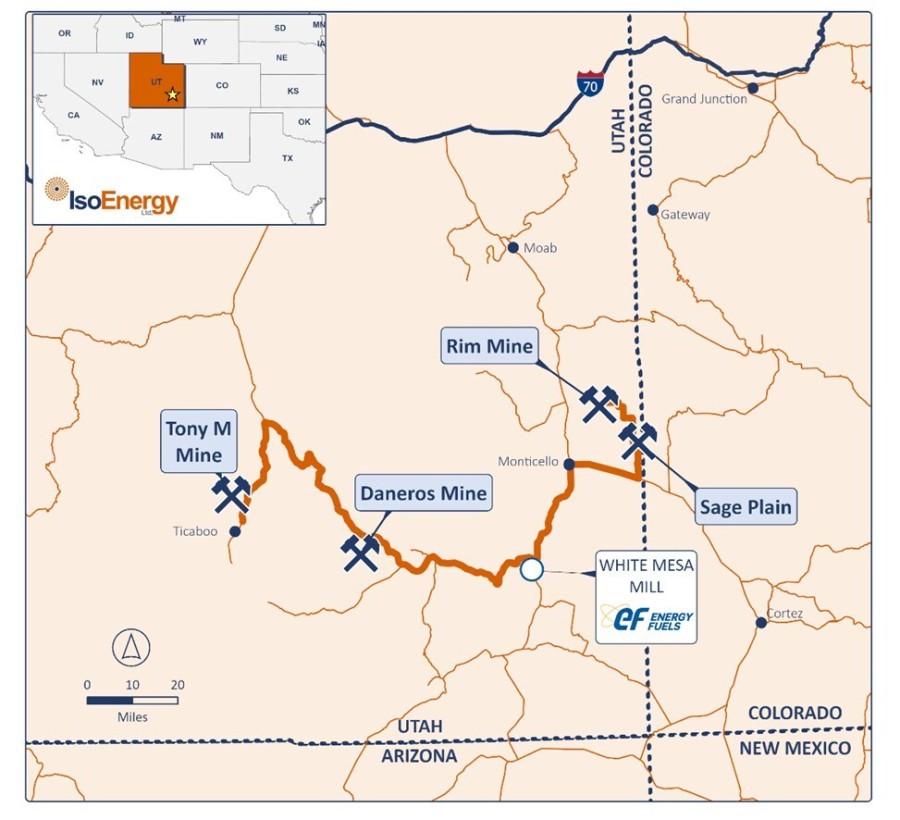

TORONTO, May 27, 2025 /CNW/ - IsoEnergy Ltd. ("IsoEnergy" or the "Company") (NYSE American: ISOU) (TSX: ISO) is pleased to announce the commencement of key work programs at its Tony M Mine, one of its three fully permitted uranium mines in the United States, intended to support a potential near term restart decision which could establish the Company as one of a select group of U.S. uranium producers. The Company has initiated several work programs at the Tony M Mine that are expected to optimize operational readiness and reduce future production costs, while maintaining strategic flexibility to potentially restart operations quickly as market conditions continue to improve. With all required permits in place, fully developed infrastructure, and a toll milling agreement with Energy Fuels Inc. at the nearby and fully operational White Mesa Mill, the Company is well positioned to bring Tony M, as well as the Rim and Daneros Mines, back into production on an accelerated timeline.

Highlights

- Technical Studies Underway at Tony M Mine focused on optimizing mine operations, reducing costs, and accelerating restart timelines, including:

- Ore Sorting and High-Pressure Slurry Ablation (HPSA) Testing - Bulk pilot programs launched to evaluate high-efficiency material processing and reduce haulage and operating costs.

- Enhanced Evaporation Study - Aims to reduce capital costs and accelerate dewatering by increasing evaporation rates at existing pond infrastructure.

- All major mining permits in place across Tony M, Daneros, and Rim Mines, providing a significant regulatory advantage and flexibility to restart quickly.

- Toll Milling Agreement with Energy Fuels Inc. at the nearby, fully operational White Mesa Mill.

- Strong tailwinds from U.S. nuclear policy believed to underscore the strategic importance of domestic uranium production.

- Potential production decision anticipated in 2025, following results from ongoing technical and economic evaluations.

Philip Williams, CEO and Director of IsoEnergy commented, "Momentum is accelerating across the U.S. nuclear industry, yet a significant gap remains between domestic uranium supply and growing demand. We believe IsoEnergy is uniquely positioned to help close this gap with a portfolio of past-producing uranium mines and a large-scale development project in the United States. Leading the way is the Tony M Mine in Utah, a past producer that was reopened and rehabilitated in 2024. With all key operating permits in place and a toll milling agreement secured with the White Mesa Mill, Tony M is the most advanced and de-risked uranium asset in our U.S. portfolio. As we move forward, our focus is on optimizing project economics through a series of technical studies. These efforts will inform a potential production decision, targeted for later this year, aligning IsoEnergy's near-, mid-, and long-term strategy with the urgent need for secure, domestic uranium supply."

Advancing Operational Readiness at Tony M Mine

The 2025 work program at Tony M includes advancing ore sorting and enhanced evaporation studies, as well as evaluating multiple mining methods to optimize future production scenarios. The Company is also preparing for technical and economic assessments that could form the basis for a restart plan. Importantly, Tony M has been fully rehabilitated, and IsoEnergy holds a toll milling agreement with Energy Fuels Inc. at the nearby White Mesa Mill, which is fully operational. This is expected to position IsoEnergy to bring product to market far more quickly.

Ore Sorting Study

IsoEnergy has engaged Steinert Group, a global leader in separation technology, to test sensor-based ore sorting on mineralized material from the Tony M Mine. Bulk pilot testing using a Steinert KSS Sensor Sorter is scheduled to begin late June. This technology uses a combination of 3D, color, induction, and x-ray sensors to identify and separate target material, with the potential to:

- Reduce haulage costs by concentrating mineralization and lowering transport volumes to the White Mesa Mill;

- Improve mining productivity by reducing waste and enhancing ore advance rates; and

- Minimize dilution through more precise material handling.

The Company continues to evaluate mining methods, including the use of three-drum slushers, to safely recover ore left in pillars from historical operations.

High-Pressure Slurry Ablation (HPSA) Testing

In parallel, IsoEnergy is testing mineralized material from Tony M at Disa Technologies using their patented High-Pressure Slurry Ablation (HPSA) process. HPSA uses high-pressure slurry streams to separate uranium coatings from sand grains, offering similar potential benefits to ore sorting in improving process efficiency and reducing costs.

Enhanced Evaporation Study

IsoEnergy is working with RWI Enhanced Evaporation to evaluate the use of Landshark evaporators on the Tony M evaporation pond. Preliminary results suggest that enhanced evaporation could eliminate the need for constructing additional pond capacity, reducing future dewatering timelines and associated costs for the later stages of mining.

Key Permits in Place

Three of IsoEnergy's U.S. uranium mines in Utah are fully permitted, providing a strong foundation for a swift potential restart and accelerated production timelines:

- Tony M Mine

- Large Mine Notice of Intention (NOI) from the State of Utah

- Approved Plan of Operations (POO) with accompanying Environmental Assessment (EA) and Finding of No Significant Impact (FONSI) for mining on BLM-managed land

- Title V Operating Air Permit, allowing active ventilation and emissions compliance

- Daneros Mine

- Small Mine NOI, with an approved POO modification to expand surface disturbance and transition to Large Mine status

- EA and FONSI completed for proposed expansion on BLM land

- Rim Mine

- Large Mine NOI and an approved POO, also supported by completed EA and FONSI

Together, these permits provide IsoEnergy with a significant regulatory advantage, allowing for potential rapid reactivation of operations in response to improving uranium market conditions and anticipated strategic policy shifts favoring domestic nuclear fuel supply.

About IsoEnergy Ltd.

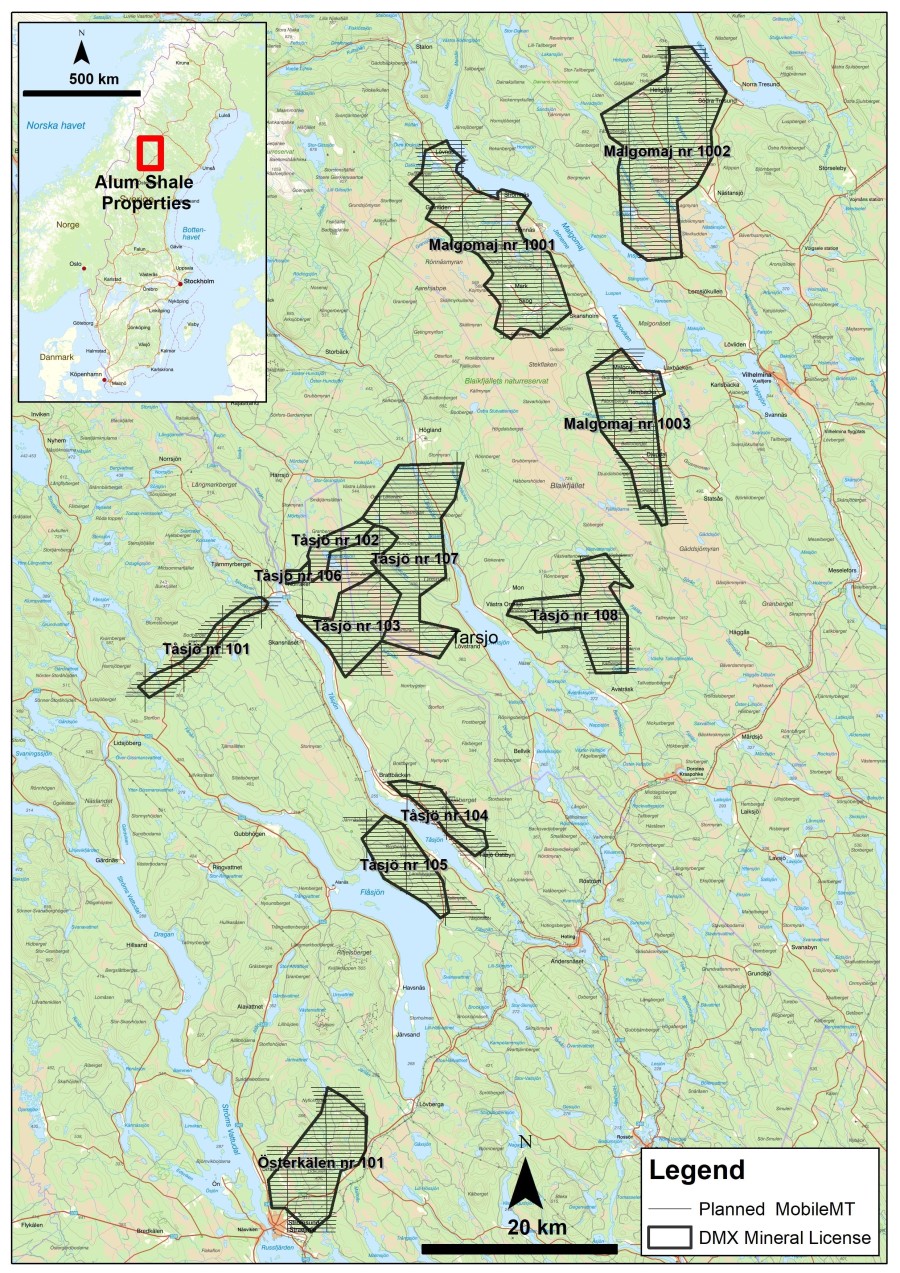

IsoEnergy (NYSE American: ISOU and TSX: ISO) is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near-, medium- and long-term leverage to rising uranium prices. IsoEnergy is currently advancing its Larocque East project in Canada's Athabasca basin, which is home to the Hurricane deposit, boasting the world's highest-grade indicated uranium mineral resource.

IsoEnergy also holds a portfolio of permitted past-producing, conventional uranium and vanadium mines in Utah with a toll milling arrangement in place with Energy Fuels. These mines are currently on standby, ready for rapid restart as market conditions permit, positioning IsoEnergy as a near-term uranium producer.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of U.S. securities laws (collectively, "forward-looking statements"). Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". These forward-looking statements may relate to the Company's properties, including expectations with respect to any potential restart decision with respect to the Company's US projects and the anticipated timing thereof; permitting, development or other work that may be required to bring any of the projects into development or production; the completion of planned technical studies and the expected results thereof; expectations regarding completion of technical and economic assessments; expectations regarding the Company's enhanced U.S. market presence; expectations regarding the Company's engagement with institutional and retail investors; increased demand for and interest in nuclear power and uranium; potential changes in US nuclear policy; and any other activities, events or developments that the Company expects or anticipates will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the results of planned exploration and development activities are as anticipated; assumptions that the results of planned technical work programs and technical and economic assessments are as anticipated; the anticipated mineralization of IsoEnergy's projects being consistent with expectations and the potential benefits from such projects and any upside from such projects; the price of uranium; assumptions regarding uranium market conditions and policy shifts; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned activities will be available on reasonable terms and in a timely manner. Although IsoEnergy has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Such statements represent the current views of IsoEnergy with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: negative operating cash flow and dependence on third party financing; uncertainty of additional financing; no known mineral reserves; aboriginal title and consultation issues; reliance on key management and other personnel; actual results of technical work programs and technical and economic assessments being different than anticipated; changes in development and production plans based upon results; availability of third party contractors; availability of equipment and supplies; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena; other environmental risks; changes in laws and regulations; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; other risks associated with the mineral exploration industry; and general economic and political conditions in Canada, the United States and other jurisdictions where the Company conducts business. Other factors which could materially affect such forward-looking statements are described in the risk factors in IsoEnergy's most recent annual management's discussion and analysis and annual information form and IsoEnergy's other filings with securities regulators which are available under the Company's profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. IsoEnergy does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.