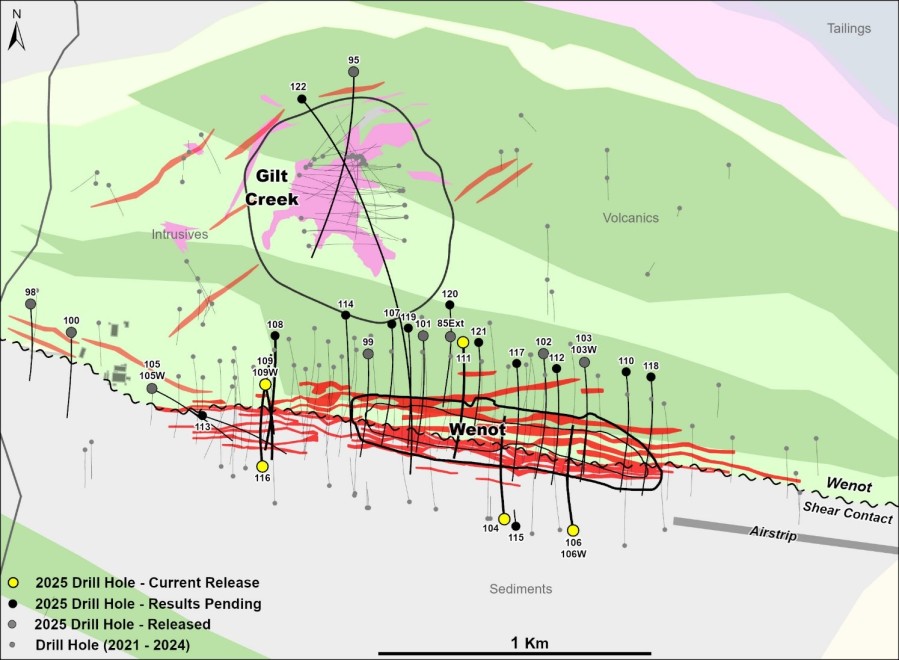

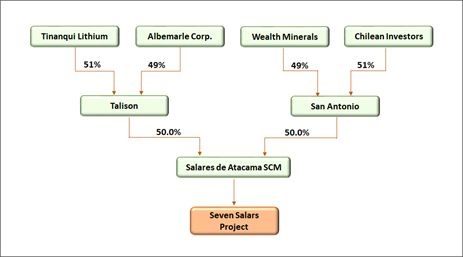

VANCOUVER, British Columbia, Aug. 01, 2017 (GLOBE NEWSWIRE) -- Wealth Minerals Ltd. (the “Company” or “Wealth”) - (TSXV:WML) (OTCQB:WMLLF) (SSE:WMLCL) (Frankfurt:EJZN) announces that it has executed a binding letter agreement (the “Letter Agreement”), whereby Wealth or a Chilean subsidiary of Wealth has been granted the option and right to acquire 49% of the issued and outstanding shares of San Antonio Sociedad Contractual Minera (“San Antonio”) and a 24.5% beneficial interest in certain exploration and exploitation mining concessions that comprise the Salares 7 Lithium project (the “Property” or the “Seven Salars Project”). The Property is a lithium brine asset portfolio currently owned 50% by Talison Lithium Ltd. (“Talison”) and 50% by San Antonio and has a total area of 39,400 hectares located over seven salars in Region II, northern Chile.

“The Seven Salars Project is one of the most important large-scale lithium brine projects in Chile. The Property includes the Salar de La Isla, believed by many to be Chile’s second largest lithium deposit and where 68 shallow drill hole samples returned an average lithium grade of 863 mg/l,” stated Hendrik Van Alphen, CEO, Wealth Minerals, Canada.

Talison acquired its 50% interest in the Seven Salars Project in 2010 and completed drill testing in 2011, but since then the project has not moved forward.

Marcelo Awad, Executive Director, Wealth Chile, “Wealth will bring a new dynamic to the ownership structure and the Company will be working diligently with the owners, allowing the project to realize its real potential. As a Chilean mining executive, I am pleased to help Chile become the dominant global lithium producer in the new green economy and I believe Seven Salars is one of the most geologically advanced new lithium projects in the country.”

Overview of the Seven Salars Project

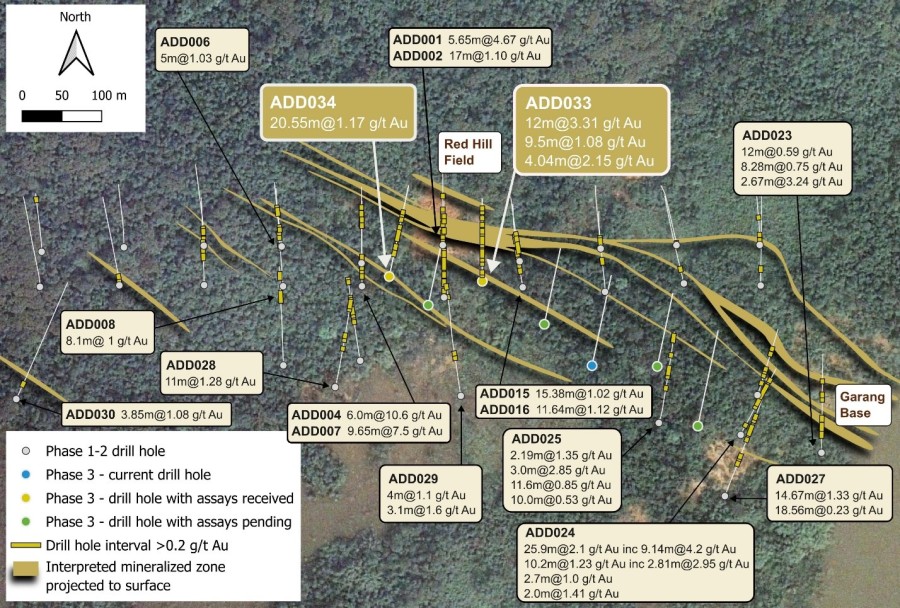

Several work programs have been completed on the Property (Figure 2). A regional geochemistry study of salars in Regions I, II and III of northern Chile was undertaken by a combination of government and non-government agencies between 1995 and 1999. The work covered, but was not limited to, the Seven Salars Project. Surface water sampling of springs and lagoons was completed and the results demonstrated widespread occurrences of anomalous lithium and potassium in surface lagoons and ponds, including a maximum value of 1,080 mg/l Li at Salar de La Isla. Anomalous values were also recorded from a number of springs feeding these salars, although results were generally below 50 mg/l.

Confirmatory sampling was undertaken by Taigo Consultants Limited in 2009 as part of a review of the Salares 7 Project. A total of 25 surface water samples were collected from lagoons along the boundaries of, or springs flowing into, five of the seven salars (comprising the Property). Results in general confirmed the results of the earlier regional survey. Taiga recommended the use of geophysical surveys to locate high salinity sub-surface brines, followed by a drilling and sampling program to define the lithium and potassium content of the brine deposits.

Between 2010 and 2011, Talison completed Transient Electromagnetic (TEM) geophysical surveys, surface brine sampling and exploration drilling on the Property and TEM geophysical surveys were completed over five salars of the seven salars. The TEM method can provide an indication of basin geometry, continuity of hydrogeological units, geological structures and the presence of brine versus fresh groundwater. Results identified a number of zones of high salinity and it appears that recent sediments have overlapped onto the salars in places, with brine extends beyond the current salar shore lines. The results of the TEM survey indicate that the depth of the salars may exceed 200 m.

Approximately 200 surface brine samples were collected and analyzed in the Talison Greenbushes Laboratory following routine QA/QC protocols. During sample collection a range of physical measurements were made on the brine including temperature, conductivity and pH. Analytical results from Salar de La Isla indicate a wide range of lithium concentrations with a maximum value of 1,080mg/l.

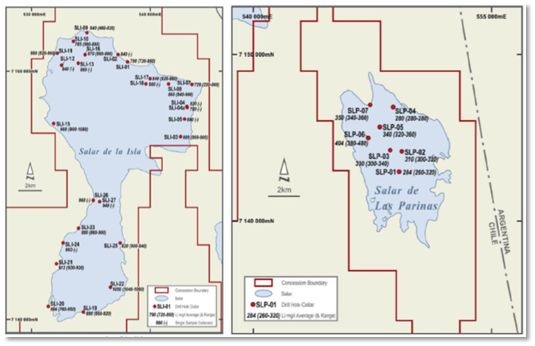

Thirty-four (34) drill holes totaling 562m were completed with a sonic drill in 2011. Twenty-seven (27) holes were drilled in Salar de La Isla and 7 holes in Salar de Las Parinas. The holes were continuously cored and 92 brine samples were collected. Drill hole locations were sited around the margins of the two salars as shown in Figures 3.

The maximum drill depth in Salar de La Isla was 43.5 m and the average depth was 16 m. Analyses of brine samples obtained during the drilling program indicate lithium concentrations range from 220 mg/l to a maximum of 1,080mg/l; the average lithium concentration of 68 samples was 863 mg/l. The average Mg/Li ratio was 6.6. Potassium concentrations ranged from 1,960 mg/l to a maximum of 9,830 mg/l; the average potassium concentration was 7,979 mg/l.

The maximum drill depth in Salar de Las Parinas was 33 m and the average depth was 22m. Lithium concentrations ranged from 260 mg/l to a maximum of 480 mg/l, with an average of 331 mg/l. The average Mg/Li ratio was 11. Potassium concentrations ranged from 4,440 mg/l to a maximum of 8,210 mg/l, with an average of 5,650 mg/l.

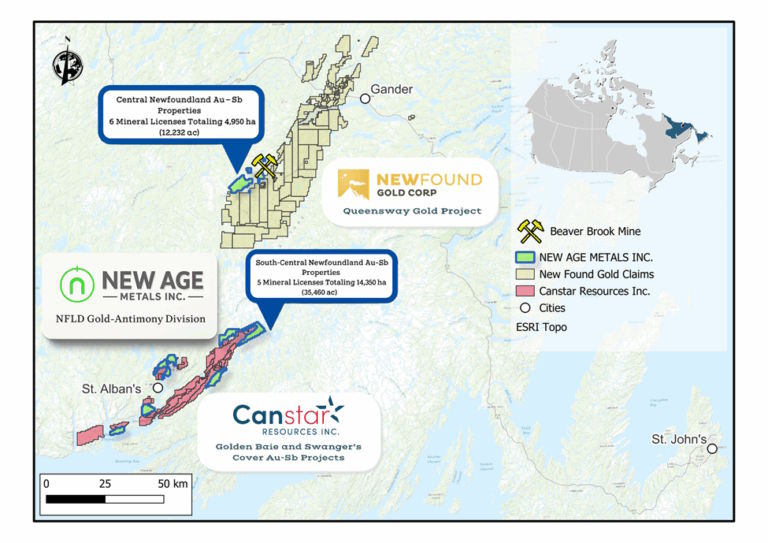

The Property also includes a land package within the Maricunga Salar, adjacent to concessions in the salar currently under exploration by Lithium Power International and Bearing Resources. Earlier in 2017, Chilean state mining company CODELCO announced the formation of a lithium production subsidiary with the goal to advance development of the Maricunga Salar.

The other salars in the Property have varying degrees of historical work completed, including surface samples, water samples and geophysical surveys. The most significant of these is three brine samples on Salar de Aquilar, which returned lithium concentrations between 257 mg/l and 337 mg/l, as well as potassium concentrations between 2,910 mg/l and 3,990 mg/l.

Commercial Terms

Subject to acceptance of the Letter Agreement and the option grant transaction contemplated thereby (the “Transaction”) by the TSX Venture Exchange (the “TSXV”) and the completion of satisfactory due diligence by Wealth on the Property and other customary conditions precedent on or before 120 days from the execution of the Letter Agreement, including a National Instrument 43-101 technical report on the Property, if required, the existing shareholders of San Antonio (the “Selling Shareholders”) will sell and transfer to Wealth, at the closing of the Transaction (the “Closing”), shares representing 49% of the issued and outstanding shares of San Antonio in consideration for the payment by Wealth of USD 11,760,000 in cash and the issuance of 4,104,545 common shares of Wealth (the “Wealth Shares”) in accordance with the following schedule:

- at Closing, an initial payment of USD 3,920,000 and the issuance of 4,104,545 Wealth Shares;

- a further payment of USD 3,920,000 on or before the day which is 4 months after Closing; and

- a further payment of USD 3,920,000 on or before the day which is 8 months after Closing.

Wealth will provide security for the payments due 4 months and 8 months after Closing by granting to the Selling Shareholders a pledge over the San Antonio shares being purchased by Wealth. In addition, the Letter Agreement provides that the definitive purchase and sale agreement will contain a buy-back provision, whereby Wealth will grant to the Selling Shareholders the right to re-acquire the San Antonio Shares purchased by Wealth at a price equivalent to 65% of the purchase price paid therefor, in the event that any of the purchase price installments are not fully paid as scheduled and such lack of payment is not remedied within 20 business days of such breach.

The Wealth Shares issued in connection with the Transaction will be subject to an initial resale restriction of 4 months and one day following the date of issue thereof. In addition, the Wealth Shares will be subject to an additional lock-up period of 8 months from the date of issue. During this lock-up period, the Selling Shareholders may only sell up to the aggregate amount of 250,000 Wealth Shares in any calendar month, and Wealth will have the first right of refusal to purchase any Wealth Share proposed to be sold by the Selling Shareholders during this period.

Wealth Lithium Interests in Chile

With this transaction, Wealth now has option interests in 16 salars and the properties have an aggregate area of 110,604 hectares (Table 1). The Company is now positioned as one of the largest holders of lithium property interests in Chile.

| Table 1: Wealth Minerals’ Lithium Brine Property Interests in Chile | ||||

| Project | Salar | Option Interest | Hectares | |

| Atacama Project | Atacama | 100 | % | 46,000 |

| Trinity Project | Pujsa | 100 | % | 1,600 |

| Calientes Norte | 2,000 | |||

| Quisquiro | 2,400 | |||

| Laguna Verde Project | Laguna Verde | 100 | % | 8,700 |

| Five Salars Project | Ascotan | 100 | % | 1,300 |

| Piedra Parada | 1,900 | |||

| Lejia | 400 | |||

| Siglia | 1,600 | |||

| Huasco | 5,300 | |||

| Seven Salars Project | Isla | 24.5 | % | 16,500 |

| Agua Amerga | 3,100 | |||

| Parinas | 5,400 | |||

| Grande | 4,000 | |||

| Aguilar | 8,800 | |||

| Piedra Parada | 1,500 | |||

| Maricunga | 104 | |||

About Talison Lithium

Talison is a leading global producer of lithium with projects in Western Australia and Chile. Production from its Greenbushes Project in Australia accounts for approximately 40% of global production. Talison is owned by Tianqi Lithium (51%) and by Albemarle Corporation (49%). Talison’s operating partner is Albemarle who is also one of only two current lithium producers in Chile and who is producing from the Atacama Salar, where Wealth has a significant land position. Talison acquired its 50% stake in the Seven Salars Property via the acquisition of TSXV listed Salares Lithium Ltd. in 2010.

About Albemarle Corporation

Albemarle Corporation (NYSE:ALB) is a global specialty chemicals company with leading positions in lithium, bromine, refining catalysts and applied surface treatments. Albemarle’s market capitalization is $13 billion and the company employs approximately 5,000 people and serves customers in approximately 100 countries. Talison’s Greenbushes Project in Australia is operated by Albemarle who also operate in the Atacama Salar, producing lithium carbonate from a location 40km south of Wealth’s Atacama Project.

About Tianqui Lithium

Tianqi Lithium is a leading global supplier of lithium products, with major businesses including lithium resource development and exploitation, downstream production processing and trade for a diverse range of high quality lithium products including mineral concentrates. The company has established global presences in China, Hong Kong, the UK, Australia and Chile, allowing the company to service customers across Europe, Asia, the Americas and Oceania.

About San Antonio

San Antonio is the underlying owner from whom Wealth will acquire a 24.5% beneficial interest in the Property.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with interests in Canada, Mexico, Peru and Chile. The Company's main focus is the acquisition of lithium projects in South America. To date, the Company has positioned itself to develop the Aguas Calientes Norte, Pujsa and Quisquiro Salars in Chile (the Trinity Project), as well as to work alongside existing producers in the prolific Atacama Salar, in addition to the Laguna Verde lithium project acquisition. The Company has also positioned itself to play a role in asset consolidation in Chile with the Five Salars Project.

The Company continues to pursue new acquisitions in the region, the latest of which is the Seven Salars Project and is eager to move the projects forward into production. Lithium market dynamics and a rapidly increasing metal price are the result of profound structural issues with the industry meeting anticipated future demand. Wealth is positioning itself to be a major beneficiary of this future mismatch of supply and demand. The Company also maintains and continues to evaluate a portfolio of precious and base metal exploration-stage projects.