TORONTO, ONTARIO--(Marketwired - June 12, 2017) - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (CSE:MTA) (CSE:MTA.CN) (CNSX:MTA) (OTCQB:EXCFF) (FRANKFURT:X9CP) is pleased to announce that it has entered into a Share and Asset Purchase Agreement ("Agreement") with Coeur Mining, Inc. ("Coeur Mining") and certain subsidiaries of Coeur Mining (collectively "Coeur") pursuant to which Metalla will (the "Transaction"):

- acquire a portfolio of three (3) royalties and one (1) stream (the "Coeur Portfolio"); and

- pay to Coeur Mining consideration valued at USD$13,000,000 (the "Purchase Price") consisting of:

- common shares of Metalla issued from treasury (the "Consideration Shares") representing approximately 19.9% of the pro-forma issued and outstanding Metalla common shares on a non-diluted basis, which Consideration Shares are to be issued at a price equal to the 30-day volume weighted average price of Metalla's common shares as of the date immediately preceding the closing date; and

- an unsecured convertible debenture (the "Convertible Debenture") in the principal amount of the balance of the Purchase Price and bearing interest at a rate of 5% per annum. The Convertible Debenture will automatically convert into common shares of Metalla at the time of future equity financings (at such financing price) or future asset acquisitions (at such acquisition price) and enables Coeur Mining to maintain its 19.9% interest in Metalla until the outstanding principal is either converted in full or otherwise repaid.

TRANSACTION HIGHLIGHTS

- Significant Cash Flow to Start Immediately: The Coeur Portfolio will provide immediate leverage to silver and gold prices. Two (2) out of the four (4) assets are currently in production with the third (3rd) planned for development by a major silver producer.

- Counterparty Diversification: The Coeur Portfolio counterparties include Cobar Operations Pty Ltd ("Cobar"), a wholly owned subsidiary of CBH Resources Limited, Pan American Silver Corp. ("Pan American"), Dynasty Metals & Mining Inc., ("Dynasty") and Regulus Resources Inc. ("Regulus").

- Asset Diversification: The Coeur Portfolio will give the Company exposure to assets in Australia, Argentina, Ecuador, and Chile.

- Long-Term Optionality: Combination of significant near term cash flow and long life development assets.

- New Major Shareholder: Coeur will join Metalla as its largest shareholder.

COEUR PORTFOLIO

- Endeavor Silver Stream - Metalla estimates that the Endeavor silver stream will generate cash flow of USD$2.5 million (CAD$3.3 million) for the balance of 2017 and USD$3.8 - $4.2 million (CAD$5 - 5.5 million) at an average price of USD$17 per ounce of silver, before taxes for the calendar year of 2018. This is based on an estimate of the Endeavor mine delivering approximately 987,500 ounces silver over the next 24 months according to the mine plan (with deliveries and revenues being allocated to Metalla starting as of June 1, 2017 in accordance with the Agreement). Metalla will have the right to buy 100% of the silver production up to 20.0 million ounces (7,120,577 ounces have been delivered as of April 2017) from the Endeavor mine in north-central New South Wales, Australia for an operating cost contribution of USD$1.00 for each ounce of payable silver, indexed annually for inflation, plus a further increment of 50% of the silver price when it exceeds USD $7.00 per ounce. The Endeavor mine, operated by Cobar, is an underground zinc, lead, and silver mine.

- 2% NSR on the Joaquin Project - a two percent NSR royalty payable by Pan American on minerals mined from the concessions which form part of Joaquin project located in central Santa Cruz Province, Argentina, 145 kilometres from Manantial Espejo silver-gold mine owned by Pan American. Pan American recently purchased the Joaquin project from Coeur for US$25 million. The Joaquin project is estimated to contain a measured and indicated resource of 65.2 million oz silver and 61,100 ounces of gold in 15.7 million tonnes @ 128.9 gpt Ag and 0.12 gpt Au.(1)

- 1.5% NSR on the Zaruma Gold Mine - a one and a half percent NSR royalty payable by Dynasty on minerals mined from the Zaruma gold mine located in the Zaruma-Portovelo Mining District of southern Ecuador, 3 kilometers north of the town of Zaruma. Between 2012 and 2014 the mine produced 72,430 ounces Au and 152,292 ounces of Ag. Dynasty has recently been restructured and is currently only trial mining at lower levels according to the Company. The Zaruma gold mine has an estimated measured and indicated resource of 1.094 million ounces of gold in 2.62 million tonnes with an average grade of 12.97 gpt gold with an additional 1.448 million inferred ounces in 3.7 million tonnes at a grade of 12.2 gpt gold.(2)

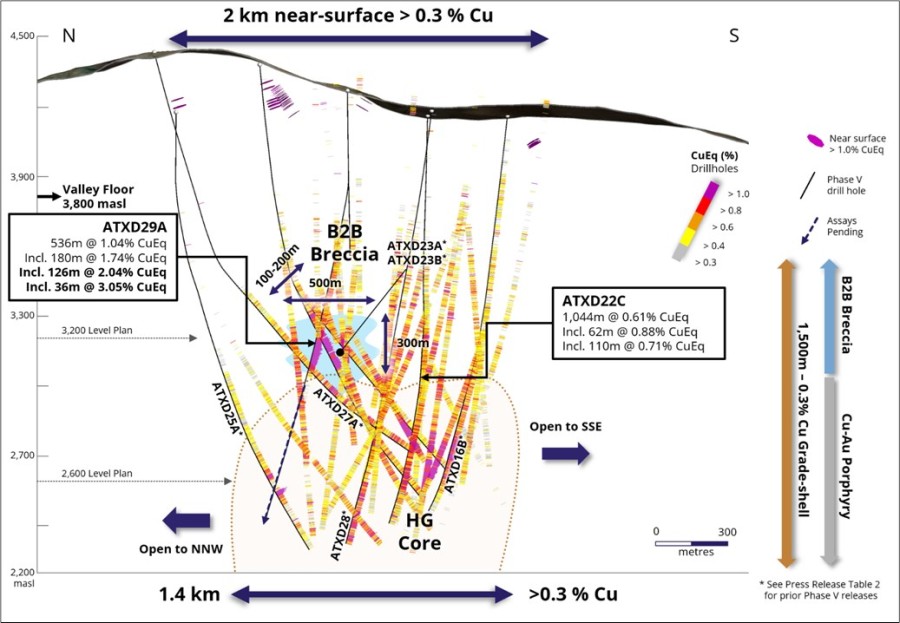

- 1.5% NSR on the Puchuldiza Project - a one and a half percent NSR royalty payable by Regulus on minerals mined from the Puchuldiza project located in the Andean Plateau (Puna) of northernmost Chile. The Puchudiza project has an estimated inferred resources of 686,000 ounces of gold in the inferred category (30.07 million tonnes @ 0.71 g/t gold).(3) The Puchudiza royalty is subject to a right of first refusal and is capped at USD$5 million.

Brett Heath, President of Metalla Royalty & Streaming commented, "This acquisition provides an extraordinary amount of growth for Metalla. Our shareholders will benefit from the immediate increase in annual cash flow from the Endeavor Stream as it bridges us to our existing royalty portfolio that is expected to produce for us in the future. It also adds two more major producers as counterparties, Pan American Silver and CBH Resources, along with further geographic and asset diversification. Our access to capital, and market liquidity should also be meaningfully increased, which will allow Metalla to continue to aggressively build our royalty and streaming portfolio."

CLOSING OF THE TRANSACTION

The closing will be subject to customary conditions for similar transactions, including (i) notice of the Transaction to the Canadian Securities Exchange and (ii) entry by Metalla and Coeur into an assignment and assumption agreement pursuant to which the Coeur Portfolio will be transferred from Coeur to Metalla or, in the case of the Zaruma royalty and the Endeavour silver stream, Metalla will acquire the Coeur entity holding it. Metalla must also obtain the consent of the Australian Foreign Investment Review Board ("FIRB Approval") in connection with acquiring its interest in the Endeavor mine and such FIRB Approval is anticipated to require between 60 and 120 days from the date of execution of the Agreement. Closing of Transaction is expected to occur as soon as possible after the receipt of the FIRB Approval.

METALLA POST CLOSING CAPITAL STRUCTURE

Following completion of the Transaction the total issued and outstanding shares of Metalla is expected to be approximately 71,017,747, with Coeur holding 19.9% (14,132,534 shares). There will be no change in warrants and options outstanding. Metalla will also have the Convertible Debenture held by Coeur for the balance of the Purchase Price. The Convertible Debenture will automatically convert into common shares of Metalla at future financings (at the future financing price) or asset acquisitions (at the acquisition price) to maintain Coeur's 19.9% until the outstanding principal is either converted in full or otherwise repaid. The Convertible Debenture will bear interest at a rate of 5% per annum.

Note 1: Please refer to a technical report titled "Joaquin Project NI 43-101 Technical Report" and dated February 15, 2013 (the "Joaquin Report"). Summary of grades and tonnage estimates for the Joaquin project for different resources categories as disclosed by the Joaquin Report:

| Tonnes | Ag gpt | Ounces Ag | Au gpt | Ounces Au | |

| Measured | 5,400,000 | 156.9 | 27,200,000 | 0.11 | 19,300 |

| Indicated | 10,300,000 | 114.2 | 38,000,000 | 0.13 | 41,800 |

| M+I | 15,700,000 | 128.9 | 65,200,000 | 0.12 | 61,100 |

| Inferred | 1,000,000 | 100.7 | 3,100,000 | 0.12 | 3,700 |

Note 2: Please refer to a technical report titled "Independent Preliminary Assessment - Zaruma Gold Project - El Oro Province, Ecuador" and dated September 17, 2014 (the "Zaruma Report"). Summary of grades and tonnage estimates for the Zaruma project for different resources categories as disclosed by the Zaruma Report:

| Tonnes | Au gpt | Ounces Au | |

| Measured | 1,590,000 | 13.48 | 689,000 |

| Indicated | 1,030,000 | 12.18 | 405,000 |

| M+I | 2,620,000 | 12.97 | 1,094,000 |

| Inferred | 3,700,000 | 12.20 | 1,448,000 |

Note 3: Please refer to a technical report titled "NI 43-101 Technical Report - Puchuldiza Project - I Region, Chile" and dated November 7, 2011.

ABOUT METALLA

Metalla was created for the purpose of providing shareholders with leveraged precious metal exposure by acquiring royalties and streams. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information please visit our website at www.metallaroyalty.com.

QUALIFIED PERSON ("QP")

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and of the Ordre des Géologues du Québec and a director of Metalla. Mr. Beaudry is a QP as defined in "National Instrument 43-101 Standards of disclosure for mineral projects.