Higher Gold Sales, Record Adjusted EBITDA & Earnings, and Significant Growth in Cash

VANCOUVER, BC, Aug. 7, 2025 /CNW/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces its financial and operating results for the three and six months ended June 30, 2025 (Q2 2025 and H1 2025). In addition, the Company announces the publication of its 2024 Sustainability Report, which is available for review on our website. All amounts are in U.S. dollars unless otherwise indicated.

Q2 2025 Financial Performance

- Record revenue of $200.2 million, up 30% from Q1 2025 and 75% from Q2 2024, driven by higher gold prices and increased sales volumes.

- Cash balance increased to $310 million as of June 30, 2025, up from $240 million at March 31, 2025 as a result of strong cash flow generation from operations and proceeds from ARIS.WT.A warrant exercises. After June 30, 2025, the Company received an additional $60.5 million from the exercise of these warrants, which expired on July 29. In total, 98.7% of the warrants were exercised, generating $114.8 million in proceeds.

- Adjusted EBITDA1 of $98.7 million, up 48% from Q1 2025 and nearly triple Q2 2024. On a trailing 12-month basis, Adjusted EBITDA1 has reached $264.0 million.

- Growth capital investment of $36.7 million, supporting long-term expansion, primarily at the Marmato Bulk Mining Zone ($23.6 million) and Segovia ($6.9 million).

- Record adjusted net earnings of $47.8 million or $0.27/share – the highest since Aris Mining's formation in September 2022 – up from $0.16/share in Q1 2025 and $0.08/share in Q2 2024.

Neil Woodyer, CEO, commented "With record adjusted net earnings, over $310 million in cash, and the commissioning of the second mill at Segovia, we are well‑positioned for stronger production in the second half of 2025 while advancing construction of the Marmato Bulk Mining Zone and technical studies at Soto Norte and Toroparu, which underpin a compelling growth pipeline. The expiry of the ARIS.WT.A warrants on July 29 has simplified our capital structure and eliminated a source of non‑cash earnings volatility. We remain firmly on track to become a leading intermediate gold producer in Latin America with a highly attractive profile for investors."

|

Q2 2025 |

Q1 2025 |

Q2 2024 |

|

|

Gold production ounces (oz), total |

58,652 |

54,763 |

49,216 |

|

Gold sold (oz), total |

61,024 |

54,281 |

49,469 |

|

Segovia – AISC, Owner Mining ($/oz sold) |

$1,520 |

$1,482 |

$1,616 |

|

Segovia – CMP AISC Margin |

42 % |

41 % |

34 % |

|

EBITDA |

$31.6M |

$39.7M |

$30.8M |

|

Adjusted EBITDA |

$98.7M |

$66.6M |

$36.1M |

|

Adjusted EBITDA, last 12 months |

$264.0M |

$201.3M |

$144.6M |

|

Net earnings (loss)2 |

$(16.9)M3 or $(0.09)/share |

$2.4M or $0.01/share |

$5.7 or $0.04/share |

|

Adjusted earnings |

$47.8M or $0.27/share |

$27.2M or $0.16/share |

$12.7 or $0.08/share |

|

Adjusted earnings, last 12 months |

$112.7M or $0.65/share |

$77.7M or $0.46/share |

$42.9M or $0.31/share |

Q2 2025 Operational Performance

- Gold production totaled 58,652 oz, a 7% increase from 54,763 oz in Q1 2025. Production is expected to progressively increase in H2 2025 following the June 2025 commissioning of the second mill at Segovia.

- Marmato Narrow Vein Zone produced 7,125 oz, a 29% increase over Q2 2024 and consistent with Q1 2025 production levels.

- Segovia Operations produced 51,527 oz, supported by gold grades of 9.9 g/t and gold recoveries of 96.1%.

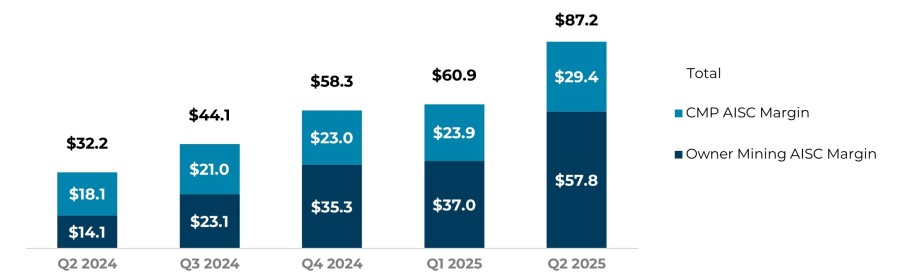

- AISC margin increased to $87.2 million, up 43% from Q1 2025. On a trailing 12-month basis, AISC margin has reached $250.4 million.

- Owner-operated Mining AISC was $1,520/oz (Q1 2025: $1,482/oz), bringing H1 2025 average to $1,503/oz, tracking toward the lower end of the full year 2025 guidance range of $1,450 to $1,600.

- Contract Mining Partner (CMP) sourced gold delivered an AISC sales margin of 42%, contributing to a 41% margin for H1 2025. This is above the full-year 2025 guidance range of 35% to 40%.

- Total AISC increased to $1,681/oz (Q1 2025: $1,570), primarily due to higher gold prices, which increased costs related to material purchased from CMPs, together with royalties and social contributions tied to gold sales.

|

Total Segovia Operating Information |

Q2 2025 |

Q1 2025 |

Q2 2024 |

||||

|

Average realized gold price ($/oz sold) |

$3,303 |

$2,855 |

$2,313 |

||||

|

Tonnes milled (t) |

167,960 |

167,150 |

155,912 |

||||

|

Average tonnes milled per day (tpd) |

1,976 |

1,966 |

1,834 |

||||

|

Average gold grade processed (g/t) |

9.85 |

9.37 |

9.14 |

||||

|

Gold produced (oz) |

51,527 |

47,549 |

43,705 |

||||

|

Gold sold (oz) |

53,751 |

47,390 |

43,366 |

||||

|

AISC margin ($M) |

87.2 |

60.9 |

32.2 |

||||

|

Segovia Operating Information by Segment |

Q2 2025 |

Q1 2025 |

Q2 2024 |

||||

|

Owner Mining |

|||||||

|

Gold sold (oz) |

32,685 |

26,963 |

20,183 |

||||

|

Cash costs – ($/oz sold) |

$1,047 |

$1,123 |

1,222 |

||||

|

AISC – ($/oz sold) |

$1,520 |

$1,482 |

1,616 |

||||

|

AISC margin ($M) |

57.8 |

37.0 |

14.1 |

||||

|

CMPs |

|||||||

|

Gold sold (oz |

21,066 |

20,427 |

23,183 |

||||

|

Cash costs – ($/oz sold) |

$1,622 |

$1,431 |

1,367 |

||||

|

AISC – ($/oz sold) |

$1,931 |

$1,687 |

1,532 |

||||

|

AISC sales margin (%) |

42 % |

41 % |

34 % |

||||

|

AISC margin ($M) |

29.4 |

23.9 |

18.1 |

||||

|

* Aris Mining operates its own mines and contracts with community-based mining partners, referred to as Contract Mining Partners (CMPs), to increase total gold production. Some partners work within Aris Mining's infrastructure, while others manage their own mining operations on Aris Mining's titles using their own infrastructure. In addition, Aris Mining purchases high grade mill feed from third-party contractors operating off-title, which further optimizes production and increases operating margins. |

Growth and Expansion Updates

- Strong cash generation funding growth:

- Operations generated $74.6 million in cash flow after sustaining capital and income taxes in Q2 2025, fully funding all growth and expansion initiatives. After expansion capital, Aris Mining generated $37.9 million in net cash flow. See the Quarterly cash-flow summary in the following sections for additional cash flow analysis.

- Segovia expansion progressing well:

- Commissioning of the second ball mill in June 2025 marked a major milestone. The expanded plant capacity is expected to steadily increase gold production throughout H2 2025.

- As underground development advances and mill feed from contract mining partners increases, Segovia remains on track to achieve annual production of 210,000 to 250,000 ounces this year and targeting 300,000 ounces next year.

- $6.9 million was invested in Q2 2025 to support the plant expansion, underground development, and exploration activities.

- Marmato Bulk Mining Zone construction advancing:

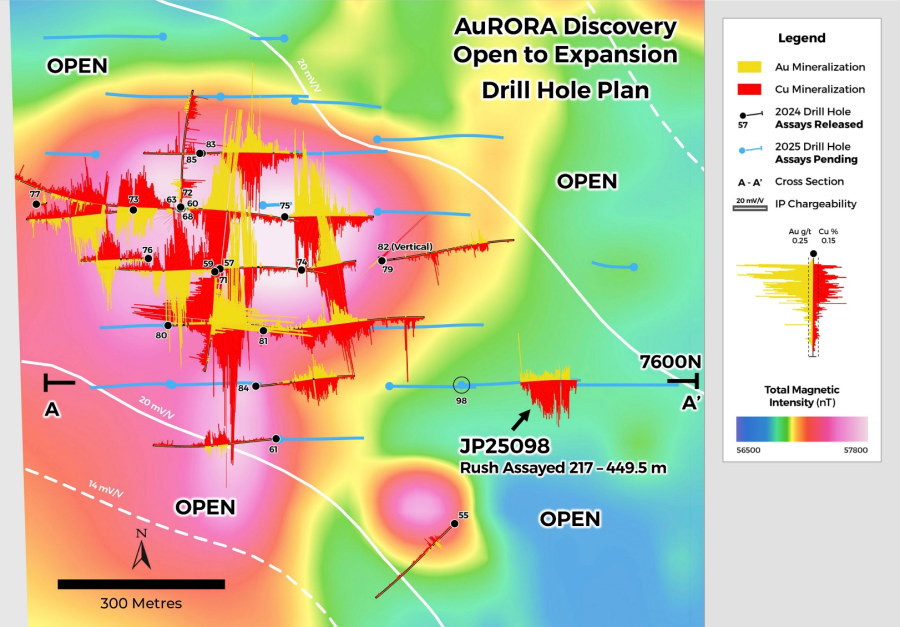

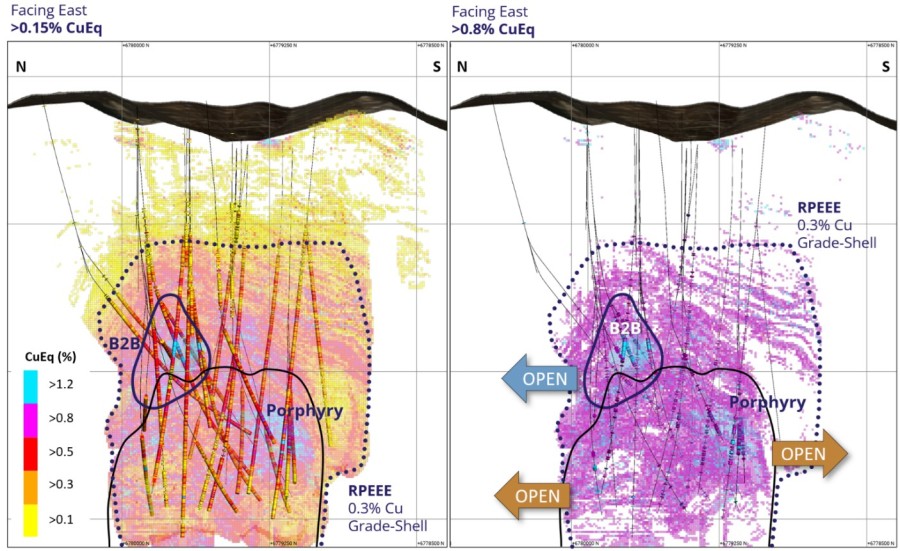

- The Bulk Mining Zone is a large, porphyry-hosted gold-silver system with wide, continuous mineralized zones that support bulk underground mining methods. Extensive drilling has defined a large mineral resource, and the deposit remains open at depth and along strike.

- Decline development to access the Bulk Mining Zone is underway.

- Earthworks for the main substation are completed and earthworks for the carbon-in-pulp (CIP) plant platforms are nearing completion.

- Equipment deliveries continued through the quarter, including major components such as crushers, mills, and tailings filters.

- $23.6 million was invested in Q2 2025.

- The project remains on schedule, with first ore and production ramp up expected in H2 2026.

- Soto Norte Project:

- A new Pre-Feasibility Study (PFS) is underway, with completion expected in Q3 2025. The PFS incorporates a smaller-scale development plan and includes processing options designed to support local small-scale miners.

- Upon completion of the PFS, Aris Mining intends to finalize and submit the required studies to apply for an environmental license for the development of Soto Norte.

- Toroparu Project:

- A new Preliminary Economic Assessment (PEA) is underway to evaluate updated development options. Following the March 2023 mineral resource update, Aris Mining completed infrastructure optimization studies that strengthen the development plan. The PEA is expected to be completed in Q3 2025.

|

Endnotes |

|

1 All references to adjusted earnings, EBITDA, adjusted EBITDA, growth capital investment, cash flow after sustaining capital and income taxes, cash costs and AISC are non-GAAP financial measures in this document. These measures are intended to provide additional information to investors. They do not have any standardized meanings under IFRS, and therefore may not be comparable to other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Refer to the Non-GAAP Measures section in this document for a reconciliation of these measures to the most directly comparable financial measure disclosed in the Company's financial statements. |

|

2 Net earnings represents net earnings attributable to owners of the company, as presented in the annual and interim financial statements for the relevant period. |

|

3 A $45.5 million non-cash loss was recognized in Q2 2025 from fair value adjustments to the Company's warrant liability, valued at $40.8 million as of June 30, 2025. The fair value of the liability is directly correlated to the Company's share price, which increased by 38% during Q2 2025 (year-to-date: 82% increase). In July 2025, the Company received an additional $60.5 million in cash proceeds from exercises of these warrants. With these exercises and the July 29, 2025 expiry of the remaining outstanding warrants, the liability has been fully extinguished, removing a source of non-cash earnings volatility from future results. |

Q2 2025 Conference Call Details

Management will host a conference call on Friday, August 8, 2025, at 9:00 a.m. New York / 6:00 a.m. Vancouver / 2:00 p.m. London / 3:00 p.m. Paris to discuss the results.

Participants may gain expedited access to the conference call by registering at Diamond Pass Registration (dpregister.com). Once registered, call in details will be displayed on screen which can be used to bypass the operator and avoid the call queue. Registration will remain open until the end of the live conference call.

Webcast

Conference Call

- Toll-free North America: +1-833-821-0197

- International: +1-647-846-2328

Audio Recording

- After the call, an audio recording will be available via telephone until end of day August 15, 2025

- Toll-free in the US and Canada: +1-855-669-9658

- International: +1-412-317-0088; and using the access code: 8035390

A replay of the event will be archived at Events & Presentations - Aris Mining Corporation.

Aris Mining's Condensed Consolidated Interim Financial Statements for the three and six months ended June 30, 2025 and 2024 and related MD&A are available on SEDAR+, in the Company's filings with the U.S. Securities and Exchange Commission (the SEC) and in the Financials section of Aris Mining's website here. Hard copies of the financial statements are available free of charge upon written request to This email address is being protected from spambots. You need JavaScript enabled to view it..

About Aris Mining

Founded in September 2022, Aris Mining was established with a vision to build a leading Latin America-focused gold mining company. Our strategy blends current production and cashflow generation with transformational growth driven by expansions of our operating assets, exploration and development projects. Aris Mining intends to unlock value through scale and diversification. The Company is listed on the TSX (ARIS) and the NYSE-A (ARMN) and is led by an experienced team with a track record of value creation, operational excellence, financial discipline and good corporate governance in the gold mining industry.

Aris Mining operates two underground gold mines in Colombia: the Segovia Operations and the Marmato Complex, which together produced 210,955 ounces of gold in 2024. With expansions underway, Aris Mining is targeting an annual production rate of more than 500,000 ounces of gold, following the commissioning of the secondmill at Segovia, completed in June and ramping up during H2 2025, and the construction of the Bulk Mining Zone at the Marmato Complex, expected to start ramping up production in H2 2026. In addition, Aris Mining operates the 51% owned Soto Norte joint venture, where studies are underway on a new, smaller scale development plan, with results expected in Q3 2025. In Guyana, Aris Mining owns the Toroparu gold/copper project, where a new Preliminary Economic Assessment (PEA) is underway and its results are also expected in Q3 2025.

Colombia is rich in high-grade gold deposits and Aris Mining is actively pursuing partnerships with the Country's dynamic small-scale mining sector. With these partnerships, we enable safe, legal, and environmentally responsible operations that benefit both local communities and the industry.

Additional information on Aris Mining can be found at www.aris-mining.com, www.sedarplus.ca, and on www.sec.gov.

Cautionary Language

Non-GAAP Measures

EBITDA, adjusted EBITDA, adjusted earnings, cash cost, growth and expansion expenditures, cash flow after sustaining capital and income tax and AISC are non-GAAP financial measures. These financial measures do not have any standardized meaning prescribed under IFRS or by Generally Accepted Accounting Principles (GAAP) in the United States, and therefore may not be comparable to other issuers. For full details on these measures refer to the "Non-GAAP Financial Measures" sections of the Company's Management's Discussion and Analysis for the three and six months ended June 30, 2025 and 2024 and years ended December 31, 2024 and 2023 (MD&As). The MD&As are incorporated by reference into this news release and are available at www.aris-mining.com, on the Company's profile on SEDAR+ at www.sedarplus.ca and in its filings with the SEC at www.sec.gov.

The tables below reconcile the non-GAAP financial measures contained in this news release for the current and comparative periods to the most directly comparable financial measure disclosed in the Company's interim financial statements for the three and six months ended June 30, 2025 and 2024; the three months ended March 31, 2025 and 2024, and Company's annual financial statements for the three months and years ended December 31, 2024 and 2023.

Quarterly cash-flow summary1

|

($000's) |

Q2 2025 |

Q1 2025 |

|

Gold revenue2 |

$200,231 |

$154,142 |

|

Total cash cost |

(83,166) |

(72,730) |

|

Royalties2 |

(7,583) |

(6,359) |

|

Social contributions2 |

(5,562) |

(4,334) |

|

Sustaining capital |

(12,710) |

(7,069) |

|

All in sustaining cost (AISC) |

(109,021) |

(90,492) |

|

AISC margin |

91,210 |

63,650 |

|

Taxes paid2 |

(42,244) |

(5,121) |

|

General and administration expense2 |

(5,187) |

(4,106) |

|

Decrease (increase) in VAT receivable |

30,813 |

(11,761) |

|

Other changes in working capital |

(877) |

(11,685) |

|

Impact of foreign exchange losses on cash balances2 |

925 |

768 |

|

After-tax adjusted sustaining margin |

74,640 |

31,745 |

|

Expansion and growth capital expenditure |

||

|

Segovia Operations |

(6,930) |

(6,368) |

|

Marmato Bulk Mining Zone |

(23,628) |

(29,661) |

|

Toroparu Project |

(2,741) |

(2,411) |

|

Soto Norte Project & other |

(3,446) |

(4,570) |

|

Total expansion and growth capital |

(36,745) |

(43,010) |

|

Financing and other costs |

||

|

Proceeds from warrant and option exercises 2 |

57,670 |

5,197 |

|

Principal repayment of Gold Notes 2 |

(4,063) |

(3,941) |

|

Capitalized interest paid2 |

(5,802) |

(5,031) |

|

Interest (paid)2 |

(18,000) |

— |

|

Finance income2 |

2,633 |

2,336 |

|

Total financing and other costs |

32,438 |

(1,439) |

|

Net change in cash2 |

70,333 |

(12,704) |

|

Opening cash balance at beginning of period2 |

239,831 |

252,535 |

|

Closing cash balance at end of period2 |

$310,164 |

$239,831 |

|

1. |

This Quarterly Cash Flow Summary is comprised of certain non-GAAP financial measures. Refer to the Non-GAAP Financial Measures section of this news release for further information. |

|

2. |

As presented in the Financial Statements and notes for the respective periods. |

Segovia AISC Margin

|

($000s except per ounce, and ounce amounts) |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

||

|

Gold produced (ounces) |

51,527 |

47,549 |

51,477 |

47,493 |

43,705 |

||

|

Gold sold (ounces) |

53,751 |

47,390 |

50,409 |

48,059 |

43,366 |

||

|

Financial Information |

|||||||

|

Gold revenue ($'000s) |

177,551 |

135,310 |

133,159 |

118,075 |

100,302 |

||

|

Average realized gold price ($/ounce sold) |

$3,303 |

$2,855 |

$2,642 |

$2,457 |

$2,313 |

||

|

Owner Mining costs |

23,228 |

19,291 |

18,845 |

15,780 |

17,187 |

||

|

CMP material purchases |

29,157 |

26,656 |

29,461 |

31,373 |

28,667 |

||

|

Processing costs |

7,412 |

7,430 |

6,879 |

6,985 |

6,536 |

||

|

Administration and security costs |

10,422 |

10,124 |

11,656 |

7,796 |

8,120 |

||

|

Change in finished goods and stockpile inventory |

961 |

(929) |

(4,070) |

1,130 |

(1,306) |

||

|

By-product and concentrate revenue |

(2,798) |

(3,073) |

(2,308) |

(2,665) |

(2,862) |

||

|

Total cash costs |

68,382 |

59,499 |

60,463 |

60,399 |

56,342 |

||

|

Cash cost per ounce sold |

$1,272 |

$1,256 |

$1,199 |

$1,257 |

$1,299 |

||

|

,43 |

3,506 |

||||||

|

Royalties |

5,539 |

4,519 |

4,342 |

3,506 |

3,078 |

||

|

Social contributions |

5,177 |

4,061 |

4,063 |

4,294 |

2,120 |

||

|

Sustaining capital |

10,861 |

5,856 |

5,426 |

5,423 |

6,224 |

||

|

Sustaining lease payments |

423 |

480 |

567 |

389 |

364 |

||

|

All-in sustaining costs |

90,382 |

74,415 |

74,861 |

74,011 |

68,128 |

||

|

All-in sustaining cost per ounce sold (Combined) |

$1,681 |

$1,570 |

$1,485 |

$1,540 |

$1,571 |

||

|

AISC Margin |

87,169 |

60,895 |

58,298 |

44,064 |

32,174 |

Cash costs per ounce

Reconciliation of total cash costs by business unit at Segovia and Marmato to the cash costs as disclosed above.

|

Three months ended June 30, 2025 |

Three months ended March 31, 2025 |

|||||||

|

($000s except per ounce amounts) |

Segovia |

Marmato |

Total |

Segovia |

Marmato |

Total |

||

|

Total gold sold (ounces) |

53,751 |

7,273 |

61,024 |

47,390 |

6,891 |

54,281 |

||

|

Cost of sales1 |

76,719 |

17,255 |

93,974 |

67,091 |

15,384 |

82,475 |

||

|

Less: royalties1 |

(5,539) |

(2,044) |

(7,583) |

(4,519) |

(1,840) |

(6,359) |

||

|

Add: by-product revenue1 |

(2,798) |

(427) |

(3,225) |

(3,073) |

(313) |

(3,386) |

||

|

Total cash costs |

68,382 |

14,784 |

83,166 |

59,499 |

13,231 |

72,730 |

||

|

Total cash costs ($ per oz gold sold) |

$1,272 |

$1,256 |

||||||

|

Total cash costs including royalties |

73,921 |

64,018 |

||||||

|

Total cash costs including royalties ($ per oz gold sold) |

$1,375 |

$1,351 |

||||||

|

Three months ended June 30, 2024 |

||||||||

|

($000s except per ounce amounts) |

Segovia |

Marmato |

Total |

|||||

|

Total gold sold (ounces) |

43,366 |

6,103 |

49,469 |

|||||

|

Cost of sales1 |

62,282 |

14,712 |

76,994 |

|||||

|

Less: royalties1 |

(3,078) |

(1,126) |

(4,204) |

|||||

|

Add: by-product revenue1 |

(2,862) |

(153) |

(3,015) |

|||||

|

Total cash costs |

56,342 |

13,433 |

69,775 |

|||||

|

Total cash costs ($ per oz gold sold) |

$1,299 |

|||||||

|

Total cash costs including royalties |

59,420 |

|||||||

|

Total cash costs including royalties ($ per oz gold sold) |

$1,370 |

|||||||

|

1 As presented in the Annual and Interim Financial Statements and notes thereto for the respective periods. |

||||||||

Cash costs per ounce – Business Units (Segovia)

|

Three months ended June 30, 2025 |

Three months ended March 31, 2025 |

||||||

|

($000s except per ounce amounts) |

Owner |

CMPs |

Total |

Owner |

CMPs |

Total |

|

|

Total gold sold (ounces) |

32,685 |

21,066 |

53,751 |

26,963 |

20,427 |

47,390 |

|

|

Cost of sales1 |

39,532 |

37,187 |

76,719 |

34,799 |

32,292 |

67,091 |

|

|

Less: royalties1 |

(3,605) |

(1,934) |

(5,539) |

(2,783) |

(1,736) |

(4,519) |

|

|

Add: by-product revenue1 |

(1,714) |

(1,084) |

(2,798) |

(1,748) |

(1,325) |

(3,073) |

|

|

Total cash costs |

34,213 |

34,169 |

68,382 |

30,268 |

29,231 |

59,499 |

|

|

Total cash costs ($ per oz gold sold) |

$1,047 |

$1,622 |

$1,272 |

$1,123 |

$1,431 |

$1,256 |

|

|

Three months ended June 30, 2024 |

|||||||

|

($000s except per ounce amounts) |

Owner |

CMPs |

Total |

||||

|

Total gold sold (ounces) |

20,183 |

23,183 |

43,366 |

||||

|

Cost of sales1 |

28,531 |

33,751 |

62,282 |

||||

|

Less: royalties1 |

(1,720) |

(1,358) |

(3,078) |

||||

|

Add: by-product revenue1 |

(2,151) |

(711) |

(2,862) |

||||

|

Total cash costs |

24,660 |

31,682 |

56,342 |

||||

|

Total cash costs ($ per oz gold sold) |

$1,222 |

$1,367 |

$1,299 |

||||

|

1 As presented in the Annual and Interim Financial Statements and notes thereto for the respective periods. |

|||||||

All-in sustaining costs (AISC)

Reconciliation of total AISC by business unit at Segovia and Marmato to the AISC as disclosed above.

|

Three months ended June 30, 2025 |

Three months ended Mar 31, 2025 |

||||||||||

|

($000s except per ounce amounts) |

Segovia |

Marmato |

Total |

Segovia |

Marmato |

Total |

|||||

|

Total gold sold (ounces) |

53,751 |

7,273 |

61,024 |

47,390 |

6,891 |

54,281 |

|||||

|

Total cash costs |

68,382 |

14,784 |

83,166 |

59,499 |

13,231 |

72,730 |

|||||

|

Add: royalties1 |

5,539 |

2,044 |

7,583 |

4,519 |

1,840 |

6,359 |

|||||

|

Add: social programs1 |

5,177 |

385 |

5,562 |

4,061 |

273 |

4,334 |

|||||

|

Add: sustaining capital expenditures |

10,861 |

1,426 |

12,287 |

5,856 |

733 |

6,589 |

|||||

|

Add: lease payments on sustaining capital |

423 |

— |

423 |

480 |

— |

480 |

|||||

|

Total AISC |

90,382 |

18,639 |

109,021 |

74,415 |

16,077 |

90,492 |

|||||

|

Total AISC ($ per oz gold sold) |

$1,681 |

$1,570 |

|||||||||

|

Three months ended June 30, 2024 |

|||||||||||

|

($000s except per ounce amounts) |

Segovia |

Marmato |

Total |

||||||||

|

Total gold sold (ounces) |

43,366 |

6,103 |

49,469 |

||||||||

|

Total cash costs |

56,342 |

13,433 |

69,775 |

||||||||

|

Add: royalties1 |

3,078 |

1,126 |

4,204 |

||||||||

|

Add: social programs1 |

2,120 |

151 |

2,271 |

||||||||

|

Add: sustaining capital expenditures |

6,224 |

782 |

7,006 |

||||||||

|

Add: lease payments on sustaining capital |

364 |

— |

364 |

||||||||

|

Total AISC |

68,128 |

15,492 |

83,620 |

||||||||

|

Total AISC ($ per oz gold sold) |

$1,571 |

||||||||||

|

1 As presented in the Annual and Interim Financial Statements and notes thereto for the respective periods. |

|||||||||||

All-in sustaining costs (AISC) – Segovia by Business Unit

|

Three months ended Jun 30, 2025 |

Three months ended Mar 31, 2025 |

|||||

|

($000s except per ounce amounts) |

Owner |

CMPs |

Total |

Owner |

CMPs |

Total |

|

Total gold sold (ounces) |

32,685 |

21,066 |

53,751 |

26,963 |

20,427 |

47,390 |

|

Total cash costs |

34,213 |

34,169 |

68,382 |

30,268 |

29,231 |

59,499 |

|

Add: royalties1 |

3,605 |

1,934 |

5,539 |

2,783 |

1,736 |

4,519 |

|

Add: social programs1 |

3,366 |

1,811 |

5,177 |

2,501 |

1,560 |

4,061 |

|

Add: sustaining capital expenditures |

8,088 |

2,773 |

10,861 |

3,917 |

1,939 |

5,856 |

|

Add: lease payments on sustaining capital |

423 |

— |

423 |

480 |

— |

480 |

|

Total AISC |

49,695 |

40,687 |

90,382 |

39,949 |

34,466 |

74,415 |

|

Total AISC ($ per oz gold sold) |

$1,520 |

$1,931 |

$1,681 |

$1,482 |

$1,687 |

$1,570 |

|

Three months ended Dec 31, 2024 |

Three months ended Sep 30, 2024 |

|||||

|

($000s except per ounce amounts) |

Owner |

CMPs |

Owner |

Owner |

CMPs |

Total |

|

Total gold sold (ounces) |

28,149 |

22,260 |

50,409 |

22,952 |

25,107 |

48,059 |

|

Total cash costs |

29,320 |

31,143 |

60,463 |

24,820 |

35,579 |

60,399 |

|

Add: royalties1 |

2,754 |

1,588 |

4,342 |

1,999 |

1,507 |

3,506 |

|

Add: social programs1 |

2,558 |

1,505 |

4,063 |

2,449 |

1,845 |

4,294 |

|

Add: sustaining capital expenditures |

3,819 |

1,607 |

5,426 |

3,640 |

1,783 |

5,423 |

|

Add: lease payments on sustaining capital |

567 |

— |

567 |

389 |

— |

389 |

|

Total AISC |

39,018 |

35,843 |

74,861 |

33,297 |

40,714 |

74,011 |

|

Total AISC ($ per oz gold sold) |

$1,386 |

$1,610 |

$1,485 |

$1,451 |

$1,622 |

$1,540 |

|

Three months ended Jun 30, 2024 |

||||||

|

($000s except per ounce amounts) |

Owner |

CMPs |

Total |

|||

|

Total gold sold (ounces) |

20,183 |

23,183 |

43,366 |

|||

|

Total cash costs |

24,660 |

31,682 |

56,342 |

|||

|

Add: royalties1 |

1,720 |

1,358 |

3,078 |

|||

|

Add: social programs1 |

1,185 |

935 |

2,120 |

|||

|

Add: sustaining capital expenditures |

4,677 |

1,547 |

6,224 |

|||

|

Add: lease payments on sustaining capital |

364 |

— |

364 |

|||

|

Total AISC |

32,606 |

35,522 |

68,128 |

|||

|

Total AISC ($ per oz gold sold) |

$1,616 |

$1,532 |

$1,571 |

|||

|

1 As presented in the Annual and Interim Financial Statements and notes thereto for the respective periods. |

||||||

Additions to mineral interests, plant and equipment

|

($'000) |

Jun 30, 2025 |

Mar 31, 2025 |

Jun 30, 2024 |

|

|

Sustaining capital |

||||

|

Segovia Operations |

10,861 |

5,856 |

6,224 |

|

|

Marmato Narrow Vein Zone |

1,426 |

733 |

782 |

|

|

Total Sustaining Capital |

12,287 |

6,589 |

7,006 |

|

|

Non-sustaining capital |

||||

|

Marmato Bulk Mining Zone |

23,628 |

29,661 |

19,143 |

|

|

Segovia Operations |

6,930 |

6,368 |

16,284 |

|

|

Soto Norte Project and Other |

3,446 |

4,570 |

3,896 |

|

|

Marmato Narrow Vein Zone |

— |

— |

1,046 |

|

|

Toroparu Project |

2,741 |

2,411 |

2,079 |

|

|

Total (Growth Capital Investment) |

36,745 |

43,010 |

42,448 |

|

|

Additions to mining interest, plant and equipment1 |

49,032 |

49,599 |

49,454 |

|

|

1 As presented in the Annual and Interim Financial Statements and notes for the respective periods. |

||||

Earnings before interest, taxes, depreciation, and amortization (EBITDA) and adjusted EBITDA

|

($000s) |

Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sept 30, 2024 |

|

|

Earnings (loss) before tax1 |

12,258 |

21,220 |

37,513 |

13,603 |

|

|

Add back: |

|||||

|

Depreciation and depletion1 |

11,929 |

10,734 |

9,530 |

9,019 |

|

|

Finance income1 |

(2,633) |

(2,336) |

(1,606) |

(1,351) |

|

|

Interest and accretion1 |

9,992 |

10,037 |

21,165 |

6,493 |

|

|

EBITDA |

31,546 |

39,655 |

66,602 |

27,764 |

|

|

Add back: |

|||||

|

Share-based compensation1 |

8,136 |

3,784 |

(483) |

2,533 |

|

|

(Income) loss from equity accounting in investee1 |

— |

14 |

14 |

17 |

|

|

(Gain) loss on financial instruments1 |

50,737 |

16,628 |

(6,561) |

12,842 |

|

|

Other (income) expense1 |

1,090 |

535 |

1,116 |

(428) |

|

|

Foreign exchange (gain) loss1 |

7,224 |

5,997 |

(5,113) |

311 |

|

|

Adjusted EBITDA |

98,733 |

66,613 |

55,575 |

43,039 |

|

|

1 As presented in the Annual and Interim Financial Statements and notes for the respective periods. |

|||||

Earnings before interest, taxes, depreciation, and amortization (EBITDA) and adjusted EBITDA

|

($000s) |

June 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sept 30, 2023 |

|

|

Earnings (loss) before tax1 |

17,904 |

10,310 |

7,963 |

26,156 |

|

|

Add back: |

|||||

|

Depreciation and depletion1 |

8,082 |

7,519 |

7,535 |

10,938 |

|

|

Finance income1 |

(1,691) |

(2,246) |

(2,580) |

(3,672) |

|

|

Interest and accretion1 |

6,496 |

6,803 |

6,772 |

6,757 |

|

|

EBITDA |

30,791 |

22,386 |

19,690 |

40,179 |

|

|

Add back: |

|||||

|

Share-based compensation1 |

1,373 |

1,842 |

2,977 |

528 |

|

|

Revaluation of investments (Denarius/Aris) |

— |

— |

536 |

— |

|

|

(Income) loss from equity accounting in investee1 |

2,301 |

551 |

(3,667) |

(1,063) |

|

|

(Gain) loss on financial instruments1 |

6,144 |

3,742 |

13,429 |

(374) |

|

|

Other (income) expense1 |

2,681 |

— |

(1,442) |

21 |

|

|

Foreign exchange (gain) loss1 |

(7,211) |

(108) |

6,685 |

2,285 |

|

|

Adjusted EBITDA |

36,079 |

28,413 |

38,208 |

41,576 |

|

|

1 As presented in the Annual and Interim Financial Statements and notes for the respective periods. |

|||||

Adjusted net earnings and adjusted net earnings per share

|

($000s except shares amount) |

Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sept 30, 2024 |

||||

|

Basic weighted average shares outstanding |

179,836,208 |

171,622,649 |

170,900,890 |

169,873,924 |

||||

|

Net earnings (loss)1 |

(16,897) |

2,368 |

21,687 |

(2,074) |

||||

|

Add back: |

||||||||

|

Share-based compensation1 |

8,136 |

3,784 |

(483) |

2,533 |

||||

|

(Income) loss from equity accounting in investee1 |

— |

14 |

14 |

17 |

||||

|

(Gain) loss on financial instruments1 |

50,737 |

16,628 |

(6,561) |

12,842 |

||||

|

Other (income) expense1 |

1,090 |

535 |

1,116 |

(428) |

||||

|

Loss on extinguishment of Senior Notes |

— |

— |

11,463 |

— |

||||

|

Foreign exchange (gain) loss1 |

7,224 |

5,997 |

(5,113) |

311 |

||||

|

Income tax effect on adjustments |

(2,528) |

(2,099) |

2,536 |

(109) |

||||

|

Adjusted net (loss) / earnings |

47,762 |

27,227 |

24,659 |

13,092 |

||||

|

Per share – basic ($/share) |

0.27 |

0.16 |

0.14 |

0.08 |

||||

|

1 As presented in the Annual and Interim Financial Statements and notes for the respective periods. |

||||||||

Adjusted net earnings and adjusted net earnings per share

|

($000s except shares amount) |

June 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sept 30, 2023 |

|

Basic weighted average shares outstanding |

151,474,859 |

138,381,653 |

137,313,095 |

137,192,545 |

|

Net earnings (loss)1 |

5,713 |

(744) |

(5,944) |

13,833 |

|

Add back: |

||||

|

Share-based compensation1 |

1,373 |

1,842 |

2,977 |

528 |

|

Revaluation of investments (Denarius/Aris) |

— |

— |

536 |

— |

|

(Income) loss from equity accounting in investee1 |

2,301 |

551 |

(3,667) |

(1,063) |

|

(Gain) loss on financial instruments1 |

6,144 |

3,742 |

13,429 |

(374) |

|

Other (income) expense1 |

2,681 |

— |

(1,442) |

21 |

|

Loss on extinguishment of Senior Notes |

— |

— |

— |

— |

|

Foreign exchange (gain) loss1 |

(7,211) |

(108) |

6,685 |

2,285 |

|

Income tax effect on adjustments |

1,738 |

78 |

(2,221) |

(796) |

|

Adjusted net (loss) / earnings |

12,739 |

5,361 |

10,353 |

14,434 |

|

Per share – basic ($/share) |

0.08 |

0.04 |

0.08 |

0.11 |

|

1 As presented in the Annual and Interim Financial Statements and notes for the respective periods. |

||||

Qualified Person and Technical Information

Pamela De Mark, P.Geo., Senior Vice President Geology and Exploration of Aris Mining, is a Qualified Person as defined by National Instrument 43-101 (NI 43-101), and has reviewed and approved the technical information contained in this news release.

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the Company's ability to deliver on its 2025 objectives, the expected benefit from the Segovia expansion, the completion timeline and expected benefit from the Marmato Bulk Mining Zone construction, the expected completion date of the new pre-feasibility study for the Soto Norte Project, the completion date of the new preliminary economic assessment for the Toroparu Project and statements included in the "About Aris Mining" section of this news release relating to the Segovia Operations, Marmato Complex, Soto Norte Project and Toroparu Project are forward-looking. Generally, the forward-looking information and forward looking statements can be identified by the use of forward looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", "will continue" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this news release.

Forward looking information and forward looking statements, while based on management's best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Aris Mining to be materially different from those expressed or implied by such forward-looking information or forward looking statements, including but not limited to those factors discussed in the section entitled "Risk Factors" in Aris Mining's annual information form dated March 12, 2025 which is available on SEDAR+ at www.sedarplus.ca and included as part of the Company's Annual report on Form 40-F, filed with the SEC at www.sec.gov.

Although Aris Mining has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management's Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward-looking information are made as of the date hereof and Aris Mining disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.