Vancouver, British Columbia--(Newsfile Corp. - June 3, 2025) - Carlyle Commodities Corp. (CSE: CCC) (FSE: BJ4) (OTC: CCCFF) ("Carlyle" or the "Company") is pleased to announce, that further to its news release dated May 26, 2025, it has closed its previously announced transaction with Axcap Ventures Inc. ("Axcap") to sell a 100% interest in its Newton Gold Project (the "Newton Project"), located in British Columbia, Canada (the "Transaction"), pursuant to the terms of the Mineral Property Purchase Agreement dated May 23, 2025 (the "Agreement").

Under the terms of the Agreement, in consideration of the Newton Project, Carlyle received aggregate consideration comprising cash, shares and warrants, as follows:

-

$500,000 in cash payments;

-

500,000 common share purchase warrants of Axcap (the "Payment Warrants"), exercisable at $0.20 per share until June 3, 2028;

-

3,750,000 common shares of Axcap (the "Initial Payment Shares"); and

-

Common shares of Axcap valued at $1,250,000 (the "Secondary Payment Shares") to be issued 12 months following closing of the Transaction at a 20-day VWAP leading up to the anniversary of the Transaction, subject to Canadian Securities Exchange minimum pricing requirements.

Additionally, upon completion of certain milestones, as set forth below, Axcap will pay Carlyle the following consideration:

| Milestone | Share Payment | Cash Payment |

| 2,000,000 oz Au (Measured or Indicated Resource) | 2,500,000 shares | $250,000 |

| 3,000,000 oz Au (Measured or Indicated Resource) | 5,000,000 shares | $250,000 |

| Completion of NI 43-101 Pre-Feasibility Study | 5,000,000 shares | $500,000 |

| Completion of Bankable Feasibility Study | 10,000,000 shares | $1,000,000 |

Pursuant to the terms of the Agreement, the Initial Payment Shares are subject to voluntary resale restrictions as follows: 25% will become freely tradable on August 3, 2025; an additional 25% will become freely tradable every two months thereafter, with the final 25% becoming freely tradable on June 3, 2026. The Secondary Payment Shares will also be subject to voluntary resale restrictions as follows: 25% will become freely tradable four months following the date of issuance; an additional 25% will become freely tradable each subsequent month, with the final 25% becoming freely tradable seven months after issuance. Additionally, the Payment Warrants, Initial Payment Shares, and Secondary Payment Shares are subject to a statutory hold period of four months and one day from the date of issuance, in accordance with applicable securities laws.

Further, in connection with the Transaction Axcap paid a finder's fee by the issuance of 1,212,500 common shares of Axcap (the "Finder Shares") to an arm's length finder, which 587,500 Finder Shares was issued upon the closing of the Transaction and 625,000 Finder Shares will be issued upon issuance of the Secondary Payment Shares, subject to applicable securities laws and the policies of the CSE. The Finder Shares are subject to a statutory hold period of four months and one day from the date of issuance, in accordance with applicable securities laws.

About Carlyle

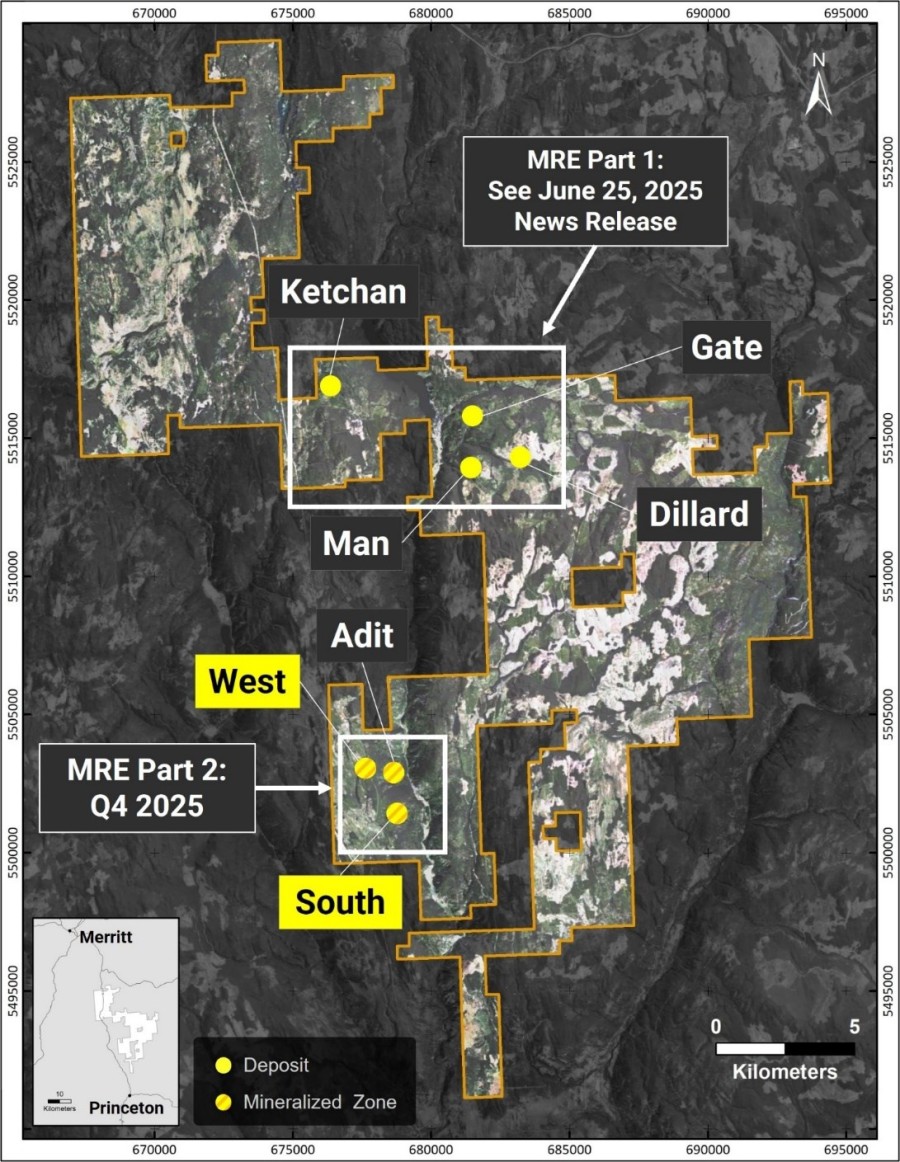

Carlyle is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. Carlyle owns 100% of the Quesnel Gold Project located in the Cariboo Mining Division, 30 kilometers northeast of Quesnel in central B.C, holds the option to acquire 100% undivided interest in the Nicola East Mining Project, located approximately 25 kilometers east of the mining town of Merritt, B.C., and is listed on the CSE under the symbol "CCC", on the OTC Market under the ticker "CCCFF" and the Frankfurt Exchange under the ticker "BJ4".

ON BEHALF OF THE BOARD OF DIRECTORS OF

CARLYLE COMMODITIES CORP.

"Morgan Good"

Morgan Good

Chief Executive Officer

For more information regarding this news release, please contact:

Morgan Good, CEO and Director

T: 604-715-4751

E: This email address is being protected from spambots. You need JavaScript enabled to view it.

W: www.carlylecommodities.com

FORWARD-LOOKING STATEMENTS

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of Carlyle regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the issuance of the Secondary Payment Shares and the milestone payments pursuant to the Agreement; the expected benefits of the Transaction to Carlyle; that Axcap will issue the remaining Finder Shares; or complete the disclosed Milestones and make the payments to Carlyle related thereto.

These forward-looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: the benefits of the Transaction or the prospects of the Newton Project; managements expectations regarding the Newton Project may prove to be inaccurate; and adverse regulatory changes or other changes impacting Carlyle's business plans and ability to achieve its business objectives.

In making the forward looking statements in this news release, Carlyle has applied several material assumptions, including without limitation, that: the Transaction will result in the benefits for Carlyle as currently anticipated by management; and that Carlyle will be able to carry out its business plans and achieve its business objectives, as currently anticipated by management. Although management of Carlyle has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.