West Vancouver, British Columbia--(Newsfile Corp. - June 23, 2025) - Magnum Goldcorp Inc. (TSXV: MGI) (the "Company" or "Magnum") is pleased to announce that it has entered into a Letter of Intent ("LOI") dated June 19, 2025 with Atlantico Energy Metals Inc. ("Atlantico") to acquire all of the outstanding shares of Atlantico (the "Transaction"). The Transaction is subject to TSX Venture Exchange (the "TSXV") approval pursuant to TSXV Policy 5.2 - Changes of Business and Reverse Takeovers and will be considered a Reverse Takeover under TSXV policies.

The Transaction

Pursuant to the terms of the LOI, the Company will acquire all of the outstanding shares in the capital of Atlantico (the "Atlantico Shares") which are issued and outstanding immediately prior to the closing of the Transaction (the "Closing") in consideration for units of the Company (each a "Consideration Unit") at a deemed price equal to the greater of $0.10 per Consideration Unit and the minimum price permitted by the TSXV. Each Consideration Unit will consist of one common share in the capital of the Company and one transferrable warrant (each a "Warrant"). Each Warrant will entitle the holder to acquire an additional Share (a "Warrant Share") at a price of $0.20 for a period of 24 months from the date of Closing (the "Closing Date").

Prior to Closing, Atlantico intends to complete a private placement to raise gross proceeds of up to $1,380,000 (the "Offering") by issuing up to 13,780,000 Atlantico Shares (the "Atlantico Financing Shares") at a price of $0.10 per Atlantico Financing Share. The proceeds of the Offering will be used for the Transaction expenses, exploration expenses, for investor relations and marketing expenses and for general and administrative expenses before and after the Transaction. The Atlantico Financing may be closed in one or more tranches and the Atlantico Financing Shares will be exchanged for Consideration Units in the Transaction. Finder's fees may be paid in connection with the Atlantico Financing and in connection with the Transaction.

Completion of the Transaction remains subject to a number of conditions including without limitation entry into a definitive transaction agreement, completion of the parties' respective due diligence, receipt of all necessary approvals from the shareholders of the parties and all applicable stock exchanges and regulatory authorities, and such other conditions as are customary in transactions of this nature.

About Atlantico Energy

Atlantico is a British Columbia incorporated company which has entered into an option agreement with arm's length third party (the "Optionor) to acquire a 100% interest in the Novo Cruzeiro Lithium Project (the "Project") located in Brazil. In order to exercise the option and to acquire an 100% interest in the Project Atlantico has issued 15,000,000 common shares to the Optionor and must pay a total of $200,000 in cash to the Optionor prior to August 2, 2025 ($100,000 of which has been paid), and an additional $150,000 in cash prior to March 3, 2026.

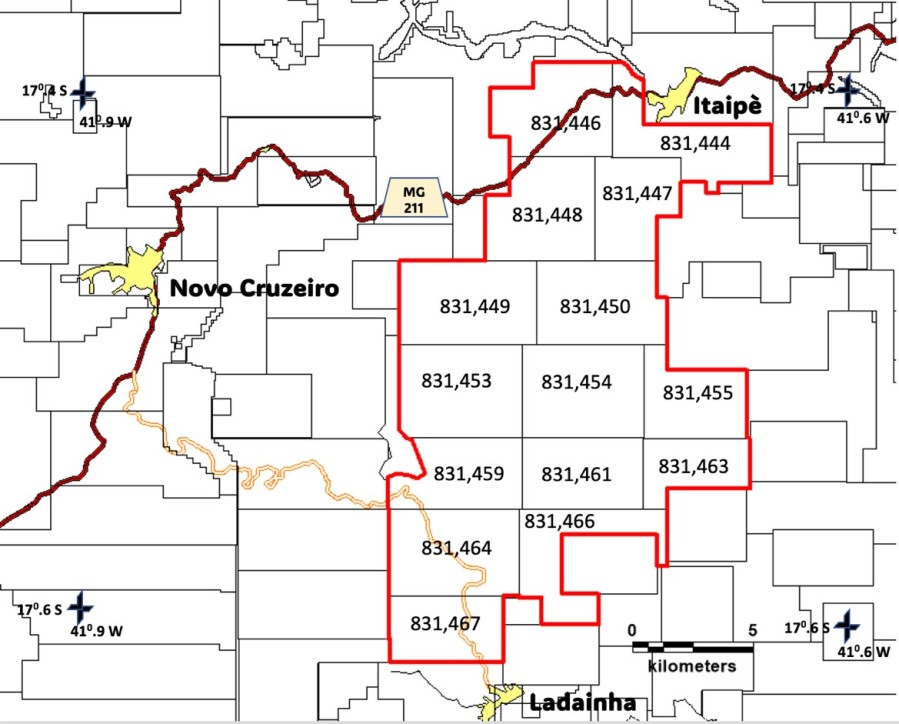

The Project is an early-stage lithium exploration project located in the East Brazilian Pegmatite Belt, near the town of Novo Cruzeiro, in northeastern Minas Gerais, Brazil. The Project comprises 15 contiguous exploration permits, covering 24,427.28 hectares across the municipalities of Itaipé, Ladainha, and Novo Cruzeiro. The granted exploration permits (2023) are in good standing with the Brazilian authorities.

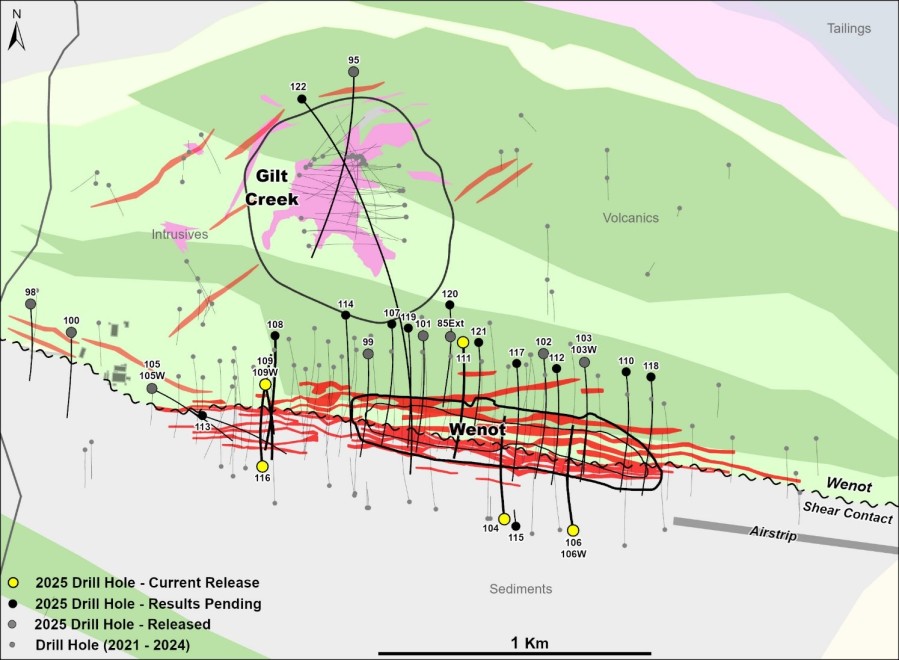

Figure 1 shows the Project and the surrounding competitor claims:

Figure 1. Atlantico Claims bordered in red. With permit numbers.

Figure 1. Atlantico Claims bordered in red. With permit numbers.

Table 1 List of Exploration permits Novo Cruzeiro property:

| AMN Exploration Permit No. | Area in Hectares |

| 831443/2023 | 1,733.05 |

| 831444/2023 | 1,645.61 |

| 831446/2023 | 1,819.88 |

| 831447/2023 | 1,358.45 |

| 831449/2023 | 1,982.48 |

| 831450/2023 | 1,842.41 |

| 831453/2023 | 1,983.40 |

| 831454/2023 | 1,984.89 |

| 831455/2023 | 1,329.50 |

| 831459/2023 | 1,446.41 |

| 831461/2023 | 1,494.28 |

| 831463/2023 | 1,019.94 |

| 831464/2023 | 1,965.39 |

| 831466/2023 | 1,456.77 |

| 831467/2023 | 1,324.82 |

| Total | 24,387.24 Ha |

The property is easily accessible via federal highway BR-116 and state highway MG-211, with lodging and supplies available in nearby towns. The region features a tropical climate with a wet summer season and lies along the eastern escarpment of the Espinhaço Range, at elevations between 600-1,200 meters.

The main exploration target is spodumene rich, Lithium Cesium Tantalum pegmatites. There is no record of modern exploration on the property. There is no known mineralization on the property, no historic drilling, and no resources. Available data includes government geological mapping, regional airborne geophysics, and studies of the Eastern Brazilian Pegmatite Province, which hosts Brazil's main lithium mines.

Brazil is widely known as a major player in the global mining and metals industry, with a world-class range of natural resources and geo-diversity. From grassroots mineral exploration to world-class mineral deposits, Brazil has been friendly to foreign investment since the end of the military government and the new democratic constitution in 1988. Brazil has a strong domestic market, qualified mining professionals, suppliers, and abundant water and clean (hydro) energy, making Brazil an attractive jurisdiction to invest in. The Fraser institute gave Brazil a score of 68.5 (out of a possible 100) and ranked at 29 out of 86 countries listed in their annual survey of global mining companies. https://www.fraserinstitute.org/sites/default/files/2023-annual-survey-of-mining-companies.pdf.

Board and Management of Resulting Issuer

Upon completion of the Transaction, it is anticipated that the Company's Board and Senior Management will be comprised of the following individuals.

Bonn Smith, Chief Executive Officer and Director

Bonn Smith is a capital markets strategist and the former CEO of GoldHaven Resources Corp, with a proven track record of launching, scaling, and funding early-stage companies across the resource and technology sectors. He has led multiple organizations through key phases of growth and raised millions in venture financing, both privately and publicly. As CEO and Director of Atlántico, he brings sharp market instincts, hands-on leadership, and a focused approach to positioning the company for sustainable, long-term success.

Sead Hamzagic, Chief Financial Officer, Secretary and Director

Sead Hamzagic, CPA, CGA is a chartered professional accountant and seasoned financial executive with over 35 years of experience in public practice and financial management, primarily within the natural resources sector. He has served as CFO and Director for multiple TSX Venture, NASDAQ, and CSE-listed companies, specializing in public company reporting, regulatory compliance, IPOs, reverse takeovers, and strategic financings through his own accounting and consulting practice, established in 2008.

Douglas Mason, Director and Chair

Douglas Mason is the Non-Executive Chairman of Foremost Clean Energy Ltd. and a seasoned capital markets executive with over 30 years of experience leading public companies. He was the Founder and CEO of Clearly Canadian Beverage Corporation from 1988 to 2005, where he helped pioneer the "new age" beverage category, and later served as CEO of Naturally Splendid Enterprises Ltd, a hemp and natural foods company. Douglas has raised hundreds of millions in venture financing and brings a strong track record in corporate leadership, strategic growth, and public company development across energy, mining, and consumer sectors.

David Smith, Director

David Smith is a seasoned entrepreneur and business leader with over 30 years of experience in executive and board roles across public companies in the resource, technology, and consumer sectors. He co-founded a diversified real estate development and sales firm that has operated successfully for more than 35 years, as well as two publicly traded environmental companies that were scaled and acquired. His strategic insight and creative approach to public company growth and venture capital financing make him a valued Director of Atlántico.

Non-Arm's Length Relationships

It is anticipated that the Transaction will not constitute a non-Arm's Length Transaction (as defined in the policies of the TSXV). No Non-Arm's Length Party (as defined in the policies of the TSXV) of the Company has any beneficial interest, direct or indirect, in Atlantico prior to giving effect to the Transaction and no such persons are also Insiders (as defined in TSXV Policy 1.1) of Atlantico.

It is anticipated that shareholder approval of the Transaction will be required pursuant to TSXV Policy 5.2 and that such shareholder approval may be obtained by written consent in accordance with TSXV Policy 5.2.

Sponsorship

Sponsorship of a "Reverse Takeover" is required by the TSXV unless exempt therefrom in accordance with the TSXV's policies. In the absence of an available exemption from the sponsorship requirements, the Company intends to make an application to the TSXV for a waiver from sponsorship requirements. There is no assurance that if applied for, a waiver will be granted.

Filing Statement

In connection with the Transaction and pursuant to the requirements of the TSXV, the Company will file a filing statement on its issuer profile on SEDAR (www.sedar.com), which will contain details regarding the Transaction, the Company, Atlantico and the Company upon completion of the Transaction.

All information contained in this press release with respect to Atlantico was supplied by Atlantico, and the Company and its directors and officers have relied on Atlantico for such information.

Trading in the Company's shares on the TSXV is currently halted and will remain halted pending receipt and review of acceptable documentation regarding the Transaction pursuant to TSXV Policy 5.2

The Company will issue a subsequent press release in due course containing the required financial statement disclosure for Atlantico and additional details regarding the Transaction once confirmed.

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV Requirements, disinterested shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this press release.

For further information visit the Company's website at www.magnumgoldcorp.com.

Magnum Goldcorp Inc.

"Douglas L. Mason"

_______________________________________

Douglas L. Mason, Chief Executive Officer

Contact:

This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel 604.922.2030

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company, Atlantico and the Resulting Issuer do not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things, statements relating to: (a) the business plans of the Company following completion of the Transaction (the "Resulting Issuer") (b) the completion of Transaction and the Atlantico Financing (c) the listing of the Resulting Issuer on the TSXV,; and (d) the expected composition of the board of directors and management of the Resulting Issuer.

Such forward-looking statements are based on a number of assumptions of the management of Innovation and the management of the Company, including, without limitation, that (i) the parties will obtain all necessary corporate, shareholder and regulatory approvals and consents required for the completion of the Transaction (including TSXV approval), (ii) the Atlantico Financing will be completed, (iii) the Transaction will be completed on the terms and conditions and within the timeframes expected by each of the Company and Atlantico, (iv) the Resulting Issuer will be listed on the TSXV, as anticipated, (v) the board of directors and management of the Resulting Issuer will be composed of the individuals expected by the Company and Atlantico; and (vi) there will be no adverse changes in applicable regulations or TSXV policies that impact the Transaction.

Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company, Atlantico or the Resulting Issuer to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (A) there can be no assurances that the Company and Atlantico will obtain all requisite approvals for the Transaction, including the approval of the Company's shareholders, or the approval of the TSXV (which may be conditional upon amendments to the terms of the Transaction), or that the Transaction will be completed on the terms and conditions contained in the LOI, or at all, (B) there can be no assurances as to the completion of or the actual gross proceeds raised in connection with the Atlantico Financing, (C) the parties and the completion of the Transaction may be adversely impacted by changes in legislation, changes in TSXV policies, political instability or general market conditions, (D) the proposed directors may refuse to act as directors of the Resulting Issuer, (E) risks relating to the current global trade war, or (F) financing may not be available when needed or on terms and conditions acceptable to the Resulting Issuer.

Such forward-looking information represents the best judgment of the management of Atlantico and the management of the Company based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither the Company nor Atlantico, nor any of their representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this press release.