Vancouver, British Columbia--(Newsfile Corp. - June 3, 2025) - Canterra Minerals Corporation (TSXV: CTM) (OTCQB: CTMCF) (FSE: DXZB) ("Canterra" or the "Company") is pleased to announce additional drilling results from its ongoing 10,000 metre ("m") drill program at its 100% owned Buchans Project in the Central Newfoundland Mining District, located 50 kilometres ("km") north of Equinox Gold's Valentine Gold Mine and 34 km northwest of Teck's past producing Duck Pond Mine (Figures 1 & 2).

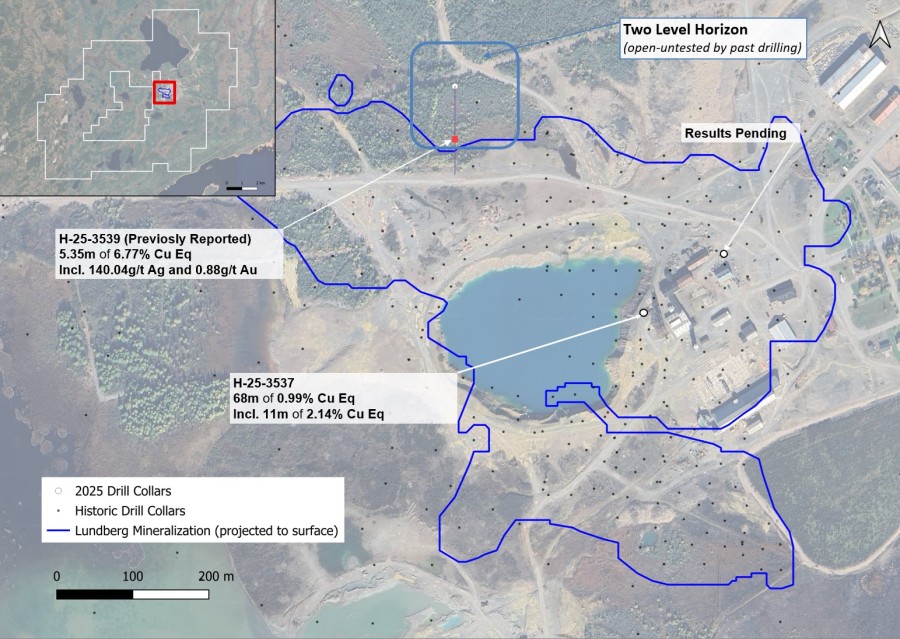

Drill Highlights and Insights from Drillhole H-25-3537 (1&2):

-

68.0m of 1.0% CuEq (0.50% Cu, 1.00 % Zn, 0.43% Pb, 3.5 g/t Ag & 0.06 g/t Au), from surface

-

including 11.0m of 2.14% CuEq (0.63% Cu, 3.22% Zn, 1.62% Pb, 6.9 g/t Ag & 0.14 g/t Au) from surface

-

Broad intersections of stockwork semi-massive sulfide mineralization that are expected to expand current open pit mineral resource

-

Further demonstration of continuity of the Lundberg deposit, an open pit resource favourably situated on a brownfields site with excellent infrastructure

-

Builds upon the Company's successful expansion of the high-grade Two Level discovery announced on May 20, 2025, validating the exploration model targeting extensions of high-grade mineralization historically mined at Buchans Mine

-

Additional drilling results from the current program, including the Pumphouse Target, will be released as assays are received and compiled

Chris Pennimpede, President and CEO of Canterra commented: "This exceptional 68-metre intersection from surface demonstrates robust, continuous mineralization that has the potential to grow existing open pit mineral resources at Buchans. The consistency and grade of this intersection reinforces our belief that Buchans represents one of the most compelling undeveloped critical minerals opportunities in Atlantic Canada."

Table 1. Assay Highlights. Copper Equivalents (CuEq%) as per metal prices of April 11, 2025 (see notes 2 & 3 at end of release for additional explanation).

| Hole | From (m) | To (m) | Width (m) |

Cu% | Zn% | Pb% | Ag g/t | Au g/t | *CuEq (%) | Comments |

| H-25-3537 | 8.00 | 76.00 | 68.00 | 0.50 | 1.00 | 0.43 | 3.5 | 0.06 | 0.99 | Lundberg |

| incl. | 8.00 | 19.00 | 11.00 | 0.63 | 3.22 | 1.62 | 6.9 | 0.14 | 2.14 | " " |

| incl. | 29.00 | 37.00 | 8.00 | 1.47 | 0.39 | 0.14 | 4.8 | 0.06 | 1.74 | " " |

| incl. | 65.00 | 76.00 | 11.00 | 0.45 | 0.41 | 0.12 | 2.2 | 0.02 | 0.64 | " " |

| and | 93.00 | 108.00 | 15.00 | 0.18 | 1.75 | 1.19 | 2.8 | 0.03 | 1.01 | " " |

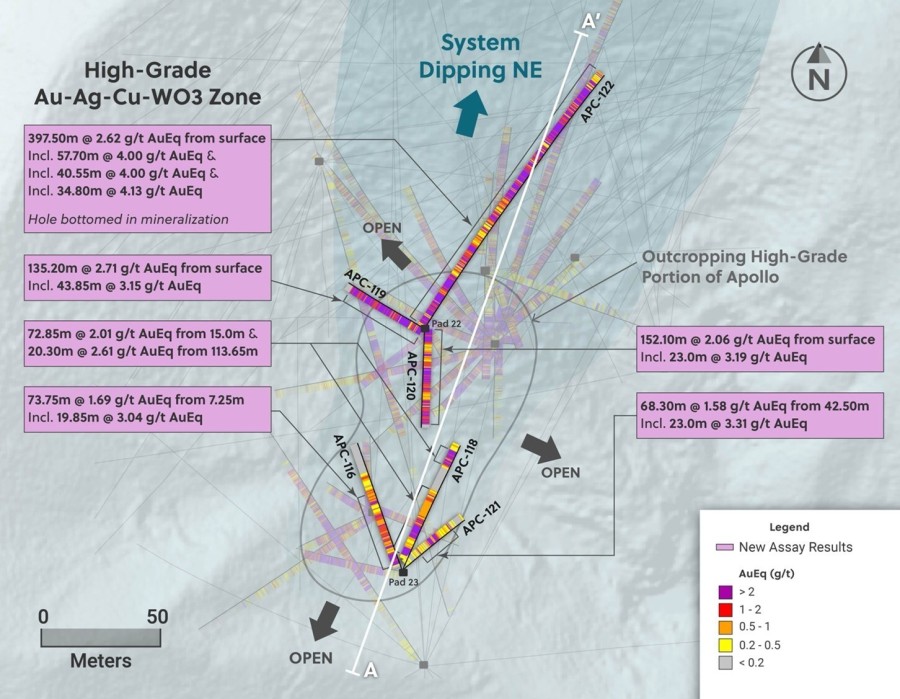

Figure 1. Buchans 2025 drilling collars and assay highlights to date.

Buchans Project

Canterra's Buchans Project hosts the world-renowned, past producing Buchans Mine as well as the undeveloped Lundberg open pit resource. This brownfield project covers 95 km2 near the town of Buchans and includes the past producing Buchans Mine operated by Asarco from 1928 to 1984.

The undeveloped Lundberg deposit comprises VMS stockwork sulphide mineralization composing a large, near-surface open pit resource proximal to the previously mined, high-grade Lucky Strike massive sulphide orebody. At the former Lucky Strike orebody, Asarco is reported to have mined 5.6 million tonnes1 of high-grade ore averaging 18.4% Zn, 8.6% Pb, 1.6% Cu, 112 g/t Ag & 1.7 g/t Au. Lucky Strike's past production is a significant portion of the former Buchans Mine's past production that is reported to have totaled 16.2 million tonnes1 at an average grade of 14.5% Zn, 7.6% Pb, 1.3% Cu, 1.37 g/t Au & 126 g/t Ag mined from five orebodies.

Table 2: Lundberg Deposit Mineral Resource Estimate - Effective Date: February 28, 2019

| NSR Cut-off ($US/t) | Category | Tonnes | Cu % | Zn % | Pb % | Ag g/t | Au g/t | NSR ($US/t) | |

| 20 | Indicated | 16,790,000 | 0.42 | 1.53 | 0.64 | 5.69 | 0.07 | 54.98 | |

| Inferred | 380,000 | 0.36 | 2.03 | 1.01 | 22.35 | 0.31 | 72.95 |

- Mineral Resources were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (MRMR) (2014) and CIM MRMR Best Practice Guidelines (2019).

- Mineral Resources are defined within an optimized pit shell with pit slope angles of 45⁰ and an overall 2.9:1 strip ratio (waste: mineralized material)

- Price assumptions used were US$1.20 /lb Zn, US$1.00 /lb Pb, US$3.00 /lb Cu, US$1250 /oz Au, and US$17 /oz Ag.

- Metallurgical recoveries to concentrates are based on the "Centralized Milling of Newfoundland Base Metal Deposits - Bench Scale DMS and Flotation Test Program" (Thibault & Associates Inc., 2017). Metal recoveries are 83.0% Cu, 13.3% Au, and 7.84% Ag in the copper concentrate, 84.3% Pb, 10.5% Au, and 50.3% Ag in the lead concentrate, and 87.2% Zn, 8.28% Au, and 14.8% Ag in the zinc concentrate.

- Net Smelter Return (NSR) $US/t values were determined by calculating the value of each Mineral Resource model block using an NSR calculator. The NSR calculator uses the stated metal pricing, metallurgical recoveries to concentrates, concentrate payable factors and current shipping and smelting terms for similar concentrates.

- Pit optimization parameters include: mining at $3 US per tonne, processing at $15 US per tonne, and G&A at $2 US per tonne (total $20 US per tonne).

- Mineral Resources are reported at a cut-off value of $20 US/t NSR within the optimized pit shell and is considered to reflect reasonable prospects for economic extraction by open pit mining methods.

- Mineral Resources were interpolated using Inverse Distance Squared methods applied to 1.5 m downhole assay composites.

- Results of an interpolated Inverse Distance Squared bulk density model (g/cm3) were applied.

- Mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resource tonnages have been rounded to the nearest 10,000. Totals may vary due to rounding.

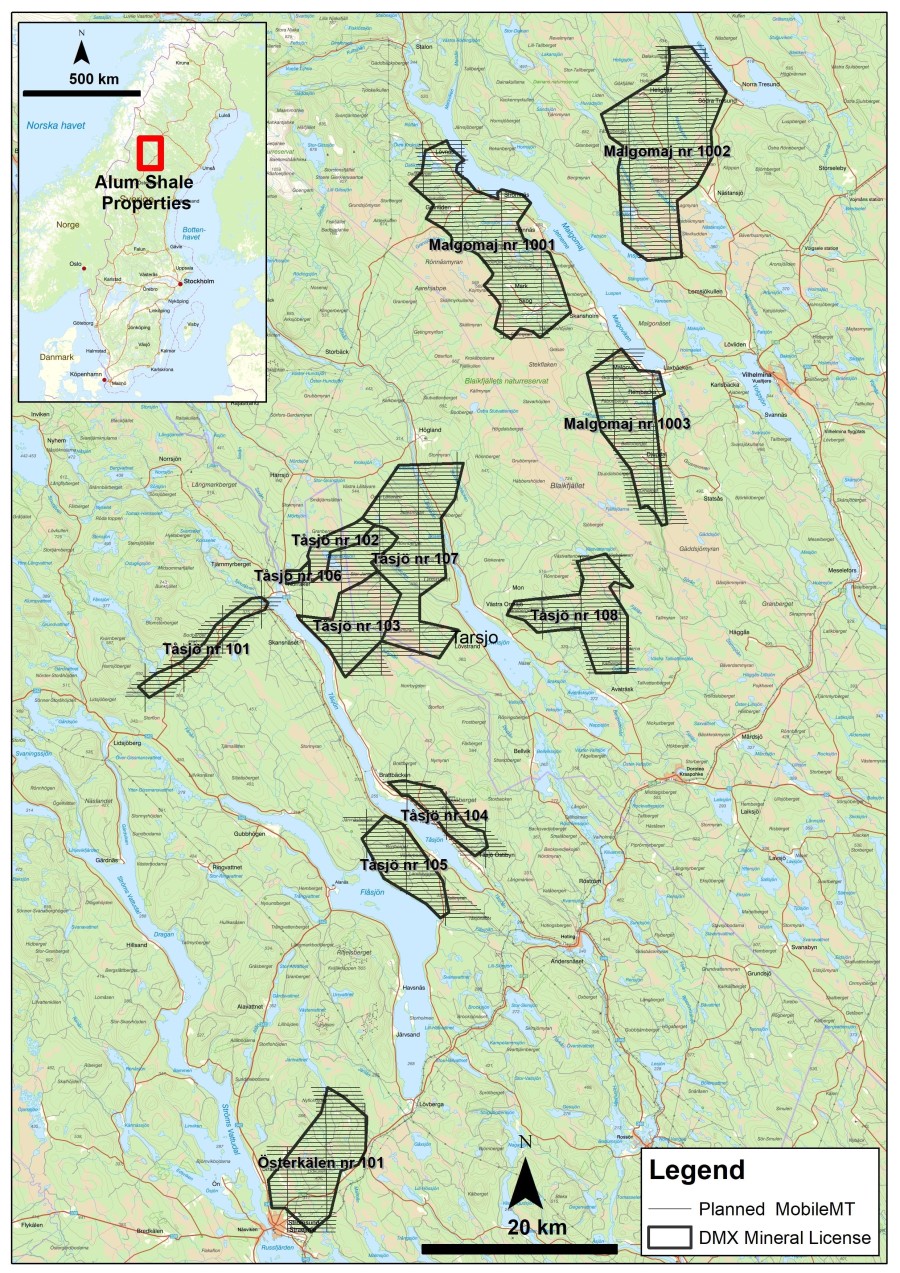

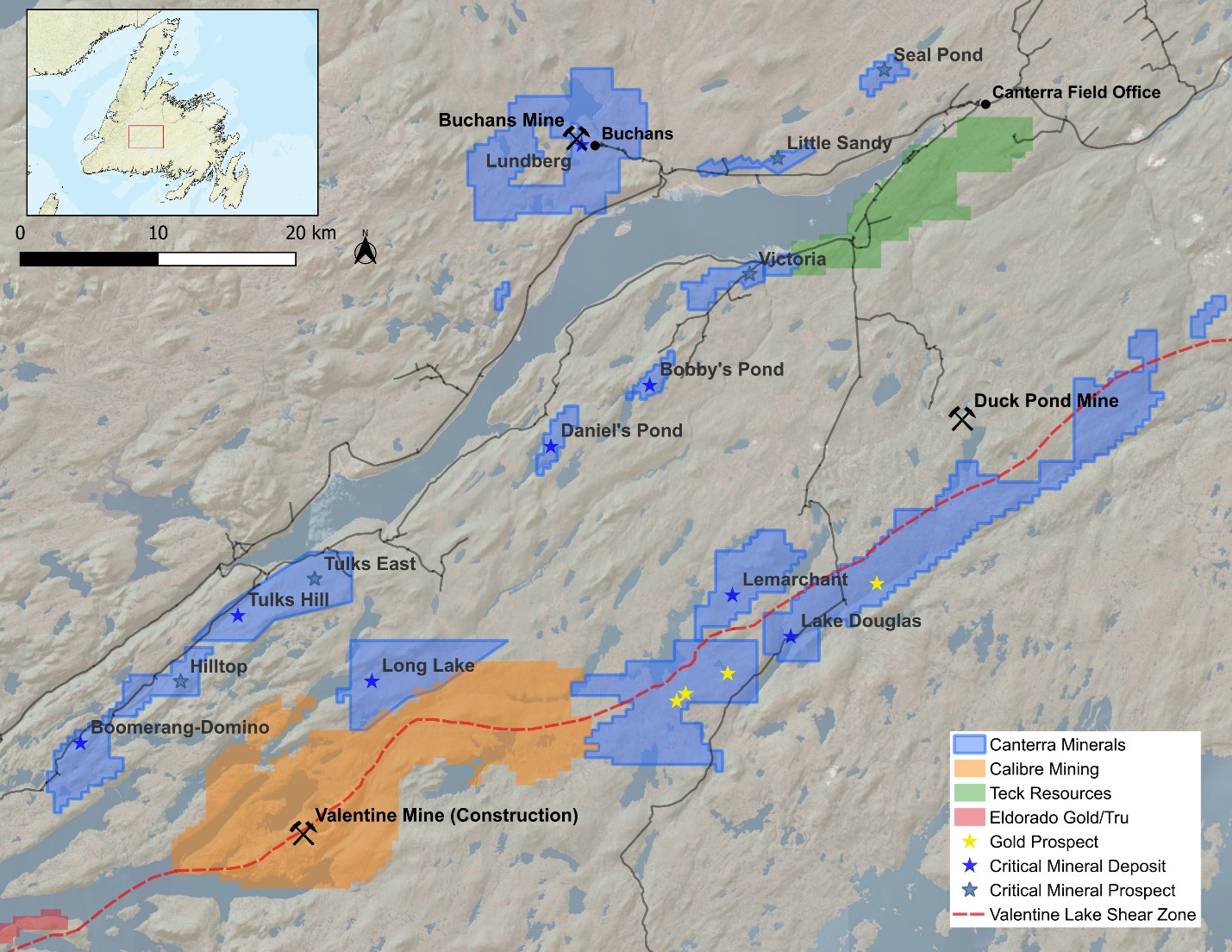

Figure 2. Canterra's Central Newfoundland Mining District properties.

Notes:

(1) Past production figures from Kirkham, R.V., ed., 1987, Buchans Geology, Newfoundland. Geological Survey of Canada, Paper 86-24, 288 p.

(2) True widths estimated to be a ~90% of reported core lengths. Copper equivalents (CuEq) based on total contained copper, zinc, lead, silver and gold and metal prices as of April 11, 2025 (Cu - US$4.06/lb, Zn - US$1.19/lb, Pb - US$0.85/lb, Ag - US$32.23/oz and Au - US$3,236.00/oz).

(3) Copper Equivalent % = Cu% + (Pb% * 22.046 * Pb Rec.* Pb price) + (Zn% * 22.046 * Zn Rec. * Zn price) + (Ag g/t/31.10348 * Ag Rec. * Ag price) + (Au g/t/31.10348 * Au Rec. * Au Price))/(Cu Price * 22.046 * Cu Rec.). Metal recoveries are assumed to be 100% (Rec.)

Table 3. Drill collar locations

| Hole | Length (m) | Azimuth | Dip | Northing (UTM NAD83 Zone 21) |

Easting (UTM NAD83 Zone 21) |

| H-25-3537 | 121 | 0 | -90 | 5,407,849 | 509,973 |

Newfoundland and Labrador Junior Exploration Assistance

Canterra would like to acknowledge financial support it may receive from the government of Newfoundland and Labrador's Junior Exploration Assistance Program related to completion of its 2025 exploration programs at Buchans.

About Canterra Minerals

Canterra is a diversified minerals exploration company focused on critical minerals and gold in central Newfoundland. Canterra holds Newfoundland's second-largest combined critical minerals inventory with seven resource-stage deposits. The Buchans Project hosts the Lundberg Copper-Zinc-Lead deposit, the largest and most advanced critical minerals deposit within the Central Newfoundland Mining District. The Company's projects are near the world-renowned, past-producing Buchans Mine and Teck Resources' Duck Pond Mine, which collectively produced copper, zinc, lead, silver and gold. Canterra's gold project is located on-trend of Equinox Gold's Valentine mine currently under construction and cover a ~60 km extension of the same structural corridor that hosts mineralization within Equinox Gold's mine. Past drilling by Canterra within the Company's gold projects intersected multiple occurrences of orogenic-style gold mineralization within a large land position that remains underexplored.

QA/QC Protocols

Samples consist of saw-cut (NQ drill core) with one-half retained for reference and one-half submitted for analyses. Samples were submitted in sealed plastic bags delivered by Canterra personnel to SGS Canada's preparatory facility in Grand Falls-Windsor, Newfoundland. Sample batches consisted of core samples, control standards, blanks and duplicates. Once prepared, pulps (SGS procedure code PRP89) were shipped to SGS Canada's laboratory in Burnaby, BC to be homogenized and subsequently analyzed for multi-element assays (including Cu, Pb, Zn, Ag and Au) using sodium peroxide fusion with ICP-OES finish (codes GE_ICP90A50 for Cu, Pb, Zn, Ag, GE_AAS22E50 for Ag by-2-acid digestion by AAS, and GE_FAA30V5 for Au by 30g Fire Assay by AAS). Overlimit assays were completed as necessary by pyrosulphate fusion/XRF for Cu, Pb, Zn (code GO_XRF70V) and Ag by 30g Fire Assay, gravimetric (code GO_FAG37V). SGS Natural Resources analytical laboratories operate under a Quality Management System that complies with ISO/IEC 17025. SGS CANADA's minerals laboratory in Burnaby is accredited by the Standards Council of Canada (SCC) for specific mineral tests listed on the scope of accreditation to the ISO/IEC 17025 standard. Further details regarding SGS procedures are available at SGS Analytical Methods. Canterra also submits representative pulps to ALS Geochemistry's laboratory in Moncton New Brunswick for additional independent check assays.

Qualified Person

Paul Moore MSc. P.Geo. (NL), Vice President of Exploration for Canterra Minerals Corporation, a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

ON BEHALF OF THE BOARD OF CANTERRA MINERALS CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, including statements with respect to estimated mineral resources, the opening of avenues for substantial discoveries within the belt, the Buchans Project being ripe for a modern approach with significant exploration potential for high grade VMS mineralization, the Company anticipating being strongly positioned to unveil the next mineral discovery in central Newfoundland. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects.; as well as those risks and uncertainties identified and reported in the Company's public filings under its SEDAR+ profile at www.sedarplus.ca. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.