Vancouver, British Columbia--(Newsfile Corp. - December 19, 2017) - Vangold Mining Corp. ("Vangold" or the "Company") (TSXV: VAN) (OTC: VGLDF) is pleased to announce, that its wholly owned subsidiary, Obras Mineras El Pinguico SA de CV (OMP) and Exploraciones Mineras Del Bajio SA de CV ("EMDB") have entered into an Acquisition Agreement for a 100% interest in the rights derived from a mining concession covering the lot referred to as San Carlos; title 166666; file 031/04372 (the "San Carlos Property").

Vangold has agreed to acquire the silver and gold development property for an aggregate purchase price of CDN$425,000 (the "San Carlos Acquisition") of which CDN$350,000 of the purchase price will be satisfied through the issuance of 5,000,000 common shares of Vangold to EMDB and the remaining CDN$75,000 will be paid in cash. The common shares issued to EMDB will be subject to a four-month hold period. The San Carlos Acquisition remains subject to regulatory approval.

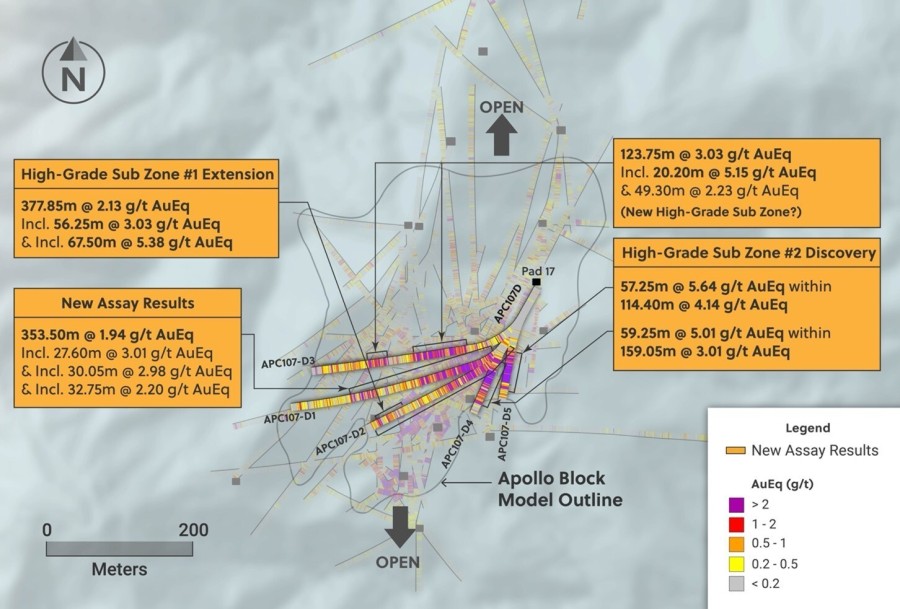

The San Carlos Property is close to Vangold's El Pinguico and Patito I & II mineral claims, which are 10 km from the City of Guanajuato. These claims total 800 Ha and are strategically located on the top of the Veta Madre Vein system, a highly mineralized region charged by massive epithermal and stockwork deposits; a mixture of native gold and silver, polybasite, pyargyrite, tetrahedrite, marcasite, sphalerite, galena, pyrite and chalcopyrite. The San Carlos Property consists of two main mineralized veins systems that run parallel and dip inwards for a potential intersection at depth similar to El Pinguico and the Veta Madre 1,000 m East. The La Escondida and San Carlos veins are believed to have the same geological formation as the El Pinguico vein, which are off-shoots of the Veta Madre charge system.

Vangold Mining CEO, Cameron King stated, "The acquisition of the San Carlos Property is an excellent fit for our portfolio. This increases our foot print in a highly mineralized, high grade silver and gold district with several nearby producing mines. Based on months of geological work, there is confidence among the team, that the San Carlos might be a potential extension from the Veta Madre, similar to Vangold's historic El Pinguico mine property with grades over 30g AuEq from recent assays.

Main structures of San Carlos claim

|

Structure |

Strike and Dip |

Known Length (m) |

Description |

|

La Escondida vein |

160°/60°SW |

2810 |

Gouge zone, argilic alteration, breccia. |

|

San Carlos vein |

340°/80°NE |

1530 |

Quartz and calcite vein, oxidized, silicified, drusiform texture, rhyolite fragments. |

|

Gavilanes fault |

350°/75°NE |

1170 |

Breccia, gouge, strong argilization, quartz-calcite veinlets. |

Private Placement Extension of Time

The Company also announces that it has received regulatory acceptance to an extension of time to complete a non-brokered private placement, the first tranche of which was completed on November 9, 2017. The Company expects to close the second tranche of the financing on or before January 14, 2018.

About Vangold Mining Corp.

Vangold is a development-stage silver and gold company with nine mining concessions in the Guanujuato, Mx mining district. Vangold is aggressively pursuing its production plans by bringing the historic El Pinguico mine back online. Having an acquisition focus, targeting advanced mineral properties and the pursuit of near production opportunities will continue to fuel our growth.

Qualified Person

Mr. Hernan Dorado, a director of Vangold Mining Corp. is a member of the Mining and Metallurgical Society of America and is a qualified person as defined in National Instrument 43-101, and has reviewed and approved the technical contents of this news release.