VANCOUVER, British Columbia, Jan. 16, 2017 (GLOBE NEWSWIRE) -- Panoro Minerals Ltd. (TSX-V:PML) (Lima:PML) (Frankfurt:PZM) ("Panoro", the "Company") is pleased to announce the completion of an agreement with the Community of Cochapata at its 100% owned Cotabambas Project in Peru. The completion of the community agreement together with the already approved semi detailed environmental impact assessment permits the Company to continue the planned exploration program into the next stage, which will include:

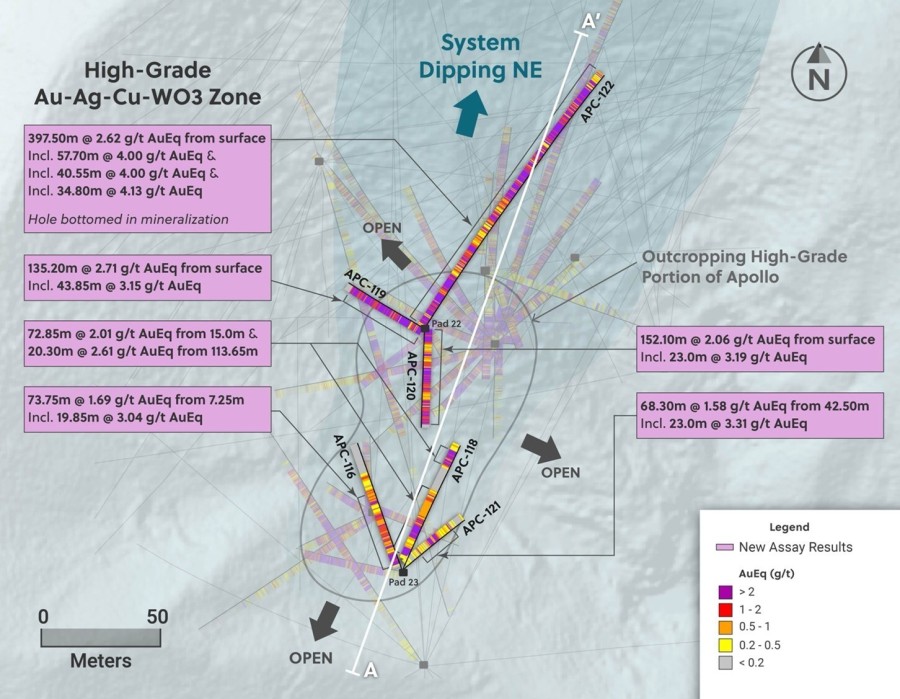

- Step-out drilling to expand the oxide copper resource and assessment of the potential to incorporate a heap leach SX/EW process into the project plan;

- Exploration geophysics and drilling at the Maria Jose zone targeting near surface high grade mineralization for potential mill feed; and

- Metallurgical testing to test for potential improvement in recoveries from all four mineralogical types in the current resource.

The completion of the community agreement marks the second such agreement completed with the community of Cochapata since Panoro acquired the Cotabambas Project and is the sixth such agreement completed with the three communities in the vicinity of the Cotabambas Project. The agreement includes commitments similar in nature to those of the prior agreements with the principal component being the acquisition of land for existing community members in the rural area of Anta, near the city of Cuzco and approximately 100 km from the Cotabambas Project location.

Luquman Shaheen, President & CEO, states “We are very pleased to have completed this agreement with the Community of Cochapata, again demonstrating the Company’s commitment to work with our local communities to advance the Cotabambas project. The Company can now continue the current exploration activities into the drilling stage. We plan to mobilize the field teams before the end of January.”

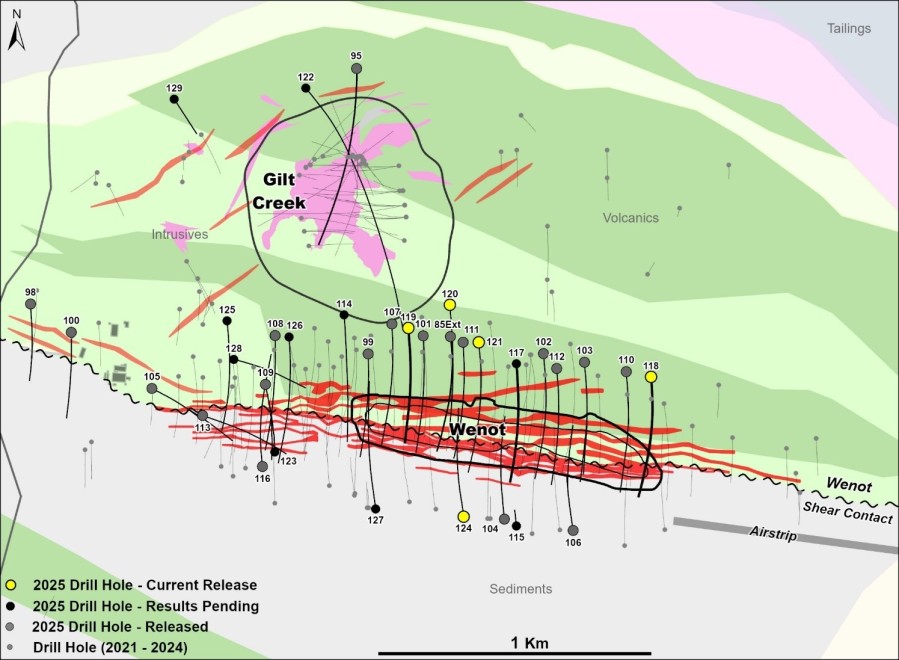

Panoro has been completing detailed geological mapping in the area of proposed step out drilling at the Ccalla zone where the Company is targeting the delineation of additional oxide resources. Furthermore, additional mapping has been completed at the Maria Jose Target area where a program of Induced Polarization and Magnetic geophysical surveys will be completed prior to final drill targeting. A total of 14,000 m of drilling is planned for these two areas in 2017.

In addition to the above works Panoro will also be conducting further metallurgical testing at the Cotabambas Project.

At the Antilla Project, Panoro will be commencing scoping level engineering studies to review potential optimizations of the project plan in order to reduce capital and operating costs and further improve project economics. This scoping work at the Antilla Project will also begin in January.

About Panoro

Panoro Minerals is a uniquely positioned Peru focused copper exploration and development company. The Company is advancing a significant project portfolio in the strategic Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects. The Company is well financed to expand, enhance and advance its projects in the region where infrastructure such as railway, roads, ports, water supply, power generation and transmission are readily available and expanding quickly. The region boasts the recent investment of over $US 15 billion into the construction or expansion of four large open pit copper mines.

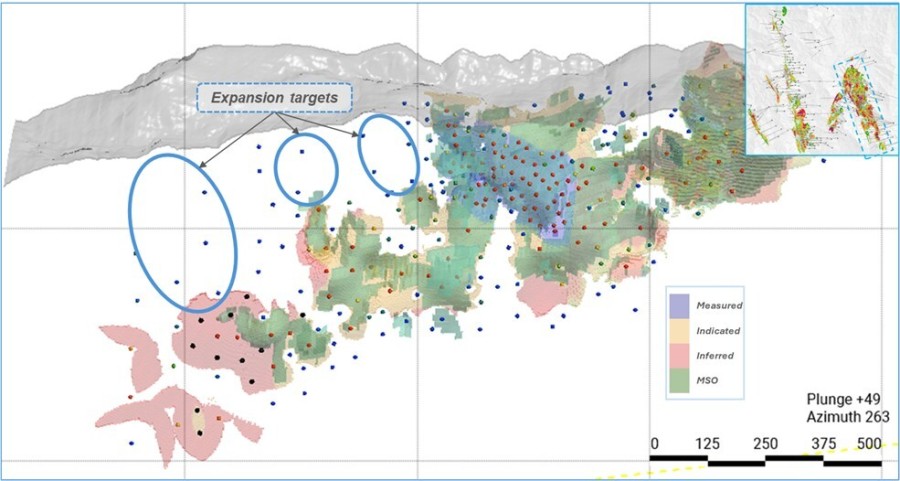

Since 2007, the Company has completed over 70,000 m of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

| Project | Resource Classification |

Million tonnes |

Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

| Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

| Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

| @ 0.20% CuEq cutoff, effective October 2013, Tetratech | ||||||

| Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 |

| Inferred | 90.5 | 0.26 | - | - | 0.007 | |

| @ 0.175% CuEq cutoff, effective May 2016, Tetratech | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

| Key Project Parameters | Cotabambas Cu/Au/Ag Project | Antilla Cu/Mo Project | ||

| Mill Feed, life of mine | million tonnes | 483.1 | 350.4 | |

| Mill Feed, daily | tonnes | 80,000 | 40,000 | |

| Strip Ratio, life of mine | 1.25 : 1 | 0.85 : 1 | ||

| Before Tax1 |

NPV7.5% | million USD | 1,053 | 491 |

| IRR | % | 20.4 | 22.2 | |

| Payback | years | 3.2 | 3.3 | |

| After Tax1 |

NPV7.5% | million USD | 684 | 225 |

| IRR | % | 16.7 | 15.1 | |

| Payback | years | 3.6 | 4.1 | |

| Annual Average Payable Metals |

Cu | thousand tonnes | 70.5 | 36.8 |

| Au | thousand ounces | 95.1 | - | |

| Ag | thousand ounces | 1,018.4 | - | |

| Mo | thousand tonnes | - | 0.9 | |

| Initial Capital Cost | million USD | 1,530 | 603 | |

| Project economics estimated at commodity prices of; Cu = US$3.00/lb, Au = US$1,250/oz, Ag = US$18.50/oz, Mo = US$12/lb | ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.