Vancouver, British Columbia--(Newsfile Corp. - June 3, 2025) - Noble Plains Uranium Corp. (TSXV: NOBL) (OTCQB: IXIXF) (FSE: INE) ("Noble Plains" or the "Company") is pleased to announce that it has secured an option to acquire a 100% interest in 30 highly strategic mineral claims collectively called the Shirley Central Property in the prolific Shirley Basin of Wyoming, a historically productive and infrastructure rich uranium district in the United States.

Several of the Shirley Central Property claims lie directly within Ur-Energy Inc.'s Shirley Basin permit boundary, while others are surrounded by Uranium Energy Corp's (UEC) land package-placing Noble Plains in the middle of a rapidly developing uranium hub. Ur-Energy Inc.'s Shirley Basin Project currently hosts a National Instrument 43-101 compliant Measured (1,367,000 short tons) and Indicated (549,000 short tons) Resource of 8.816 million pounds U₃O₈ at 0.23%1 and is under active construction2.

"This acquisition is a clear reflection of our strategy-targeting sound geological projects in premier U.S. uranium jurisdictions," stated Drew Zimmerman, President of Noble Plains. "We're focused on acquiring brownfield assets with proven potential and strong ISR amenability, and this new land package in the Shirley Basin is a prime example."

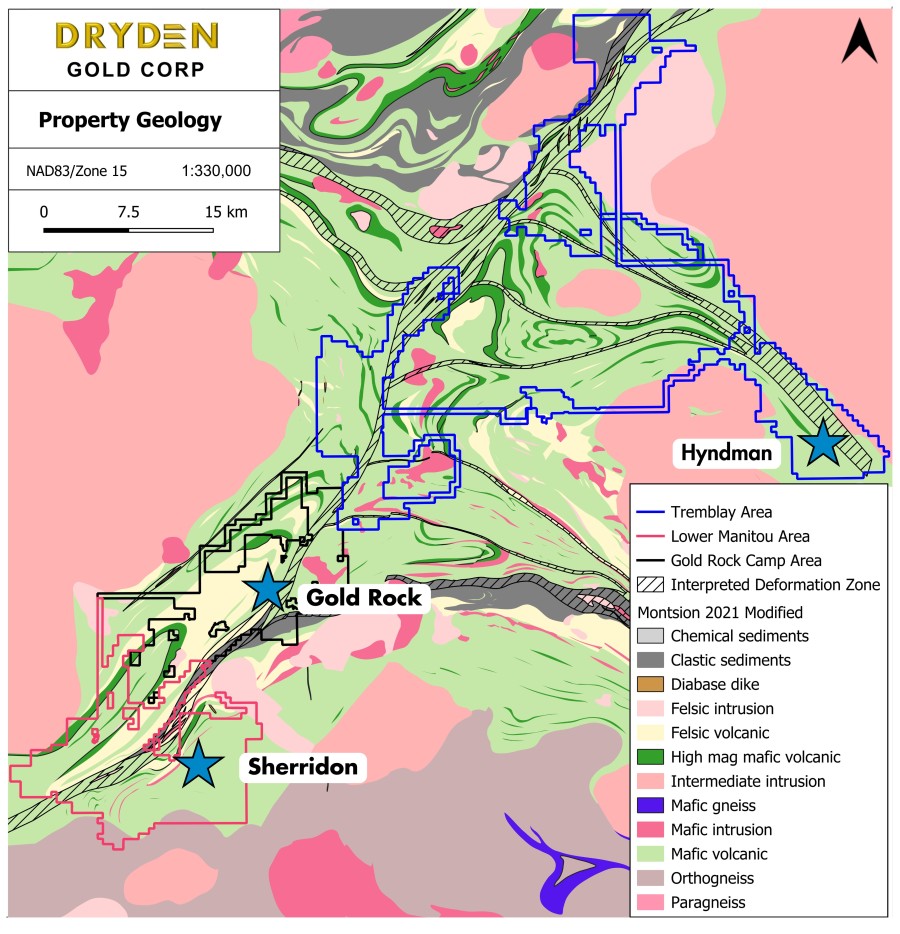

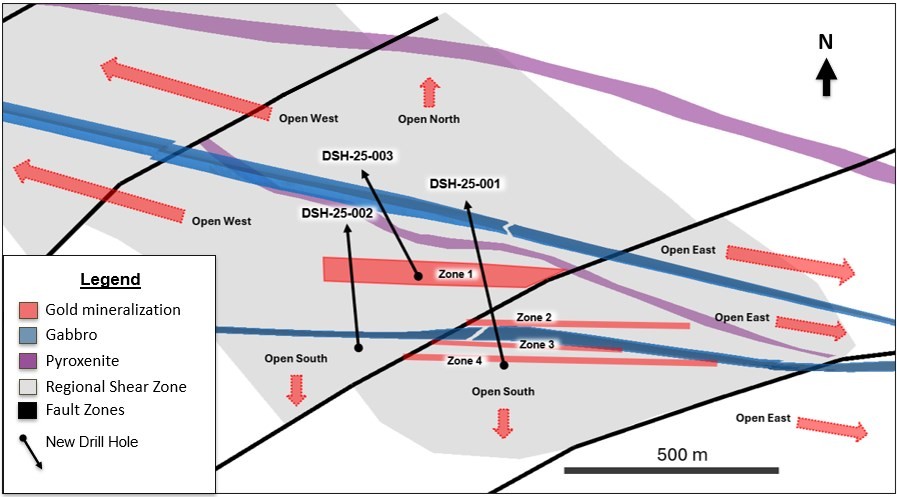

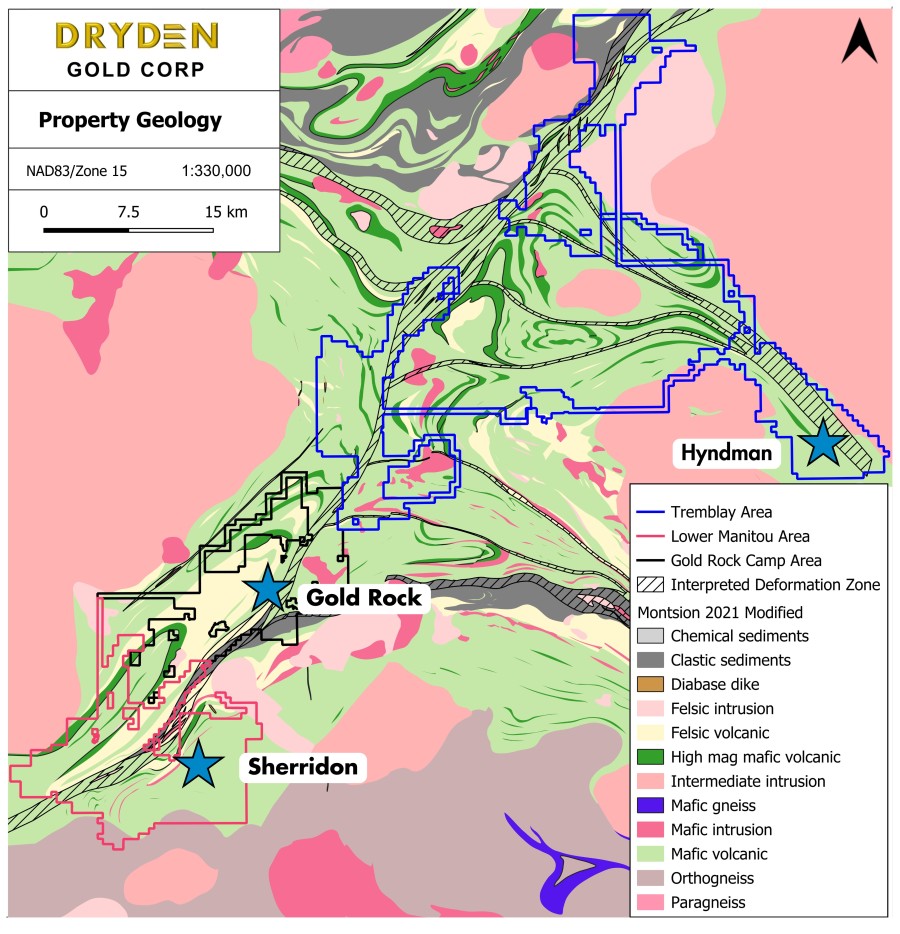

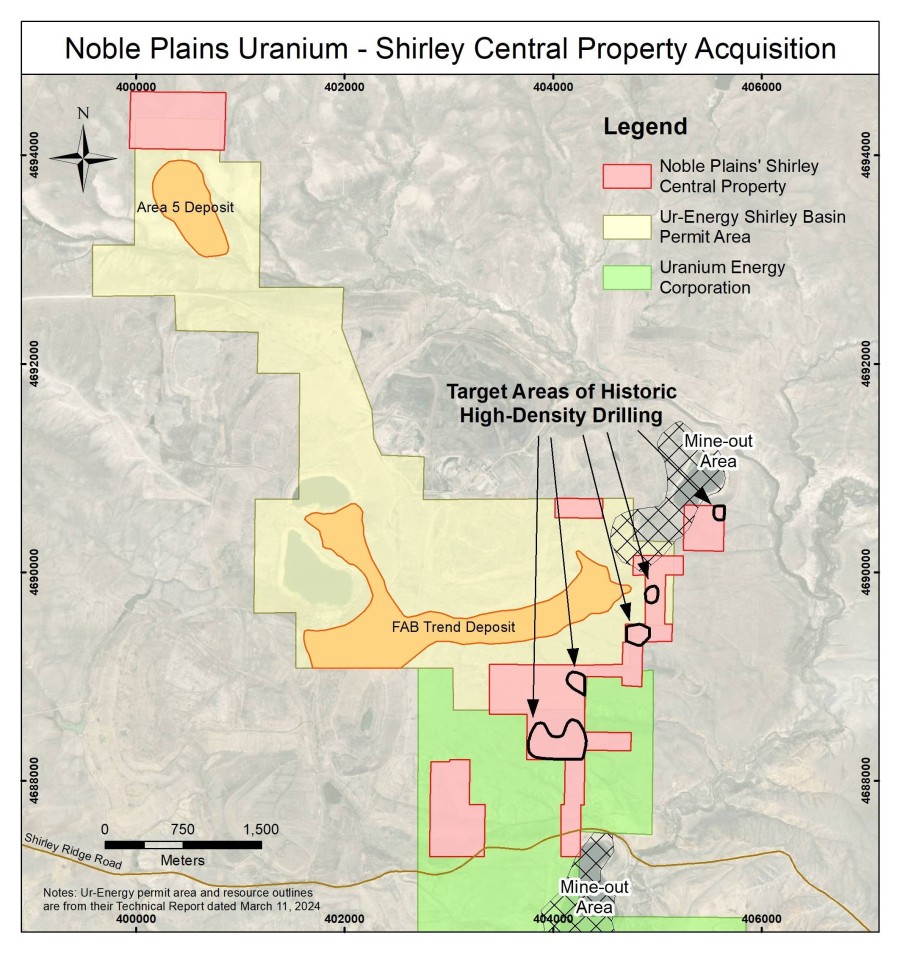

Figure 1: Shirley Central Property Acquisition Map

Figure 1: Shirley Central Property Acquisition Map

The Company has obtained, digitized, and interpreted historical aerial photos and records to reveal at least five distinct areas of dense, systematic drilling within the Shirley Central Property as conducted by past operators, such as Kerr-McGee (see Figure 1). These were drilled between former producing open-pit mines, targeting uranium mineralization with denser grid spacing (25m by 25m) designed to delineate higher-grade zones. Historic exploration density strongly suggests high-confidence targets for future ISR resource delineation. Noble Plains plans to fast-track permitting to begin drilling on these "bullseye" targets by late summer 2025.

"The Shirley Basin is very well-understood geologically and in a historically productive uranium district in the United States," said Paul Cowley, CEO of Noble Plains. "This land package sits between past-producing open pits and has dense historical drilling with clear signs of mineralization that make it an exceptional geological opportunity with five "bullseye" targets already identified for drill testing."

The Shirley Central Property adds to the Company's Shirley East Property (aka Hot Property), expanding Noble Plains' Shirley Basin footprint to a total of 101 unpatented mineral claims covering 8.44 km² (3.26 mi²), consolidating the Company's position in a premier U.S. uranium district (see Figure 2).

Figure 2: Noble Plains' Properties in Shirley Basin (pink and red)

Figure 2: Noble Plains' Properties in Shirley Basin (pink and red)

Shirley Basin

Wyoming is the top uranium-producing state in the U.S. and hosts the country's largest ore reserves. The Shirley Basin alone produced over 52 million pounds of U₃O₈ between 1960 and 1992 at an average grade of 0.22% U₃O₈ -over three times the current U.S. average.

With ISR now the dominant method of uranium production in Wyoming, these newly optioned claims are especially compelling. ISR offers lower capital and operating costs, minimal surface disturbance, and no tailings-aligning with Noble Plains' commitment to environmentally responsible development.

1 Updated Initial Assessment Technical Report Summary on Shirley Basin ISR Uranium Project, Carbon County Wyoming, USA dated March 4, 2024 and prepared by Western Water Consultants, Inc.

2 Ur-Energy Announces Decision to Build Out Shirley Basin Mine: Press Release dated March 13, 2024

Terms of Transaction

The Company has signed a property option agreement (the "Agreement") effective June 1, 2025, with a private vendor pursuant to which the Company can acquire a 100% interest in the Shirley Central Property. Pursuant to the Agreement, the Company will pay US$50,000 annually to the vendor. Between the third anniversary of the effective date of the Agreement and a construction decision, the Company can exercise the option to own a 100% interest in the Shirley Central Property subject to a 3% gross value royalty. At that time, annual option payments of US$50,000 convert to an annual US$50,000 milestone payment. The Shirley Central Property option transaction is considered an Exempt Transaction, as such term is defined in the policies of the Exchange and, thus, does not require Exchange approval.

On Behalf of the Board of Directors,

"Paul Cowley", CEO

For further information, please contact: Paul Cowley: (604) 340-7711

Website: www.nobleplains.com

Bradley Parkes, P.Geo., VP Exploration and Director of Noble Plains Uranium Corp., is the Qualified Person as defined in National Instrument 43-101, who has read and approved the technical content of this news release.

This news release includes certain forward-looking statements as well as management's objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.