Vancouver, British Columbia--(Newsfile Corp. - July 9, 2025) - Scottie Resources Corp. (TSXV: SCOT) (OTCQB: SCTSF) (FSE: SR80) ("Scottie" or the "Company") is pleased to announce a $16.8 million non-brokered private placement financing (the "Offering"), of which a lead order of $6 million, translating to $8.4 million in charitable flow-through funding, will be provided by Ocean Partners UK Limited ("Ocean Partners") (see the Company's news release dated July 7, 2025).

The Offering will consist of: (i) a best efforts non-brokered private placement of up to 10,957,792 charitable flow-through shares of the Company ("Charity FT Shares") at a price of $1.23 per Charity FT Share for gross proceeds of $13,500,000, of which Ocean Partners will receive 6,818,182 common shares of the Company ("Common Shares"); and (ii) a best efforts non-brokered private placement of up to 3,750,000 non-flow through Common Shares at a price of $0.88 per Common Share of the Company for gross proceeds of approximately $3,300,000.

Each Charity FT Share will qualify as a "flow-through share" (within the meaning of subsection 66(15) of the Income Tax Act (Canada)).

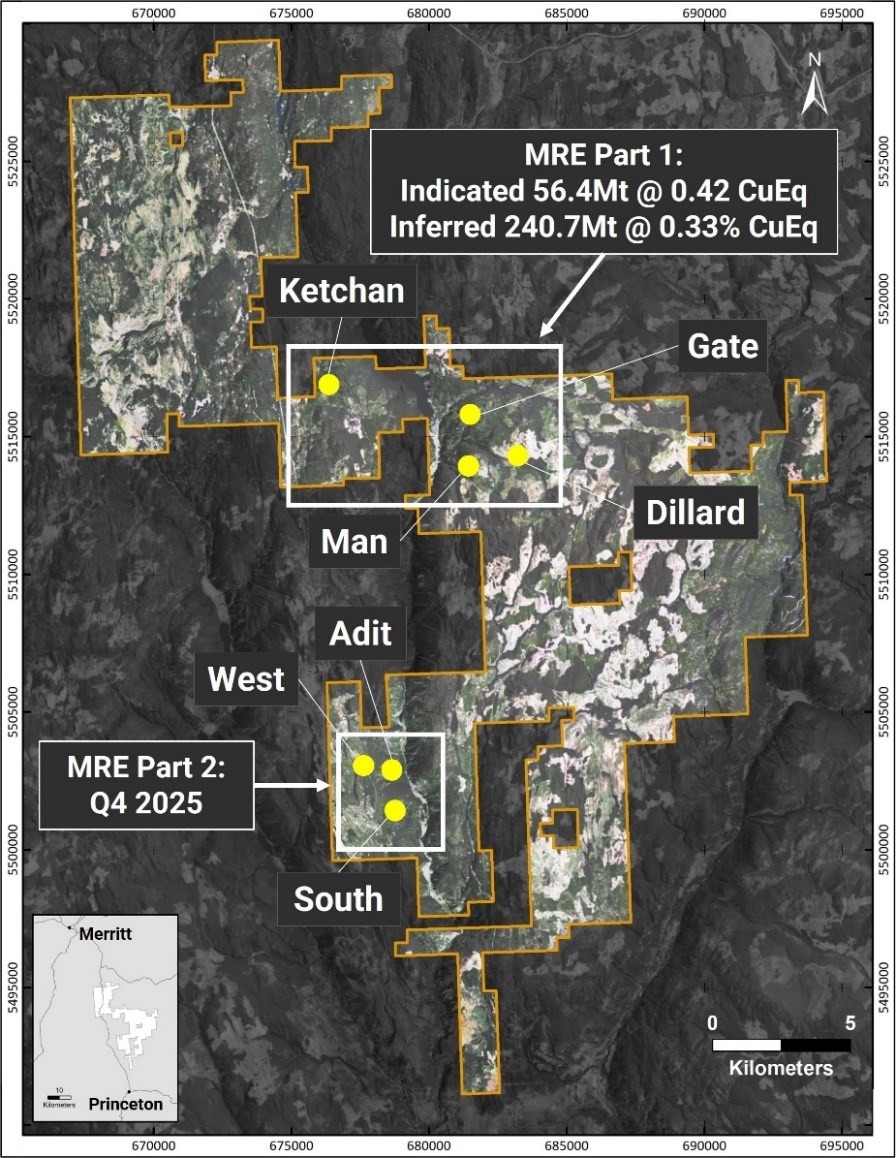

The gross proceeds from the issue and sale of the Charity FT Shares will be used by the Company to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as such terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") related to the Scottie Gold Mine Project in British Columbia. Qualifying Expenditures with respect to the Charity FT Shares with also qualify as "BC flow-through mining expenditures" as such term is defined in the Income Tax Act (British Columbia). All Qualifying Expenditures will be renounced in favour of the subscribers for the Flow-Through Shares effective on or before December 31, 2025. The non-flow-through common shares will be used to fund engineering and environmental studies and G&A expenses.

The net proceeds from the sale of the Common Shares will be used for development activities, study work, permitting activities, and for working capital and general corporate purposes.

In connection with the Offering, the Corporation may engage certain arm's-length parties who may receive a cash finder's fee payment and/or warrants to purchase common shares in the capital of the Corporation in consideration of securities that are sold to subscribers introduced by such parties. Any cash finder's fee payment and/or warrants will be subject to the approval of, and will be issued in accordance with, the rules of the TSX Venture Exchange (the "TSXV").

The Offering is expected to close on or about July 30, 2025 or such other date as the Corporation may determine and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the acceptance of the TSXV. The securities issued pursuant to the Investment and the Private Placement will be subject to a statutory four-month hold period.

This press release does not constitute an offer of sale of any of the foregoing securities in the United States. None of the foregoing securities have been and will not be registered under the U.S. Securities Act of 1933, as amended (the "1933 Act") or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements. This press release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the foregoing securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Dr. Thomas Mumford, P.Geo., a qualified person under National Instrument 43-101, has reviewed the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES CORP.

Scottie owns a 100% interest in the Scottie Gold Mine Property which includes the Blueberry Contact Zone and the high-grade, past-producing Scottie Gold Mine. Scottie also owns 100% interest in the Georgia Project which contains the high-grade past-producing Georgia River Mine, as well as the Cambria Project properties and the Sulu and Tide North properties. Altogether Scottie Resources holds approximately 58,500 hectares of mineral claims in the Stewart Mining Camp in the Golden Triangle.

The Company's focus is on expanding the known mineralization around the past-producing mines while advancing near mine high-grade gold targets, with the purpose of producing a high-margin DSO product.

All of the Company's properties are located in the area known as the Golden Triangle of British Columbia which is among the world's most prolific mineralized districts.

Additional Information:

Brad Rourke

CEO

+1 250 877 9902

This email address is being protected from spambots. You need JavaScript enabled to view it.

Forward-Looking Statements

This news release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this news release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things, statements relating to the closing of the Offering and the anticipated timing thereof; the anticipated use of proceeds from the Offering; the timing and receipt of all required approvals, including TSXV approval, to complete the Offering; and discussion of future plans, projects, objectives, estimates and forecasts and the timing related thereto.

Such forward-looking statements are based on a number of assumptions of management, including, without limitation, the Company's ability to continue with its stated business objectives and obtain required approvals; the ability of the Company to complete the Offering; the Company's ability to obtain all required approvals, including TSXV approval, to complete the Offering; and the Company's anticipated use of proceeds from the Offering. Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: risks associated with the business of the Company; risks related to the satisfaction or waiver of certain conditions to closing of the Offering; the failure of the Company to obtain all required approvals, including TSXV approval, to complete the Offering; the inability of the Company to complete the Offering; and other risk factors as detailed from time to time and additional risks identified in the Company's filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.ca).

Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither the Company nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this news release. Neither the Company nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this news release by you or any of your representatives or for omissions from the information in this news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES