VANCOUVER, British Columbia, Oct. 02, 2017 (GLOBE NEWSWIRE) -- Wealth Minerals Ltd. (the “Company” or “Wealth”) - (TSXV:WML) (OTCQB:WMLLF) (SSE:WMLCL) (Frankfurt:EJZN), announces that on September 28, 2017, it has closed the non-brokered private placement as announced on September 25, 2017 (the “Placement”). The Company issued a total of 2,583,700 common shares, including shares issued pursuant to finder’s fees, at a price of $1.50 per share for gross proceeds of $3,875,550. All shares issued by the Company have a four month hold period in Canada ending on January 29, 2018. Finder’s fees were paid in cash to Haywood Securities Inc. ($113,841.00) and Canaccord Genuity Corp. ($31,447.50).

The net proceeds from the Placement are intended to fund option payments on the Company’s mineral property options, the costs for the review and assessment of additional potential lithium mineral property acquisitions in South America, exploration work on the Company’s existing projects and for general and administrative expenses and working capital purposes.

None of the foregoing securities have been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with interests in Canada, Mexico, Peru and Chile. The Company's main focus is the acquisition of lithium projects in South America. To date, the Company has positioned itself to develop the Aguas Calientes Norte, Pujsa and Quisquiro Salars in Chile (the Trinity Project), as well as to work alongside existing producers in the prolific Atacama Salar, in addition to the Laguna Verde lithium project acquisition. The Company has also positioned itself to play a role in asset consolidation in Chile with the Five Salars Project.

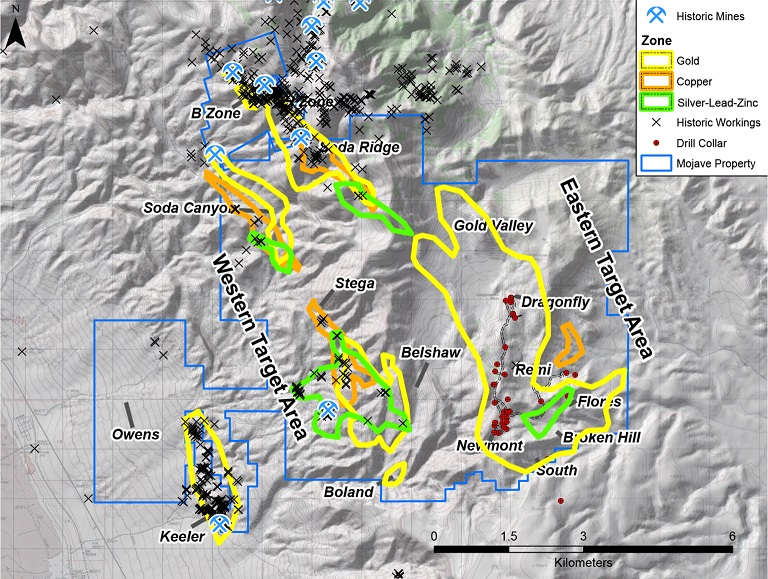

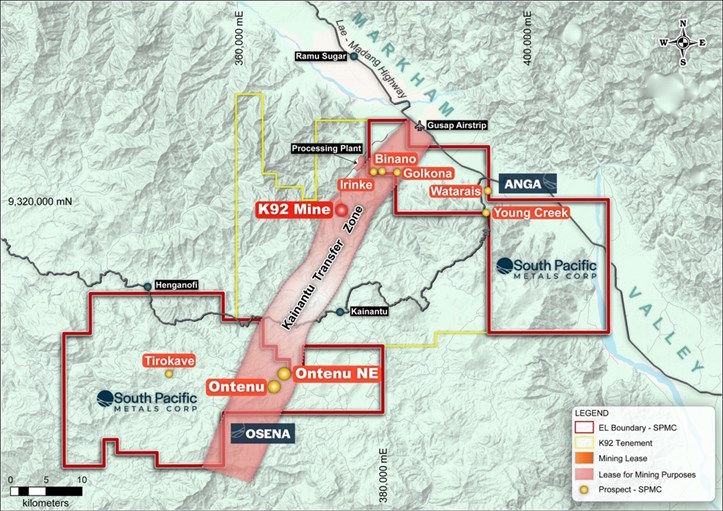

The Company continues to pursue new acquisitions in the region, the latest of which is the Seven Salars Project and is eager to move the projects forward into production. Lithium market dynamics and a rapidly increasing metal price are the result of profound structural issues with the industry meeting anticipated future demand. Wealth is positioning itself to be a major beneficiary of this future mismatch of supply and demand. The Company also maintains and continues to evaluate a portfolio of precious and base metal exploration-stage projects.