TORONTO, Oct. 06, 2025 (GLOBE NEWSWIRE) -- AbraSilver Resource Corp. (TSX: ABRA) (“AbraSilver” or the “Company”) is pleased to announce that it has entered into an agreement with National Bank Financial Inc. and Beacon Securities Limited, acting as co-lead underwriters and co-bookrunners, on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters have agreed to purchase, on a “bought deal” basis 6,113,000 common shares of the Company (the “Shares”) at a price of C$7.10 per Share (the “Offering Price”), with a right to arrange for substituted purchasers, pursuant to the listed issuer financing exemption (“LIFE”), for aggregate gross proceeds of C$43,402,300 (the “Offering”). The Company has granted to the Underwriters an option, exercisable, in whole or in part, at any time up to 48 hours prior to the Closing Date, to purchase up to an additional 929,253 Shares at the Offering Price, for additional gross proceeds of up to C$6,597,696.30 (the “Underwriters’ Option”).

In addition to and concurrent with the Offering, the Company may complete a private placement offering (the “Concurrent Private Placement”) of Shares of the Company at the Offering Price pursuant to a participation right (the “Participation Right”) held by Kinross Gold Corporation (“Kinross”) and Proener SAU (“Central Puerto”). Should the Underwriters’ Option be exercised, Kinross and Central Puerto will have the option to purchase additional Shares under the Concurrent Private Placement in accordance with the Participation Right. Any Shares sold pursuant to the Concurrent Private Placement will be subject to a hold period of four months plus one day from the Closing Date. If the Participation Right is exercised, the closing of the Concurrent Private Placement is expected to occur concurrently with or shortly following the closing of the Offering and is subject to the Company receiving all necessary approvals, including the conditional approval from the Toronto Stock Exchange.

John Miniotis, President and CEO, commented, “We are very pleased with the positive momentum AbraSilver continues to build and the support we have received from our investors. The funds raised will help accelerate the development of our high-quality Diablillos silver-gold project and further positions our Company as one of the leading silver-gold development companies in the Americas.”

The Company intends to use the net proceeds of the Offering to fund early development expenditures, including on-site infrastructure, securing critical long lead-time items, advanced engineering and exploration programs in support of the advancement of its 100%-owned Diablillos silver-gold project in the Salta province of Argentina, and for general corporate purposes.

The closing date of the Offering is expected to occur on or about October 22, 2025 (the “Closing Date”), and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including the conditional approval from the Toronto Stock Exchange. Notwithstanding the foregoing, the closing of the Offering must occur no later than the 45th day following the date of this news release.

The Offering will be made pursuant to the listed issuer financing exemption available under National Instrument 45-106 – Prospectus Exemptions as amended by Coordinated Blanket Order 45-935 - Exemptions from Certain Conditions of the Listed Issuer Financing Exemption, in each of the provinces and territories of Canada other than Quebec. The Shares may also be offered for sale in the United States pursuant to available exemptions from the registration requirements under the U.S. Securities Act of 1933. The Shares issued under the listed issuer financing exemption will not be subject to a statutory hold period pursuant to applicable Canadian securities laws.

There is an offering document relating to the Offering that can be accessed under the Company’s profile at www.sedarplus.ca and at www.abrasilver.com. Prospective investors should read this offering document before making an investment decision.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration requirements is available.

About AbraSilver

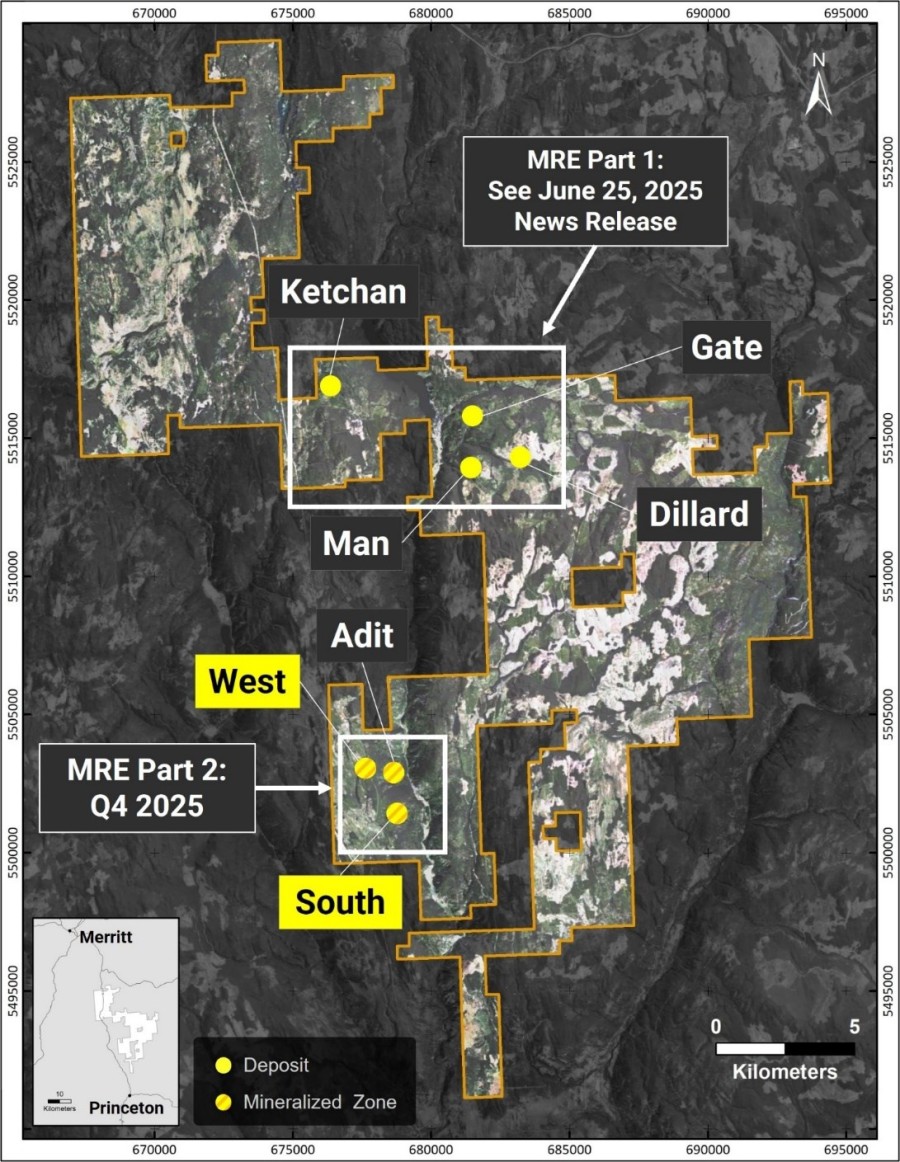

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos (tank leach-only) consists of 73.1 Mt grading 79 g/t Ag and 0.66 g/t Au, containing approximately 186Moz silver and 1.6Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders. In addition, the Company has an earn-in option and joint venture agreement with Teck on the La Coipita project, located in the San Juan province of Argentina. AbraSilver is listed on the Toronto Stock Exchange under the symbol "ABRA" and in the U.S. on the OTCQX under the symbol "ABBRF."

For further information, please visit the AbraSilver website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on X at www.x.com/abrasilver.

Alternatively, please contact:

John Miniotis, President and CEO

This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel: +1 416-306-8334

Cautionary Note Regarding Forward-Looking Information

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation, including in respect of the Offering, the Concurrent Private Placement, the approval of the Toronto Stock Exchange, the exercise of the Underwriters’ Option and the related potential purchase of additional Shares under the Concurrent Private Placement by Kinross and Central Puerto in accordance with the Participation Right, the expected Closing Date, and the use of net proceeds thereof. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR+ at www.sedarplus.ca. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES