Highlights:

-

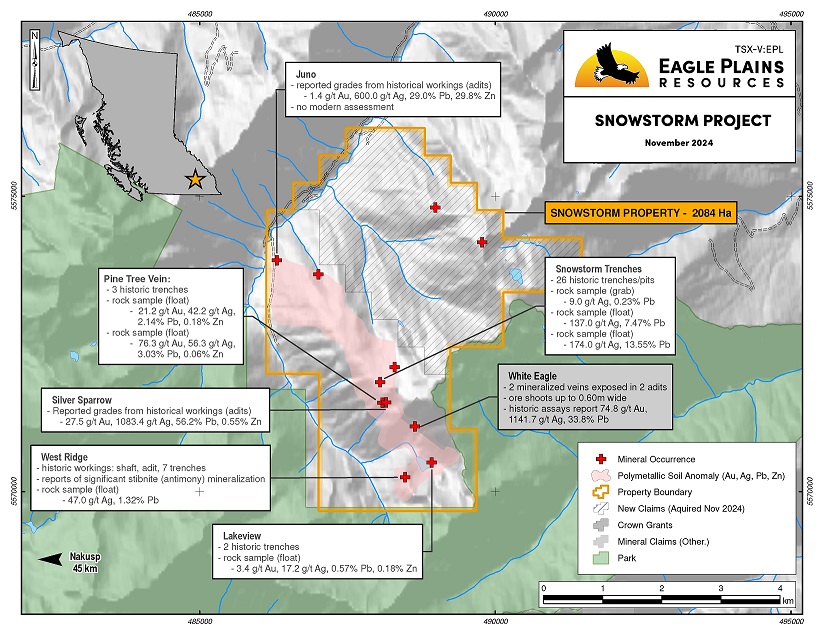

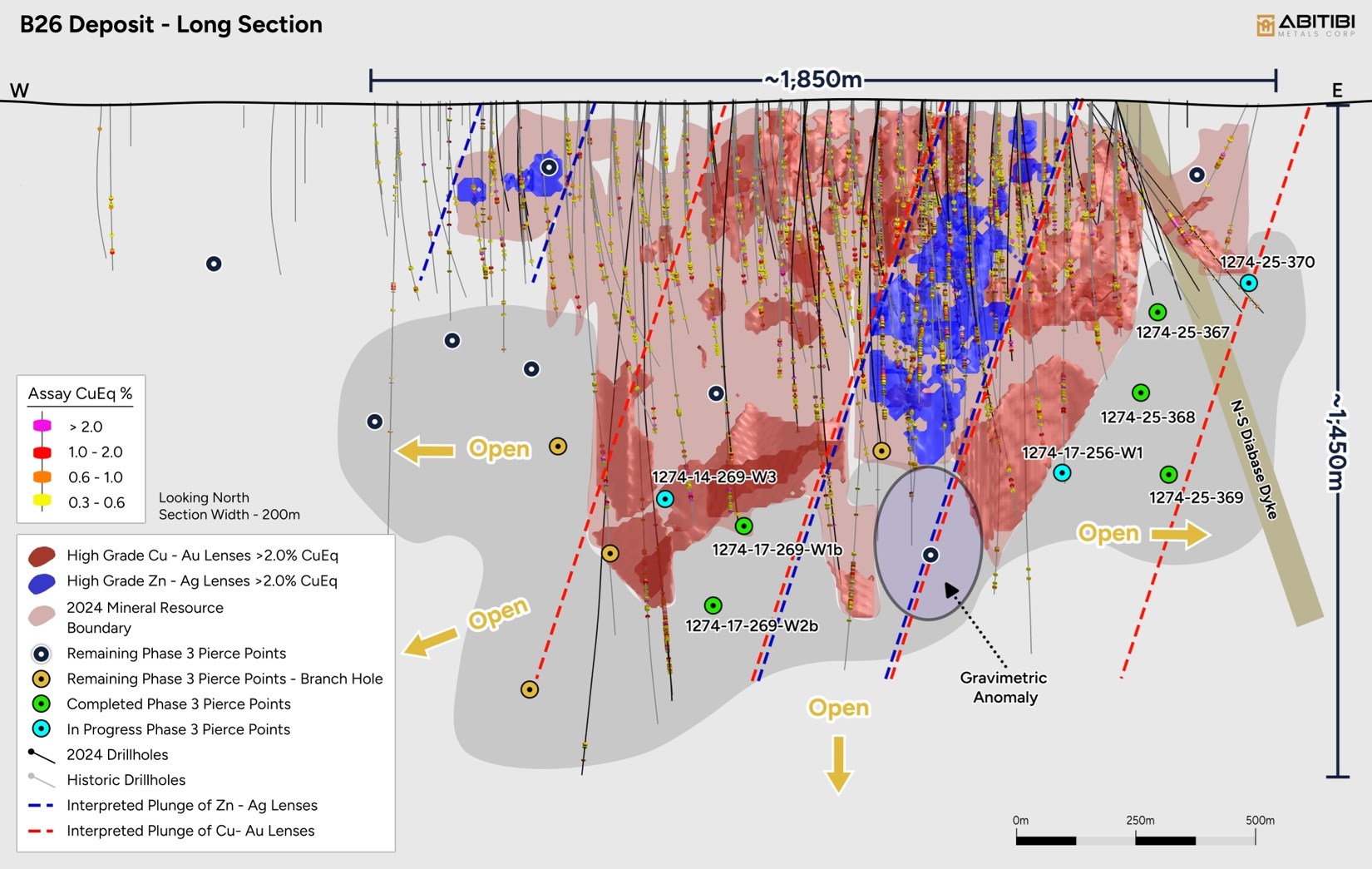

Hole 1274-17-269-W2b intersected 30 metres of strong VMS style mineralization 80 metres beyond current resource boundary between 1,140 and 1,170 meters along the hole. Visual observations (refer to Figure 1) confirm the presence of copper stringers and mineralization in key growth corridors; assays pending.

-

Hole 1274-25-368 intersected two multi-metre zones of disseminated copper and copper-sphalerite mineralization, located approximately 160 metres beyond previously drilled holes. The mineralized intervals were encountered between 662 and 686 metres downhole, assays are pending.

-

A total of eight holes completed, and 7,000 metres drilled to date in Phase 3 drill program, with three rigs active and 10,500 metres remaining.

London, Ontario--(Newsfile Corp. - August 7, 2025) - Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) ("Abitibi" or the "Company") is pleased to report on the progress of its ongoing Phase 3 drill program at the B26 polymetallic deposit in Québec. Drilling continues to successfully intersect mineralization beyond the current Mineral Resource Estimate ("MRE"), confirming the expansion of the mineralized footprint. The Company currently owns 50% of the B26 deposit and retains the option to earn an additional 30% from SOQUEM Inc. ("SOQUEM"), a subsidiary of Investissement Québec (see news release dated November 16, 2023).

As of this release, eight holes have been completed in Phase 3 and a total of 7,000 metres drilled to date, including holes drilled prior to breakup). To accelerate exploration efforts, a third drill rig was mobilized last week, targeting high-priority expansion zones across the western and down-plunge of the B26 mineralized system.

Jonathon Deluce, CEO of Abitibi Metals, stated: "The Phase 3 drill program is simultaneously delivering multiple positive developments, and we are just beginning to unlock its full potential. Directional drilling offers a significant advantage over conventional methods by reducing costs while generating multiple intercepts in the same area. This approach allows us to quickly identify and focus on the most promising zones, optimizing capital allocation and maximizing value for our project-and ultimately, for our shareholders."

Drilling Update at B26 Deposit:

Abitibi has completed several key step-out holes designed to test the boundaries of the current resource model. Visual analysis of core indicates strong mineralization in multiple holes.

Notable Highlights include:

-

1274-17-269-W1b: Intersected a mineralized zone approximately 80 metres beyond the existing MRE, representing a meaningful step-out and validating continued growth potential. This hole encountered a heavily mineralized interval of 6.6 metres from 993.0 within a broader 17.4-metre mineralized package between 982.2 and 999.6 metres downhole; assays are pending.

-

1274-17-269-W2b: This hole, a second Devico branch from the original hole 1274-17-269, cut 30 metres of strong VMS style copper stringers mineralization 80 metres beyond current resource boundary between 1,140 and 1,170 meters along the hole. The intercept is located some 80-metre east of hole 1274-24-338W1 and about 160 metres below 1274-17-269-W1b.

-

1274-25-368: The hole cut the mineralized envelope at predicted depth. A 1.7-metre chalcopyrite bearing intercept and a 1.2-metre sphalerite - chalcopyrite bearing intercept were cut between 682 and 686 metres in the hole. The hole targets an additional 160-metre step-out from hole 1274-16-234 in the eastern extension, aimed at following up on previously intersected mineralization.

-

1274-25-367: Drilling has been completed with core processing in progress. Drilling targeted an additional 80-metre step-out from hole 1274-14-182 in the eastern extension, aimed at following up on previously intersected mineralization.

Figure 1: Copper stringers mineralization observed in Hole 1274-17-269W2b

Figure 1: Copper stringers mineralization observed in Hole 1274-17-269W2b

Figure 2: B26 Long Section with Holes Completed

Figure 2: B26 Long Section with Holes Completed

About B26 polymetallic project:

The B26 polymetallic deposit is a rapidly advancing copper-gold asset with strong growth potential, underpinned by a recently announced Mineral Resource Estimate of 11.3 million tonnes at 2.13% CuEq (Indicated) and 7.2 million tonnes at 2.21% CuEq (Inferred). The deposit hosts approximately 550 million pounds of copper, 370,000 ounces of gold, along with significant zinc and silver credits, establishing B26 as a cornerstone asset in Québec's critical minerals strategy.

With high-impact exploration underway, a growing resource base, and strong copper-gold fundamentals, the B26 deposit is well-positioned to become a premier polymetallic resource supporting the global shift toward electrification and Québec's critical minerals supply chain.

On November 16, 2023, Abitibi Metals entered into an option agreement with SOQUEM Inc., a subsidiary of Investissement Québec, to earn up to 80% ownership of the B26 Deposit over seven years (see November 16, 2023 press release). The Company currently holds 50% ownership and is actively advancing toward earning an additional 30% interest.

Located just 5 km south of the past-producing Selbaie Mine, B26 lies within the heart of Québec's Abitibi region-approximately 90 km west of the Matagami mining camp and 140 km north-northwest of Amos. The project spans 66 contiguous mining claims, totaling 3,328.51 hectares, and benefits from exceptional infrastructure in a well-established mining district.

B26 is characterized by stacked massive and semi-massive polymetallic sulfide lenses, extending over one kilometre within a steeply dipping felsic volcanic basin. Mineralization is hosted primarily in rhyolite and associated tuffs, with two main styles observed:

- A northern domain, copper-rich chalcopyrite veins and veinlets are hosted in sericitized and chloritized rhyolite.

- A southern domain, disseminated to massive sphalerite, pyrite, and galena mineralization hosted in a dome of massive rhyolite.

- These mineralized zones are stacked sub-parallel, generally trending east-west and dipping 87° south, highlighting a structurally complex and prospective system that remains open laterally and at depth.

Phase 3 Drill Program: Driving Growth and Value

The ongoing Phase 3 drill program is designed to strategically advance B26 through three key objectives:

- Resource Growth - Higher-Grade Focus:

Targeted drilling is aimed at defining the continuity of previously underestimated higher-grade zones, improving the geological model and structural orientation and continuity. - Expansion of Mineralized Trends:

Step-out drilling is testing open-ended mineralized zones both at depth and along strike, with the goal of increasing overall tonnage and mineralized footprint. - Unlocking Regional Potential:

Exploration will also target new discoveries across the project's broader 8 km east-west trend and a 7 km northwest-southeast corridor between B26 and the past-producing Selbaie mine.

Collectively, these targets represent a critical step in unlocking the next phase of growth at B26. With the potential to significantly expand the strike length, depth, and overall mineralized footprint of the deposit, this phase of drilling could significantly enhance the scale, grade continuity, and long-term development potential of one of Quebec's most promising mineral deposits.

Looking Ahead:

Initial assay results from Phase 3 are expected in the coming month and will continue throughout the remainder of 2025. Abitibi Metals is fully funded to Q1, 2027, the Company has budgeted approximately 25,000 additional metres for Phase 4 drilling, to be strategically deployed in 2026 based on ongoing exploration success.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Mr. Louis Gariépy, P.Eng (OIQ #107538), VP Exploration of Abitibi Metals, who is a "qualified person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Abitibi Metals Corp:

Abitibi Metals Corp. (CSE: AMQ) is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi's portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate of 11.3MT @ 2.13% Cu Eq (Ind.: 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag) & 7.2MT @ 2.21% Cu Eq (Inf.: 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag), and the Beschefer Gold Project, where historical drilling has identified four historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres (BE13-038) and 13.07 g/t gold over 8.75 metres (BE12-014) amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec's mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

For more information, please call 226-271-5170, email This email address is being protected from spambots. You need JavaScript enabled to view it., or visit https://www.abitibimetals.com.

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Note 1: Technical Report NI 43-101 Resource Estimation Update Project B26, Quebec, For Abitibi Metals Corp., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada - Geostat., Effective Date: November 1, 2024, Date of Report: February 26, 2025

Forward-looking statement:

This news release contains certain statements, which may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company's behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi's forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects," "estimates," "anticipates," or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results "may," "could," "might" or "occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.