Bravada Gold Corporation (TSX.V: BVA) (the "Company" or "Bravada") has received drill results for the second-phase drilling program at the Company's Baxter Low-sulfidation gold property in the Walker Lane Gold trend in Nevada. Kinross Gold U.S.A., Inc., a wholly owned subsidiary of Kinross Gold Corporation ("Kinross"), drilled 25 additional reverse-circulation (R.C.) holes for a total of 3,839 meters. The relatively shallow holes were widely distributed over the northern portion of the property in order to extend shallow disseminated gold mineralization and to provide vectors to zones of potentially high-grade gold "feeder" zones.

Earlier this year, Kinross completed a 4,439-meter program consisting of 16 R.C. holes that were widely distributed within the large Baxter property and discovered a new zone of shallow, oxide gold mineralization at the Sinter target. Hole BAX16-13 contained the strongest mineralization: 6.1m averaging 2.199 grams gold per ton (g/t gold) beginning at 32m depth within a thicker interval of 32.0m averaging 0.880g/t gold. Other holes in the target area intersected gold mineralization at approximately the same horizon (see news release NR-07-16).

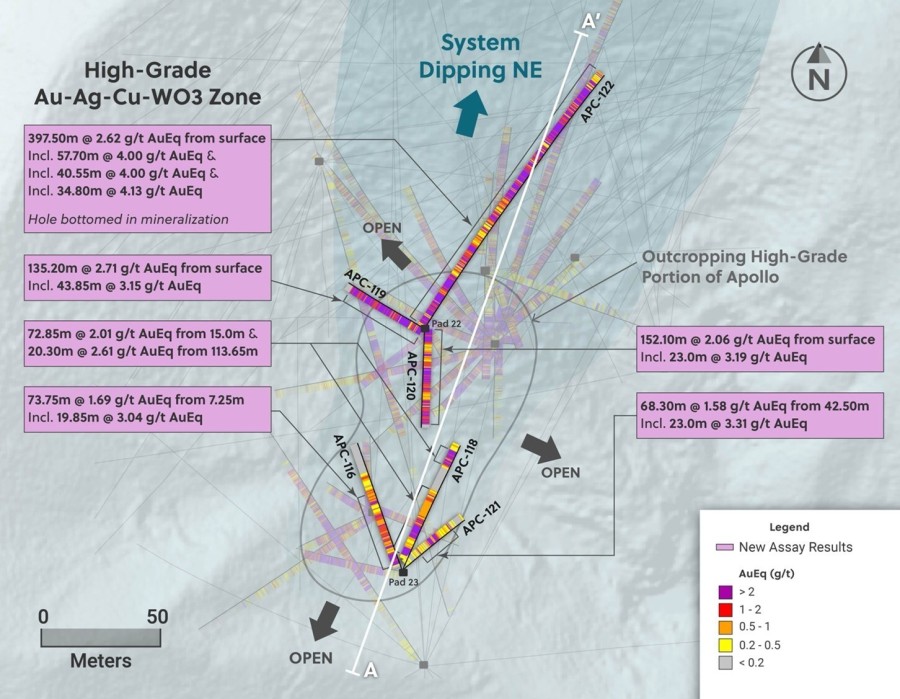

This second phase of drilling somewhat expanded the footprint of mineralization at the Sinter target with holes BAX16-17, -18 and -19, which were drilled from the same pad in different directions. Two holes, BAX16-31 and -32, intersected a potential new zone of mineralization at the eastern end of the Sinter target, where it is open to the north, south, and east. Significant intervals of +0.2g/t Au are shown in the table below and other holes contain lower concentrations of anomalous gold with narrow zones of up to 0.2g/t Au. Locations of holes are shown on the figure below.

| Northern Baxter Project - Significant Drill Intercepts | ||||||||

| Hole | T.D. (m) | Azimuth | Dip | Intercept | @ ~200ppb cut-off grade | |||

| BAX16-17 | 166 | 239 | -50 | 51.8-56.4 (4.6m) of | 626 | ppb Au | ||

| BAX16-18 | 197 | 149 | -61 | 24.4-50.3 (25.9m) of | 301 | ppb Au | ||

| BAX16-19 | 122 | 0 | -90 | 35.1-36.6 (1.5m) of | 940 | ppb Au | ||

| BAX16-31 | 166 | 0 | -90 | 61.0-67.1 (6.1m) of | 260 | ppb Au | ||

| BAX16-32 | 152 | 0 | -90 | 29.0-32 (3m) of | 1,055 | ppb Au | ||

| and | 106.7-112.8 (6.1m) of | 381 | ppb Au | |||||

| True thicknesses are uncertain with current drilling density | ||||||||

| TOTAL =3,839meters | ||||||||

Data from the shallow drilling is being further evaluated to determine vectors to potentially high-grade "feeder" structures. In addition, inversion of existing magnetics and gravity geophysics is planned in order to obtain a 3D geophysical model, which may also aid in vectoring to "feeders."

About Baxter

The Baxter property consists of 240 unpatented lode claims (~1,940 hectares) in the Walker Lane Gold trend of western Nevada. Bravada previously demonstrated extensive low-sulfidation gold and silver mineralization at surface and in relatively shallow reverse-circulation drill holes at several target areas.

Kinross has the option to earn a 60% interest in the property by spending $2.0 million over five years and it can earn an additional 15% interest by spending an additional $2 million on exploration and development expenses over two additional years. Upon Kinross completing its earn-in, Bravada may contribute to expenditures at its percentage of interest or be diluted. Should Bravada's working interest reduce below 10% as a consequence of Kinross contributing Bravada's working interest share of agreed exploration program expenditures, Bravada would convert its working interest to a 1% NSR royalty (see NR-01-15 dated February 3, 2015).

About Bravada

Bravada is an exploration company with 15 properties in Nevada, one of the best mining jurisdictions in the world. The Company follows a portfolio approach to exploration, focusing on gold and silver, and during the past 11 years has successfully identified and advanced properties that have the potential to host high-margin deposits while successfully attracting partners to fund later stages of project development. Currently, five of its Nevada properties are being funded by partners, which in aggregate include earn-in work expenditures of up to $6.5 million and payments to Bravada of up to +$3.0 million in cash and shares, with Bravada retaining residual working or royalty interests.

Bravada's most advanced precious metals property is Wind Mountain, which hosts a significant Indicated and Inferred resource of gold and silver with exciting potential for new discoveries. Currently defined resources at Wind Mountain are primarily oxide and near surface; thus, a low-cost open-pit, heap-leach operation could be permitted relatively quickly. The Company also holds a royalty interest in the Shoshone Pediment barite deposits, which are being permitting for mining by Baker Hughes.

Source: Bravada Gold