TORONTO, July 24, 2019 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (“Xanadu” or “the Company”) is pleased to report that a drill rig has been mobilised to commence drilling at the Kharmagtai copper-gold project in Mongolia (Figure 1). The objective of this program is to confirm the presence of the oxide gold cap above the Stockwork Hill deposit and characterise this mineralisation for gold deportment to give direction for further work. An initial development of an oxide gold operation would be focused exclusively on mining and processing near-surface resources. The low cost drill program is the first step towards this goal. Subject to further technical, environmental and social studies the larger-scale copper-gold project is expected to be developed in the future.

HIGHLIGHTS

- Potential for low-cost, high-value oxide gold project at Kharmagtai

- Targets include gold cap above Stockwork Hill, where several holes have highlighted high grade oxide gold previously

- Previous drilling in these areas is stepped off targeting deeper copper-gold mineralisation, underestimating shallow oxide gold potential

- Oxide gold may provide early cashflow for the project and/or alternative financing options for the development of the larger-scale project

- Further development of oxide gold metallurgical performance will be targeted with additional test work.

Xanadu’s Chief Executive Officer, Dr Andrew Stewart, said:

“We are excited about the opportunity for a near term, low-cost, high-value oxide gold project at Kharmagtai to fund further exploration and development of the large-scale copper gold project. Kharmagtai sits on a granted mining lease with a registered water resource and an established power supply nearby. We have the ability to move quickly on an oxide gold project.

This first round of drilling is designed to quickly and cheaply test the concept and confirm the tenor of the oxide cap we know is above the established sulphide copper-gold resources”.

OXIDE GOLD DRILL PROGRAM

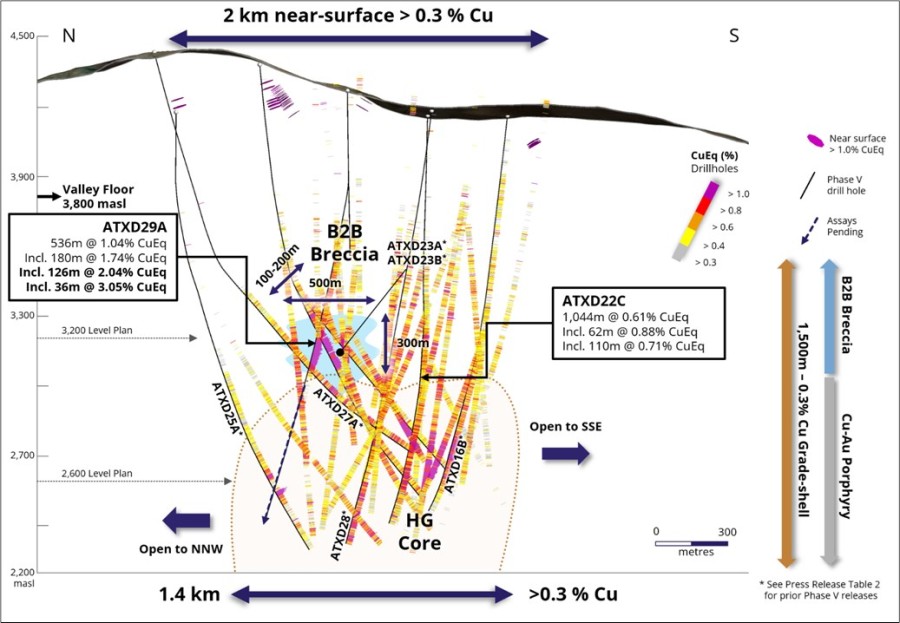

The objective of this drill program is to quickly and cheaply test one of the main oxide gold targets at Kharmagtai to confirm the expected gold grades and characterise the gold deportment. A total of eight vertical PQ drill holes have been designed to test several sections across the oxide cap and several holes to test beneath extremely high-grade gold at surface along strike (Figure 2, 3, 4 and 5). PQ drilling is being used to ensure sufficient material for metallurgical and geotechnical data to be gathered. Screen fire assays will be used to help determine the gold grain sizes and ensure accurate QAQC going forward. Material from this work will be submitted for gravity and leach metallurgical work to obtain initial recovery data. This work will form a decision point for further drilling and resource estimation.

OXIDE POTENTIAL ABOVE EXISTING DEPOSITS

Drilling at Stockwork Hill has been focused on deeper sulphide mineralisation and not shallow oxide gold potential. In the preliminary economic assessment released in April, this material was highlighted as being sparsely drilled, despite the presence of free gold in the soil above both deposits. This gap in drill data is driven by the need to drill diamond drill holes at a dip of 60 to 70 degrees, meaning holes need to be stepped back from the top of the orebody to best intersect mineralisation further down.

SHALLOW GOLD POTENTIAL AT KHARMAGTAI – EXPLORATION TARGETS DEVELOPED

As previously released (see press release dated 20th March, 2019) a review of the shallow gold potential of the Kharmagtai lease has been conducted with the aim of assessing the potential for a low-cost, high-value gold project to deliver cash into the early stages of a larger scale copper-gold development.

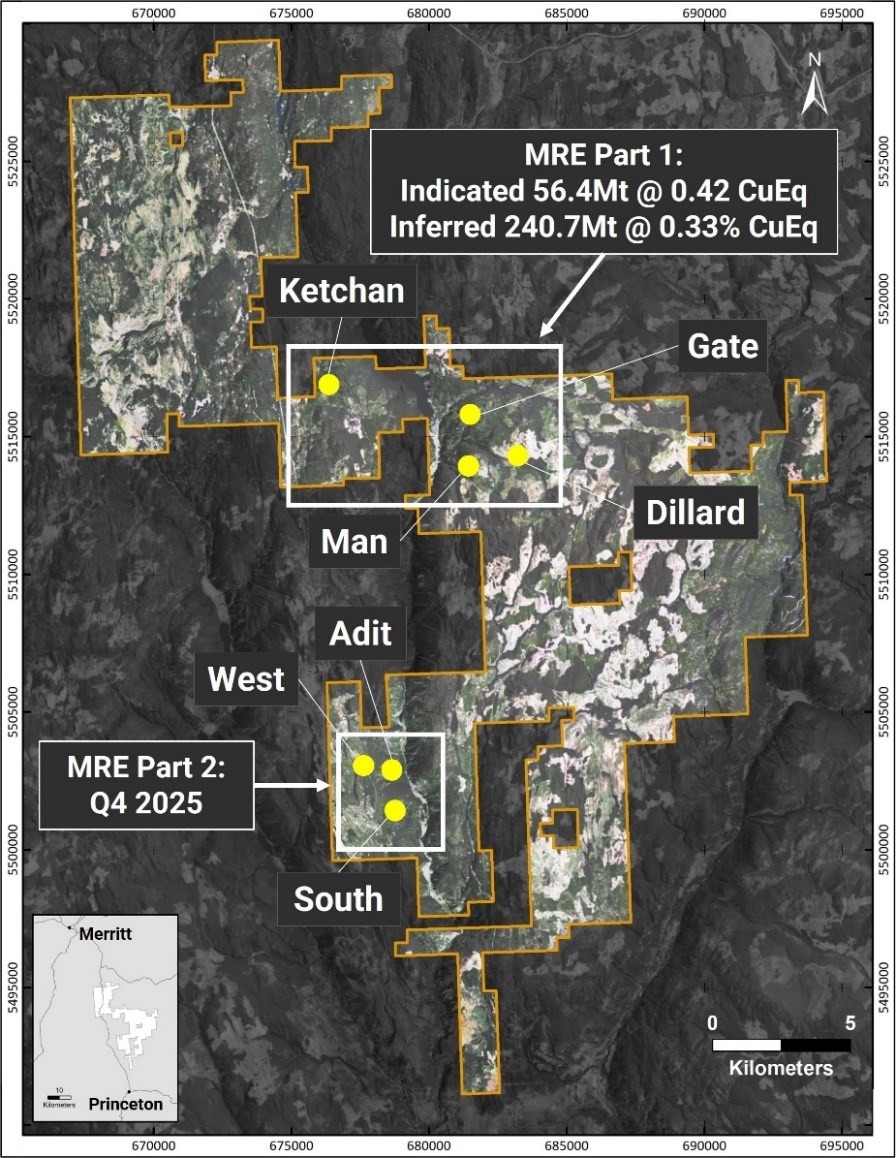

Eight gold targets across the lease have been reviewed in detail and exploration targets developed for each of these prospects. This work informs a decision point for drilling and further metallurgical work. These targets include sparsely drilled oxide gold above the existing resources at Copper Hill and Stockwork Hill, oxide gold potential above Golden Eagle, disseminated free gold and electrum within Golden Eagle and numerous carbonate base metal epithermal gold veins previously drilled while targeting porphyry mineralisation (Table 1). The location of each target is summarised in Figure 2.

The Exploration Target is conceptual in nature as there has been insufficient exploration to define a Mineral Resource. It is uncertain if further exploration will result in the determination of a Mineral Resource under the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, the JORC Code” (JORC 2004). The Exploration Target is not being reported as part of any Mineral Resource or Ore Reserve.

Table 1: Kharmagtai oxide gold exploration targets

| Target Name | Gold Style*1 | Length*2 | Width*3 | Depth*4 | Density*5 | Tonnage Range*6 | Grade Range*7 | Metallurgical Recoveries*8 | Potential Oz Range including metallurgical factor*9 |

| Golden Eagle (0.3 to 0.6g/t Au) | Oxide gold cap and disseminated free gold and electrum | 400 to 500m | 300 to 375m | 200m | 2.76 | 66Mt to 103Mt | 0.3 to 0.6g/t Au | 77 to 92% (average 85%) | 1MOz to 1.32MOz |

| Golden Eagle (0.6 to 1g/t Au) | Oxide gold cap and disseminated free gold and electrum | 200 to 350m | 75 to 100m | 150m | 2.76 | 6.2Mt to 14.5Mt | 0.6 to 1g/t Au | 78 to 92% (average 85%) | 170KOz to 240KOz |

| Copper Hill Oxide Gold | Oxide gold cap above Copper Hill | 150 to 200m | 50 to 100m | 30m | 2.75 | 0.62Mt to 1.65Mt | 1 to 2g/t Au | No metallurgy assumes 85% | 34KOz to 45KOz |

| Stockwork Hill Oxide Gold | Oxide gold cap above Stockwork Hill | 200 to 400m | 85 to 100m | 30m | 2.75 | 1.4Mt to 3.3Mt | 1 to 2g/t Au | No metallurgy assumes 85% | 77KOz to 90KOz |

| Zaraa Vein One and Two | C.B.M Oxide Epithermal Gold |

2 X 200 to 400m veins | 2 to 3m | 45 | 2.75 | 99.5Kt to 195Kt | Vein one 2.5 to 18g/t Au Vein Two 1 to 3g/t Au |

No metallurgy assumes 85% | 15KOz to 32.75KOz |

| Wolf Vein One and Two | C.B.M Oxide Epithermal Gold |

2 x 400 to 500m | 1.5 to 2m | 45 | 2.75 | 148Kt to 248Kt | 2 to 4.5g/t Au | No metallurgy assumes 85% | 16KOz to 22KOz |

| Badger Vein | C.B.M Oxide Epithermal Gold |

280 to 500m | 1.5 to 2m | 45 | 2.75 | 52Kt to 124Kt | 2.8 to 5.7g/t Au | No metallurgy assumes 85% | 9.5KOz to 10KOz |

| Seventeen One and Two | C.B.M Oxide Epithermal Gold |

2 X 400 to 500m | 1.5 to 2m | 45 | 2.75 | 128Kt to 248Kt | 1 to 1.5g/t | No metallurgy assumes 85% | 5.2KOz to 6.8KOz |

| Target Two | C.B.M Oxide Epithermal Gold |

400 to 500m | 2 to 3m | 45 | 2.75 | 100Kt to 185Kt | 1 to 3g/t Au | No metallurgy assumes 85% | 5KOz to 8.2KOz |

1* - Each style of gold mineralisation will manifest (size, shape, gangue minerals) differently and perform differently within metallurgical plant

2* - Length of the exploration target is defined as a conservative maximum and minimum length estimation based off the distances over which drill intercepts are observed and geological or geophysical characteristics associated with the mineralisation are observed

3* - Width of the exploration targets is taken from drill intercepts and expressed as a range

4* - Depth information is gained from drill intercepts. The oxide/weathering zone is often taken from geochemical data from drilling, i.e. sulphur often helps define the base of oxidation as it is readily weathered and does not commonly exist in the weathering profile. The base of oxidation is interpreted to be the depth that sulphur appears within the drill hole

5* - Density data is taken from drilling or assumed to be the average rock density in the Kharmagtai dataset (2.75)

6* - Tonnage range is estimated as a calculation of the maximum and minimum length, width and depth.

7* - Grade range is taken directly from drill results

8* - Metallurgical factor is either taken from existing metallurgical results or assumed to be 85%.

9* - Potential Oz range is estimated from a calculation of tonnage ranges and grade ranges. Larger tonnage with lesser grade range and smaller tonnage with higher grade range.

COMPETENT-QUALIFIED PERSON STATEMENT

The information in this announcement that relates to exploration results is based on information compiled by Dr Andrew Stewart who is responsible for the exploration data, comments on exploration target sizes, QA/QC and geological interpretation and information. Dr Stewart, who is an employee of Xanadu and is a Member of the Australasian Institute of Geoscientists, has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the “Competent Person” as defined in the 2012 Edition of the “Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves” and the National Instrument 43-101. Dr Stewart consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

COPPER EQUIVALENT CALCULATIONS

The copper equivalent (CuEq) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage. Grades have not been adjusted for metallurgical or refining recoveries and the copper equivalent grades are of an exploration nature only and intended for summarising grade. The copper equivalent calculation is intended as an indicative value only. The following copper equivalent conversion factors and long-term price assumptions have been adopted: Copper Equivalent Formula (CuEq) = Cu% + (Au (ppm) x 0.6378). Based on a copper price of $2.60/lb and a gold price of $1,300/oz.

CAUTIONARY STATEMENTS REGUARDING EXPLORATION TARGETS

The Exploration Target is conceptual in nature as there has been insufficient exploration to define a Mineral Resource. It is uncertain if further exploration will result in the determination of a Mineral Resource under the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, the JORC Code” (JORC 2004). The Exploration Target is not being reported as part of any Mineral Resource or Ore Reserve.

For further information, please contact:

Andrew Stewart

Chief Executive Officer

T: +612 8280 7497

M: +976 9999 9211

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.xanadumines.com