TORONTO, July 22, 2025 /CNW/ - Summit Royalty Corp. ("Summit" or the "Company"), a private royalty and streaming company, is pleased to announce that it has entered into a definitive agreement to acquire an existing 1.0% net smelter return ("NSR") royalty on the producing Madsen Project ("Madsen") from a Fund managed by Sprott Resource Lending Corp. for total consideration of $9.9 million. Madsen is located in the prolific Red Lake mining district of Ontario and is 100% owned and operated by West Red Lake Gold Mines Ltd. (TSXV: WRLG) ("West Red Lake"). Unless otherwise indicated, all $ amounts are expressed in US dollars.

"We are very pleased to announce this royalty acquisition on a producing mine within Canada that materially enhances Summit's existing royalty portfolio," said Drew Clark, Founder and President of the Company. "Madsen is a storied mine within the prolific Red Lake mining district, having produced over 2.5 million ounces of high-grade gold during its lifetime. This acquisition materially increases Summit's cash flow and is accretive across all metrics and, importantly, provides Summit with a substantial portion of the Company's pro-forma net asset value to Canada. This acquisition also demonstrates our ability to continue to source deals on a bilateral basis outside of a typical sales process, which we will continue to do as we grow Summit into a preeminent cash flowing junior royalty and streaming company focused on precious metals."

Key Acquisition Terms and Transaction Highlights

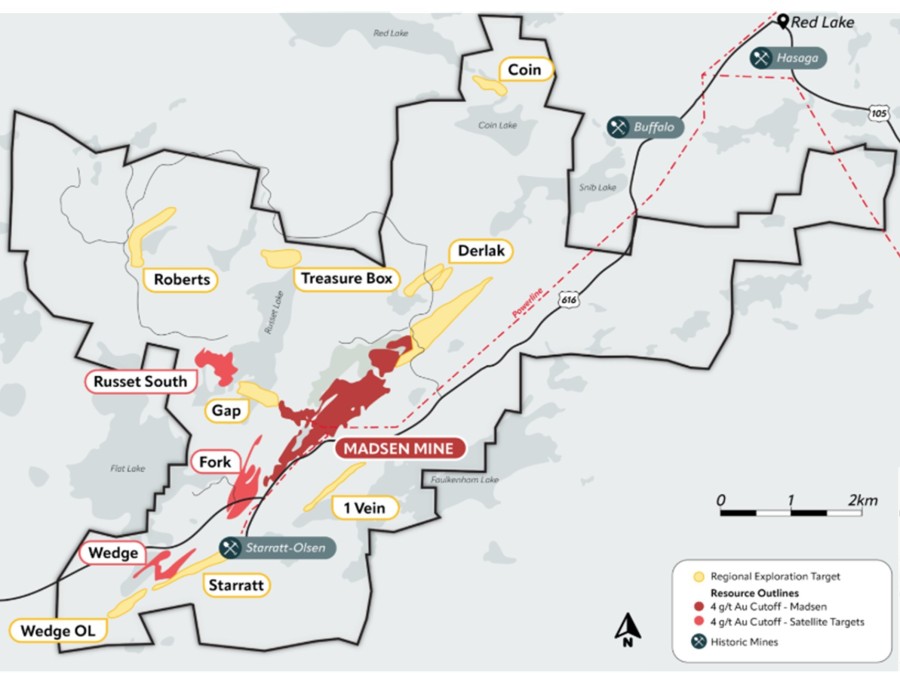

- A 1.0% NSR royalty that covers all mineral properties comprising Madsen, covering approximately 4,700 ha of highly prospective exploration ground.

- $9.9 million purchase price, with $7.9 million in cash due at closing and a contingent $2.0 million cash payment due after the earlier of: (i) production on Madsen exceeding 60 Koz of recovered gold (annualized) for three consecutive quarters; and (ii) total production on Madsen reaching a cumulative 150 Koz of recovered gold from the date of signing the definitive agreement.

- Accretive to Summit's pro-forma net asset value, revenue and cash flow per share, while allowing for potential tax synergies as a Canadian-domiciled corporation.

- Peak royalty revenue of over $2.5 million per annum, based on the analyst consensus production profile on Madsen and consensus gold prices.

- In conjunction with the previously announced reverse takeover of Eagle Royalties Ltd. (the "RTO Transaction") announced in Summit's July 2, 2025 news release, nearly half of Summit's pro-forma net asset value will be located in Canada following completion of the RTO Transaction and the acquisition of the NSR royalty on Madsen.

Project Background

Madsen is an underground gold mine located in Red Lake, Ontario, and is currently ramping-up to commercial production, which is expected in Q4-2025. West Red Lake acquired Madsen in 2023 and has since invested over C$160 million focused on technical and development work. When combined with the previous operator, over C$500 million has been invested in Madsen since 2017. Historically, Madsen produced 2.5 Moz Au at 9.7 g/t Au between 1938 to 1976 and 1997 to 1999.

In May 2025, West Red Lake completed a 14,490 tonne bulk sample that resulted in strong grade and contained gold reconciliation and confirmed the efficacy of their strong emphasis on tighter drill spacing. As of December 31, 2021, and using a gold price of US$1,800 per ounce, Madsen had an Indicated Resource of 6.9 Mt at a grade of 7.4 g/t Au containing 1.7 Moz of gold, and an Inferred Resource of 1.8 Mt at a grade of 6.3 g/t Au containing an additional 0.4 Moz of gold. This 2021 resource estimate, done at a materially lower gold price, does not include the substantial amount of drilling completed by the previous operator and West Red Lake since the beginning of 2022. As of June 30, 2024, and using a US$1,680/oz gold price, Madsen has a Probable Reserve of 1.8 Mt at 8.2 g/t Au containing 0.5 Moz of gold.

Royalty Coverage Area

Advisors

Haywood Securities Inc. is acting as financial advisor and Bennett Jones LLP is acting as legal advisor to Summit in connection with the acquisition of the NSR royalty and RTO Transaction.

About Summit Royalty Corp.

Summit is a private precious metals streaming and royalty company with an aggressive growth trajectory. Summit's current portfolio is backstopped by cash flow production with additional expansion and exploration upside. Summit intends to rapidly expand to be the next mid-tier streaming and royalty company through a series of actionable and accretive acquisitions which, given Summit's size, can have an outsized effect on its production and cash flow growth. Summit currently has no debt and sufficient cash on-hand for use in future acquisitions. Summit intends to complete a go-public transaction before year-end 2025.

ON BEHALF OF THE BOARD OF DIRECTORS OF SUMMIT ROYALTY CORP.

Drew Clark, President and Director

This email address is being protected from spambots. You need JavaScript enabled to view it.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Richard Breger, Professional Geoscientist PGeo., member of the Association of Professional Geoscientists of Ontario and a technical advisor to Summit. Mr. Breger is a qualified person for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and independent of Summit for purposes of Section 1.5 of NI 43-101.

Forward-looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as "expects", or "does not expect", "is expected", "interpreted", management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "potential", "feasibility", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This news release contains forward-looking information pertaining to, among other things: the completion of the acquisition of the NSR on Madsen; the anticipated increase to Summit's cash flow, accretive effects and redistribution of Summit's pro forma net asset value; the Company's growth strategy; the deferred cash payment and future production on Madsen; the anticipated increase in cash flow per share; the potential tax synergies resulting from the acquisition; the expected peak royalty revenue of Madsen; the anticipated actions of the operator of Madsen, including expected timing of commercial production, if any; the Company's ability to expand and complete a series of actionable and accretive transactions; and the anticipated timing and completion of any go-public transaction, including the RTO Transaction. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management's experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including, without limitation, assumptions about: future prices of gold and silver; and the accuracy of anticipated production and cash flow from Madsen. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expected or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; the global economic climate; fluctuations in commodity prices; the ability of the Company to complete further acquisition activities; community and non-governmental actions; risks involved in the mineral exploration and development industry; the ability of the Company to retain its key management employees and skilled and experienced personnel; and other risks applicable to junior production royalties companies. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.