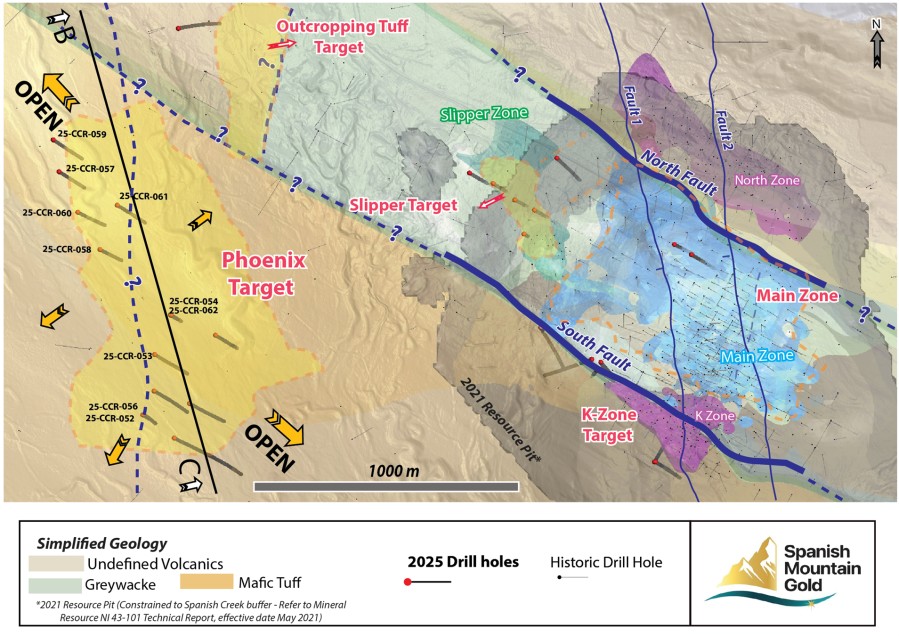

VANCOUVER, British Columbia / Jun 02, 2025 / Business Wire / Spanish Mountain Gold Ltd. (the "Company" or "Spanish Mountain Gold") (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF) confirms extensive, near surface gold mineralization intersected with overall approximate length, width and vertical depth of 1,450 m x 450 m x 60-320 m at the Phoenix Target, which is part of the Spanish Mountain Gold project, located in the Cariboo Gold Corridor, British Columbia, Canada. The Phoenix Target remains open in all directions. The 10,000 m 2025 winter diamond drilling program (the “Program”) has been completed with a total of 31 holes, including 14 holes drilled on the Phoenix Target. While some assays from the Program are still pending the Company now has the results for all the holes drilled on the Phoenix Target.

Highlights:

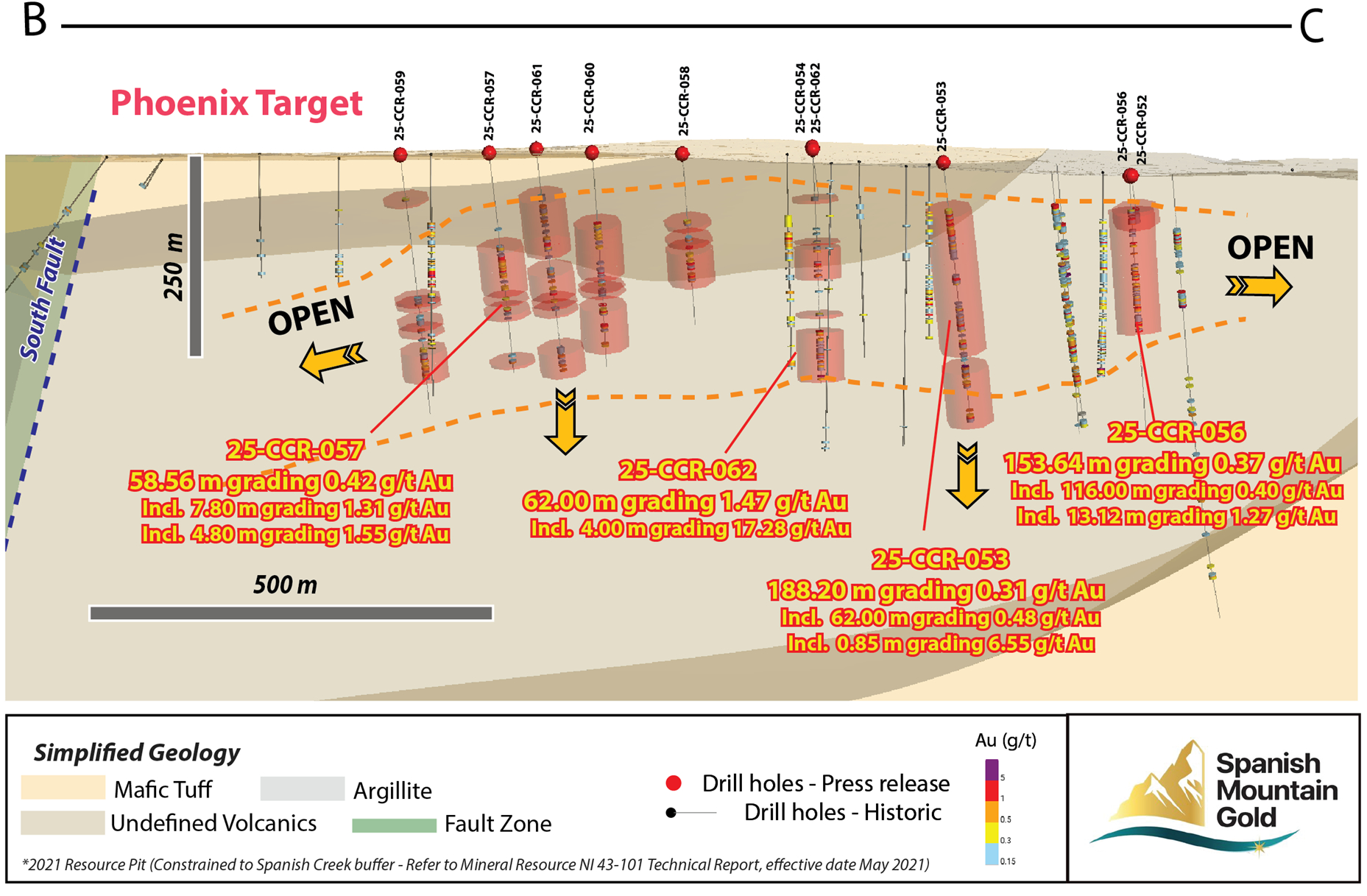

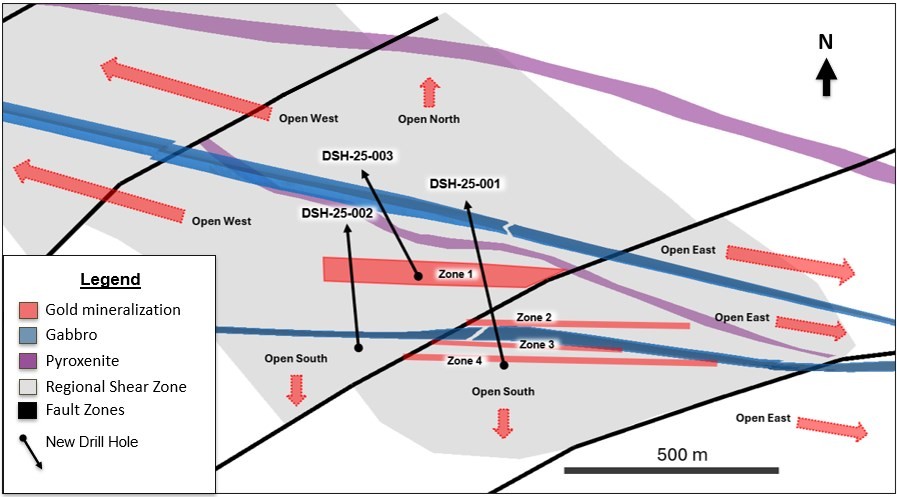

Confirmed Extensive, near surface gold mineralization containing high grade intercepts in a potentially new geological setting – Phoenix Target (See Figures 1, 2, and Table 1):

- Hole 25-CCR-062 intersected 62.00 m grading 1.47 g/t Au from 227.00 m including 4.00 m grading 17.28 g/t Au

- Hole 25-CCR-053 intersected 188.20 m grading 0.31 g/t Au from 63.00 m including 62.00 m grading 0.48 g/t Au. Also 74.00 m grading 0.29 g/t Au from 274.00 m including 0.85 m grading 6.55 g/t Au

- Hole 25-CCR-056 intersected 153.64 m grading 0.37 g/t Au from 42.36 m including 116.00 m grading 0.40 g/t Au from 80.00 m and 13.12 m grading 1.27 g/t Au

- Hole 25-CCR-057 intersected 58.56 m grading 0.42 g/t Au from 125.00 m including 7.80 m grading 1.31 g/t Au and 4.80 m grading 1.55 g/t Au

- Hole 25-CCR-058 intersected 57.00 m grading 0.41 g/t Au from 109.00 m including 20.00 m grading 0.58 g/t Au and 1.30 m grading 4.85 g/t Au

- Hole 25-CCR-059 intersected 37.60 m grading 0.43 g/t Au from 257.90 m including 1.01 m grading 3.20 g/t Au and 1.50 m grading 1.26 g/t Au

- Hole 25-CCR-060 intersected 68.00 m grading 0.24 g/t Au from 93.90 m including 2.00 m grading 2.50 g/t Au. Also 40.40 m grading 0.60 g/t Au from 197.15 m including 10.00 m grading 1.29 g/t Au

Expanding Resource Potential:

Drilling results continue to confirm the expansion of gold mineralization along the Phoenix Target over a strike length exceeding 1.4-kilometers, 450 m wide and with a consistent mineralization zone(s) with an estimated vertical depth ranging from approximately 60 - 320 meters. Containing broad intercepts of mineralization consistently grading 0.40 g/t Au and higher-grade intervals ranging from 1.0 to greater than 20.0 g/t Au substantially increases the potential for a significant addition to the Spanish Mountain Gold project's resource base. The Company has engaged Equity Exploration to establish a maiden resource estimate on the Phoenix Target (the “Phoenix MRE”) anticipated to be completed in the second quarter of 2025. The Phoenix MRE will be included in the upcoming Preliminary Economic Assessment technical report for the Spanish Mountain Gold project expected to be released in the second quarter of 2025 (the “Updated PEA”). Due to the expected timing of the Phoenix MRE, it is not anticipated that the Phoenix Target will be included in the economic analysis contained in the Updated PEA.

Peter Mah, Spanish Mountain Gold's President, CEO and Director commented, “The recent drill success near surface at Phoenix further demonstrates the potential to expand the gold resource base and for value creation upside at the Spanish Mountain Gold project. The awakening Phoenix Target, dormant since 2011, is located 1.4 kilometers west of our main deposit. Phoenix is intriguing our team in what appears to be an emerging new geological host setting for gold that remains open in all directions and present in other nearby areas such as the K Zone and Outcropping Tuff targets.”

Phoenix Target Details:

Drill holes 25-CCR-052 to 25-CCR-062, were drilled to follow up on the large target discovered in 2011 (refer to press release dated December 7, 2011, "Spanish Mountain Gold Announces Discovery of New Gold Zone") and recently expanded upon in our April 24, 2025, release “Spanish Mountain Gold Reports Initial Drill Results Multiple Near Surface and High-grade Intercepts 2025 Winter Exploration Program.”

The results from these new holes continue to demonstrate the expanding footprint of gold mineralization in the Phoenix Target area, with consistent grades over significant widths.

|

Table 1: 2025 Winter Drill Program – Summarized Gold Assay Results |

||||

|

Drillhole ID |

From |

To |

Width(m) |

Gold Grade (g/t Au) |

|

25-CCR-052 |

44.00 |

63.00 |

19.00 |

0.36 |

|

including |

44.00 |

46.00 |

2.00 |

1.98 |

|

25-CCR-053 |

63.00 |

251.20 |

188.20 |

0.31 |

|

including |

63.00 |

125.00 |

62.00 |

0.48 |

|

including |

69.30 |

98.00 |

28.70 |

0.73 |

|

25-CCR-053 |

274.00 |

348.00 |

74.00 |

0.29 |

|

including |

274.00 |

290.00 |

16.00 |

0.68 |

|

including |

274.00 |

274.85 |

0.85 |

6.55 |

|

including |

340.00 |

343.75 |

3.75 |

1.06 |

|

25-CCR-056 |

42.36 |

196.00 |

153.64 |

0.37 |

|

including |

80.00 |

196.00 |

116.00 |

0.40 |

|

including |

115.00 |

131.00 |

16.00 |

0.50 |

|

including |

153.90 |

168.00 |

14.10 |

0.66 |

|

including |

182.88 |

196.00 |

13.12 |

1.27 |

|

including |

185.00 |

188.00 |

3.00 |

3.59 |

|

25-CCR-057 |

125.00 |

183.56 |

58.56 |

0.42 |

|

including |

138.20 |

146.00 |

7.80 |

1.31 |

|

including |

138.20 |

143.00 |

4.80 |

1.55 |

|

25-CCR-057 |

194.23 |

196.00 |

1.77 |

0.34 |

|

25-CCR-057 |

207.89 |

215.90 |

8.01 |

0.42 |

|

25-CCR-057 |

276.00 |

279.65 |

3.65 |

0.43 |

|

25-CCR-058 |

109.00 |

166.00 |

57.00 |

0.41 |

|

25-CCR-058 |

124.70 |

170.00 |

45.30 |

0.49 |

|

including |

124.70 |

126.00 |

1.30 |

4.85 |

|

including |

146.00 |

166.00 |

20.00 |

0.58 |

|

including |

160.18 |

166.00 |

5.82 |

1.01 |

|

25-CCR-059 |

257.90 |

295.50 |

37.60 |

0.43 |

|

including |

270.75 |

271.76 |

1.01 |

3.20 |

|

including |

291.00 |

292.50 |

1.50 |

1.26 |

|

25-CCR-060 |

93.90 |

161.90 |

68.00 |

0.24 |

|

including |

93.90 |

95.00 |

1.10 |

1.16 |

|

including |

159.00 |

161.00 |

2.00 |

2.50 |

|

25-CCR-060 |

197.15 |

237.55 |

40.40 |

0.60 |

|

25-CCR-060 |

203.00 |

259.23 |

56.23 |

0.47 |

|

including |

203.00 |

213.00 |

10.00 |

1.29 |

|

including |

230.00 |

234.00 |

4.00 |

2.24 |

|

25-CCR-061 |

62.00 |

137.00 |

75.00 |

0.21 |

|

including |

127.79 |

130.00 |

2.21 |

1.14 |

|

25-CCR-061 |

161.00 |

196.00 |

35.00 |

0.32 |

|

including |

193.29 |

196.00 |

2.71 |

2.31 |

|

25-CCR-061 |

204.00 |

206.00 |

2.00 |

0.49 |

|

25-CCR-062 |

122.00 |

161.00 |

39.00 |

0.23 |

|

including |

143.00 |

147.73 |

4.73 |

0.82 |

|

25-CCR-062 |

227.00 |

289.00 |

62.00 |

1.47 |

|

including |

227.00 |

229.00 |

2.00 |

2.19 |

|

including |

283.00 |

287.00 |

4.00 |

17.28 |

|

including |

285.00 |

287.00 |

2.00 |

23.03 |

| Notes: | ||

|

1) |

|

Reported intersections are calculated using a 0.15 g/t Au cut-off grade. |

|

2) |

|

The complete assay table is available on the Company’s website. |

|

3) |

|

The true thickness of mineralization is unknown. |

|

4) |

|

Results from 10 of 11 drilled holes. One hole was abandoned due to hole conditions during drilling. |

| Table 2: Drill Hole Collar Location, hole depths, and core size | |||||||

|

HOLE-ID |

LOCATION ‘X’ |

LOCATION ‘Y’ |

LOCATION ‘Z’ |

LENGTH |

Azimuth |

Dip |

Core |

|

Easting |

Northing |

Elevation |

|||||

|

25-CCR-052 |

602218 |

5827525 |

1016 |

63 |

120 |

65 |

HQ |

|

25-CCR-053 |

602264 |

5827755 |

1032 |

348 |

120 |

65 |

NQ |

|

25-CCR-054 |

602327 |

5827906 |

1051 |

70 |

120 |

65 |

NQ |

|

25-CCR-056 |

602222 |

5827527 |

1016 |

324 |

120 |

80 |

HQ |

|

25-CCR-057 |

601898 |

5828454 |

1026 |

294 |

120 |

65 |

HQ |

|

25-CCR-058 |

602055 |

5828157 |

1032 |

230 |

120 |

65 |

HQ |

|

25-CCR-059 |

601876 |

5828576 |

1022 |

345 |

120 |

65 |

HQ |

|

25-CCR-060 |

601970 |

5828299 |

1030 |

287 |

120 |

65 |

HQ |

|

25-CCR-061 |

602121 |

5828326 |

1039 |

299 |

120 |

65 |

HQ |

|

25-CCR-062 |

602323 |

5827907 |

1049 |

294 |

120 |

80 |

HQ |

|

Abbreviations: metres = m, grams per tonne = g/t, gold = Au |

Drill Core Processing, Data Verification and Quality Assurance – Quality Control Program (QAQC)

Once received from the drill and processed, all drill core samples were sawn in half, labeled, and bagged. The remaining half of the drill core was securely stored on-site. Numbered security tags were applied to sample shipments to ensure chain of custody compliance. The Company inserts quality control (QC) samples at regular intervals, including blanks and reference materials, for all sample shipments to monitor laboratory performance. Standards and blanks account for a minimum of 15% of the samples in addition to the laboratory’s internal quality assurance programs. The QAQC program was overseen by the Company’s Qualified Person, Julian Manco, P.Geo, Director of Exploration (as described below).

Drill core samples were submitted to MSALABS’ analytical facility in Prince George, British Columbia, for sample preparation and PhotonAssayTM analysis. The MSALABS facilities are accredited to the International Standards ISO/IEC 17025 and ISO 9001 standard for gold and multi-element assays, with all analytical methods incorporating quality control materials at defined frequencies and established data acceptance criteria. MSALABS Inc. is independent of the Company.

PhotonAssayTM

The PhotonAssayTM method utilizes gamma ray analysis for gold detection using the Chrysos PhotonAssayTM instrument (PA1408X). This non-destructive, fully automated technique offers high accuracy for analyzing ores and pulps. Sample preparation begins with drying and crushing up to 1 kg of material to achieve at least 70% passing through a 2-millimetre (mm) sieve. The sample is then riffle split to obtain a suitable aliquot for 2 testing cycles (MSALABS Method CPA-Au1).

The PhotonAssayTM instrument bombards 400 - 600 gram samples contained in sealed containers with gamma rays. These containers remain sealed throughout the process, preserving the sample for potential further testing. The analysis is performed robotically, with results that integrate into existing laboratory management systems.

Each sample is accompanied by a reference disc traceable to a Certified Reference Material (CRM). Both the sample and reference disc undergo gamma ray exposure, with signals detected and analyzed to ensure accurate and reliable results.

The method offers a gold detection range from 0.015 parts per million (ppm - lower limit) to 10,000 ppm (upper limit). Quality control includes the use of reference materials and blanks, with all results reviewed by a competent person before reporting.

Spanish Mountain Gold implemented two QAQC methodologies to validate the accuracy of PhotonAssayTM results, both demonstrating good comparability: 1) comparative analysis of diverse mineralization styles using Total Au screen metallic methods with both FAS-415 (gravimetric finish) and FAS-211 (AAS finish), and 2) comprehensive testing of both sample aliquots and rejects using FAS-211 (AAS finish).

QAQC Testing typically can include the following spot checks: 1) Pulverizing tests to evaluate variability in sample preparation, 2) Cross-analysis at external laboratories using screen metallic method, and 3) Four-cycle radiation testing to identify and calibrate potential variability in gold results with variable radiation intensity.

To effectively manage the nugget effect on high-grade gold samples MSALABS tested samples to "extinction" (CPA-Au1E method). This approach divides samples into multiple splits, analyzes each separately using PhotonAssayTM, and then calculates a weighted average of the results. By testing various portions of the sample independently and combining their values proportionally, this method provides significantly more representative gold values than traditional single-split analysis for samples with a large nugget effect.

Multi-Elemental Analysis

For the 2025 drilling campaign Spanish Mountain Gold used IMS-230 method to provide multi-element determination using a four-acid digestion followed by ICP-OES and ICP-MS analysis.

Key Process Steps:

Sample Preparation: Samples are dried and ground to specific criteria (85% passing 75 microns (μm) for rocks and drill core; 180μm for soils and sediments). A homogeneous 10-gram sample is required.

Digestion: Samples undergo sequential digestion with nitric, perchloric, hydrofluoric, and hydrochloric acids, followed by dilution with deionized water.

Analysis: The solution is analyzed via ICP-OES and ICP-MS for multi-element quantification.

Quality Control: The process includes reference materials, blanks, and duplicates, with corrections for spectral interferences and thorough review before final reporting.

Julian Manco, M.Sc., P.Geo., has verified the data disclosed in this news release. The data verification process involved a multi-step approach to ensure accuracy and integrity. This included a detailed quality control (QC) analysis of the data, which was performed using both internal and external platforms, such as the MxDeposit™ software. These QC checks involved the analysis of certified reference materials (CRMs), blanks, and duplicates to confirm the reliability of the assay results. In addition, Mr. Manco conducted a field inspection of the specific drill intervals mentioned in this release to directly observe the geological features and verified the nature of the results presented.

Qualified Person

Julian Manco, M.Sc., P.Geo., Director of Exploration with Spanish Mountain Gold, is the Qualified Person as defined under National Instrument 43-101 who has reviewed and has approved the contents of this news release.

About Spanish Mountain Gold Ltd.

Spanish Mountain Gold Ltd. is focused on advancing its 100%-owned Spanish Mountain Gold Project towards construction of the next gold mine in the Cariboo Gold Corridor, British Columbia. We are conducting an integrated Whittle Enterprise Optimization to identify the highest potential value-add improvements while increasing the understanding of the high-grade geologic controls and associated drill targets that could upgrade and expand the gold resource. We are striving to be a leader in community and Indigenous relations by leveraging technology and innovation to build the 'greenest' gold mine in Canada. The Relentless Pursuit for Better Gold means seeking new ways to achieve optimal financial outcomes that are safer, minimize environmental impact and create meaningful sustainability for communities. Details on the Company are available on www.sedarplus.ca and on the Company's website: www.spanishmountaingold.com.

On Behalf of the Board,

“Peter Mah”

President, Chief Executive Officer and Director

Spanish Mountain Gold Ltd.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION:

Certain of the statements and information in this press release constitute "forward-looking information". Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "believes", "plans", "estimates", "intends", "targets", "goals", "forecasts", "objectives", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be considered forward-looking information. The Company's forward-looking information is based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release and include but are not limited to information with respect to, the potential to extend mineralization within the near-surface environment; the potential to expand resources and to find higher-grade mineralization at depth; the timing, size and budget of a winter drill program, and the results thereof; and the delivery of a maiden resource for the Phoenix Target, and the timing and results thereof. Other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking information if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking information.