt-Vanadium-Titanium Property, and Florence Lake Nickel Property, are both in good standing for a number of years, such that further exploration and development can await improved market conditions sentiment while the Company focuses on high-grade antimony-gold and other critical minerals.

| Further Information | |

| For further information regarding Churchill, please contact: | |

| Churchill Resources Inc. | |

| Paul Sobie, Chief Executive Officer | |

| This email address is being protected from spambots. You need JavaScript enabled to view it. | |

| Tel. | 416.365.0930 (o) |

| 647.988.0930 (m) | |

| Alec Rowlands, Business Development & IR | |

| This email address is being protected from spambots. You need JavaScript enabled to view it. | |

| Tel. | 416.721.4732 (m) |

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about Churchill’s objectives, goals and exploration activities proposed to be conducted on its properties; future growth potential of Churchill, including whether any proposed exploration programs at any of its properties will be successful; exploration results; and future exploration plans and costs. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. In particular, this release contains forward-looking information relating to, among other things, the entering into of a definitive Option Agreement and other ancillary transaction documents with respect to the Black Raven Antimony Property and the exercise of such option; the number of Common Shares that may be issued in connection with the transactions discussed herein, closing conditions and receive necessary regulatory approvals These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Such factors, among other things, include: exploration results on the Black Raven Antimony Property; the expected benefits to Churchill relating to the exploration proposed to be conducted on its properties; receipt of all regulatory approvals in connection with the transaction contemplated herein; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Churchill’s properties, if required; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; and title to properties. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Churchill cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Churchill assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.