Vancouver, British Columbia--(Newsfile Corp. - December 5, 2017) - Para Resources Inc. (TSXV: PBR) (WKN: A14YF1) (OTC Pink: PRSRF) (the "Company" or "Para") is pleased to announce that it has entered into agreements with multiple parties to secure access to additional mineral claims and historic mines adjacent to the Gold Road Mine and Mill in the Oatman Mining District in Northwestern Arizona. Many of these mines stopped production in 1942 due to the US war effort and were never restarted. They were producing from high-grade underground veins at that time.

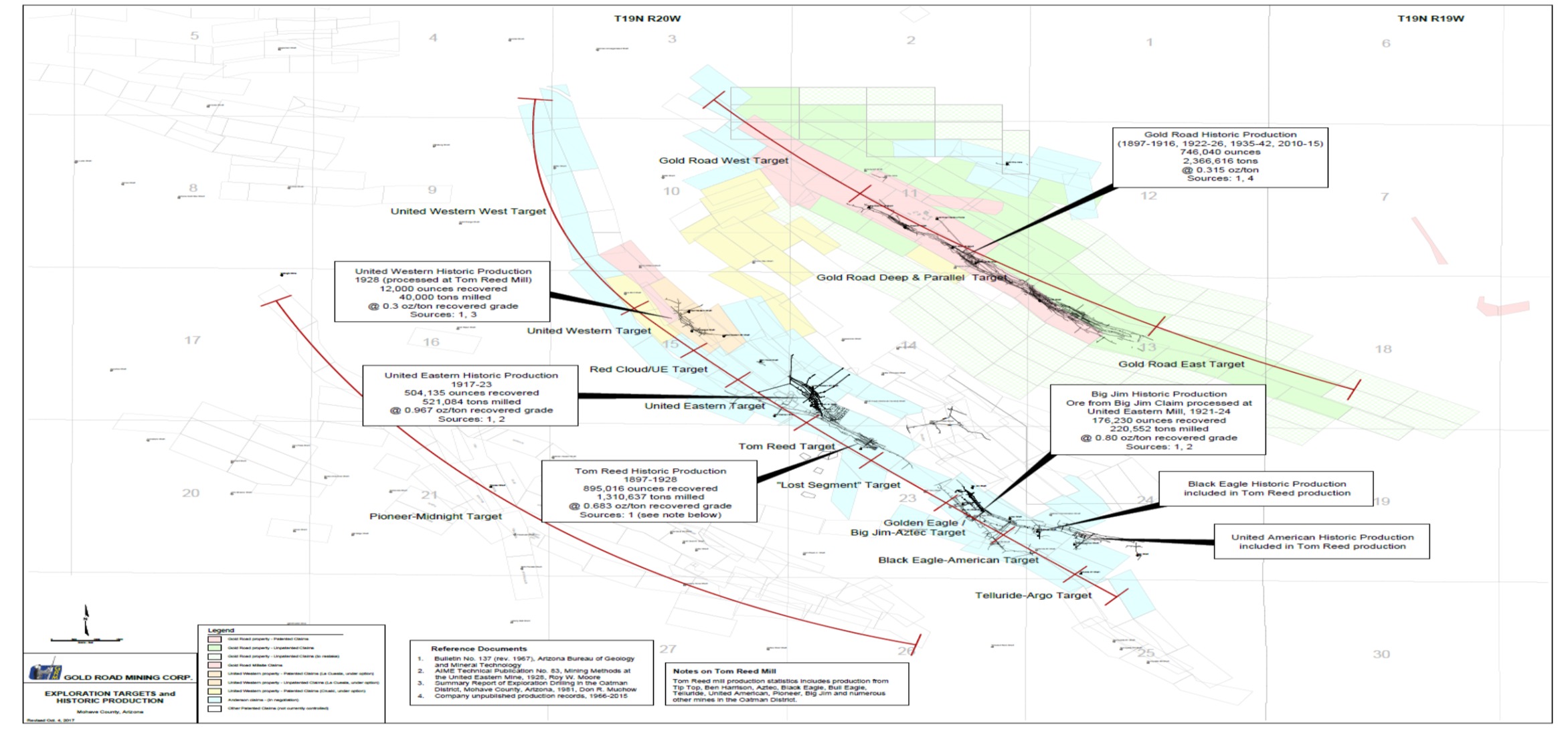

The Oatman District is the largest primary gold producing district in Arizona. Total production including Gold Road is more than 2.0 million ounces of Gold (not Au equivalent). The vast majority of the production has come from two sub-parallel vein systems, the Gold Road system and the Tom Reed-United Eastern (Tr-Ue vein) system. In addition to these two systems there is a third vein system, the Pioneer- Midnight system, which is southwest of the Tr-Ue system for which production records are mostly unknown. The distance between these veins is less than 1 kilometer.

All mineralization in the district is in epithermal quartz, calcite, adularia veins containing cyanide leachable gold, and silver. The absence of environmentally sensitive constituents (RECRA metals) and acid-generating minerals significantly reduces permitting and reclamation issues. Mining has historically been contained within patented (fee simple land) and the majority of the exploration potential is on private land. Gold Road Mining Corp. owns a modern 500 tpd cyanide leach facility designed specifically to treat the Oatman-type mineralized material. The mill is permitted to receive mineralized material from any of the mines with similar mineralized material.

Milling Facility

The mill is a 500 tpd carbon in pulp mill that has historically achieved typical recovery of 93% to 95% on run of mine mineralized material. Minimal recommissioning costs are expected as the mill last ran in July of 2016. Permitting is complete for the 500 tpd mill to be increased to 1,000 tpd and tailings capacity for 1,750,000 tons (10 years @ 500tpd) has been constructed. An additional 1,800,000 tons of tailings capacity has been permitted but not constructed. Milling cost is approximately $25/ton at a grind of 90% passing 320 mesh.

The mill is within easy hauling distance of the entire Oatman district and the mill was designed to treat mineralized material from any mine in the district. Permitting allows mineralized material from the district to be treated with no modification of the Gold Road Mill permit. Acquisition of the major target areas followed by exploration and development will increase utilization and extend life of the Oatman project. Potential feed for the mill can come from three principal vein systems.

- Gold Road Vein

- Tom Reed — United Eastern (TrUe vein)

- Pioneer — Midnight Vein

If exploration is successful, the rate of production in ounces per year is expected to be increased rapidly.

A map showing prior production, targets and average grades mined in the district is below:

Land Status

Gold Road Mining Corp. ("GRM"), Para's 88% owned subsidiary, has entered into lease and purchase agreements with three different groups that own claims in the Oatman District (the "Acquired Properties"). All of the agreements allow GRM to explore and mine on the Acquired Properties with fixed price purchase options.

The chart below shows the status of the land holdings owned and leased by Gold Road Mining Corp¹.:

¹

Gold Road Exploration and development The Gold Road mineralization is open in both directions along strike and down dip. Historic production has been:

- 746,040 oz. gold at an average grade of 0.315 oz / ton (10.80 g/t) Au over widths from 4 to 25 feet.

The mine is in excellent condition and dewatering has begun. Both exploration drilling and development drifting plans are being developed. The 840 level will allow down-dip drilling with only a minimum of crosscutting. Dewatering of this level is underway. Studies are being conducted to determine feasibility of resuming production.

District Exploration Potential TrUe Vein System

The Tr-Ue vein system is a high priority target. The goal is to discover additional mineralized shoots like those historically mined by the United Eastern and the Tom Reed companies.

- United Eastern Company (729,959 oz. gold at an average grade of 1.1 oz /ton (37.71 g/t) Au over widths of 4 to 45 feet thick)

- Tom Reed Company (907,016 oz. gold at an average grade 0.672 oz /ton (23.04 g/t) Au over widths of 4 to 35 feet thick.

Exploration including geophysics and an aggressive drilling program are being planned for 2018.

The historic grade and width of the veins at United Eastern and the Tom Reed mines were significantly better than at the Gold Road Vein. Subject to the success of the planned exploration program to prove out the historical numbers, the addition of feed material from these two historic operations could imply a significant increase on annual gold production.

Summary

As previously disclosed, GRM has engaged RPM Global USA, Inc ("RPM") and RPM is anticipated to produce a current NI 43-101 Mineral Resource Estimate and Preliminary Economic Assessment for the Gold Road project. Para has included in their purview, a study of the historic results of drilling and production at the Tom Reed, United Eastern and United Western mines.

Mr. James R Guilinger SEG MMSA SME, is a qualified person under NI 43-101 and is the author of Technical Report on the Gold Road Mine, NI 43-101 Technical Report.

ABOUT PARA RESOURCES:

Para is a junior producing gold mining company. Para owns approximately 80% of the El Limon project, in Colombia, which in addition to its current underground operation is purchasing mineralized rock mined by small artisanal miners working on the Company's property. The El Limon and OTU properties also have exploration and development upside. The Company also owns 88% of the Gold Road Mine in the Oatman District of Arizona. The Company has hired RPM Global as consulting engineers in order to produce a NI 43-101 Technical Report which it expects will establish a current Mineral Resource estimate and anticipates that it will publish a NI 43-101 PEA thereafter. Para will continue to take advantage of current market conditions to acquire and develop additional highly economic, near-term production assets that have strong exploration and development upside.