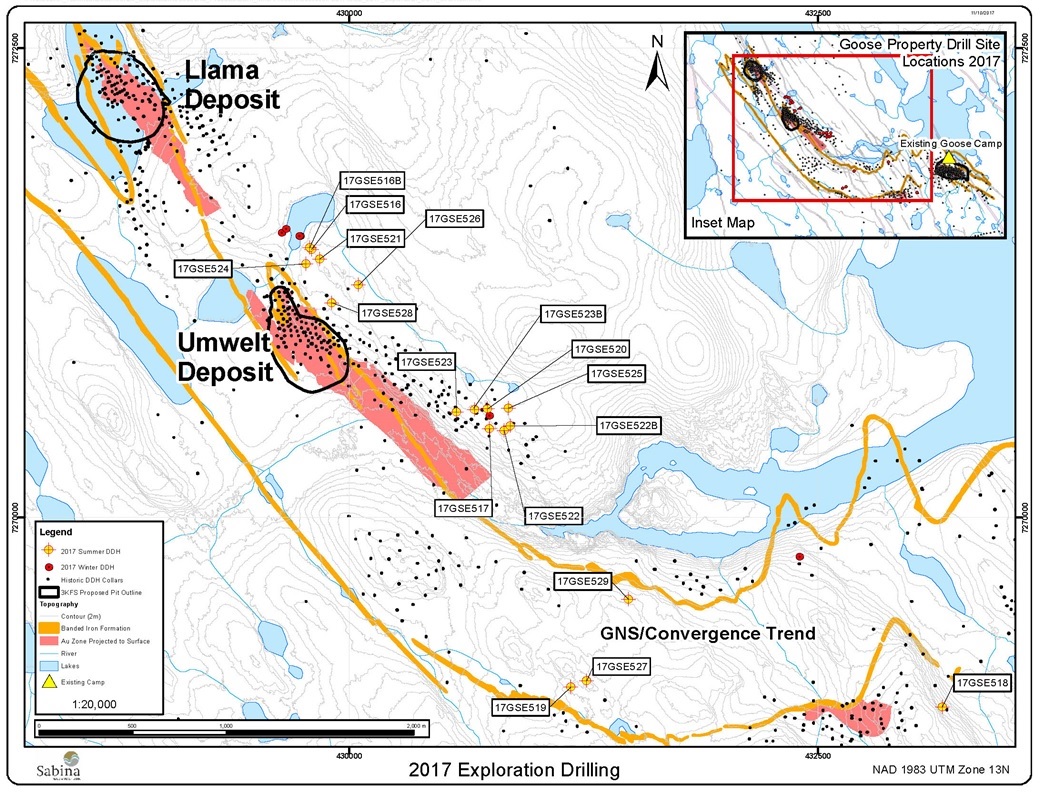

VANCOUVER, British Columbia, Nov. 20, 2017 (GLOBE NEWSWIRE) -- Sabina Gold & Silver Corp (TSX:SBB), (“Sabina” or the “Company”) is pleased to announce final assay results from the summer exploration diamond drilling program (Figure1) at its 100% owned Back River Gold Project in Nunavut Canada.

Drilling intercepts have highlighted the importance of a mineralized Deep Iron Formation (“DIF”) horizon approximately 40 to 100m stratigraphically below the main lower iron formation at the Llama and Umwelt deposits. Initial assay results of up to 98.31 g/t Au over 1.13m from drill hole 17GSE521 and 23.20g/t Au over 2.05m including 48.65g/t Au over 0.95m from 17GSE528 have been returned. Other significant drill results are included in the table below.

The DIF horizon is a new stratigraphic target over a distance of greater than 3km at Back River within the Llama and Umwelt deposit trends and is believed to be relatively continuous and favorably folded within the Goose project area. This new horizon is analogous to the DIF and lower sediments at the Goose Main deposit, which hosts approximately 20% of the existing Goose Main resource.

”We are very encouraged by the identification of this new mineralized parallel target zone under the main gold bearing structure at Llama and Umwelt,” said Bruce McLeod, President & CEO. “The DIF horizon appears to be wide spread at the Goose Property and has been identified at other deposits in the Project area through drilling and surface mapping. While more exploration is warranted to test the significance of this horizon at Llama and Umwelt, these results continue to demonstrate the potential of this strong gold endowed district for diverse resource growth opportunities.”

The summer drill program has now tested portions of this DIF horizon and proximal lower sediments in three key areas including:

- North of the Umwelt deposit, five drill holes tested the east fold limb of the Umwelt DIF over a 250m strike length at a shallow depth level from 66 to 230m. Drill hole 17GSE521 intersected 98.31g/t Au over 1.13m from 207.0-208.13m and 3.88 g/t Au over 2.61m from 221.84-224.45m.

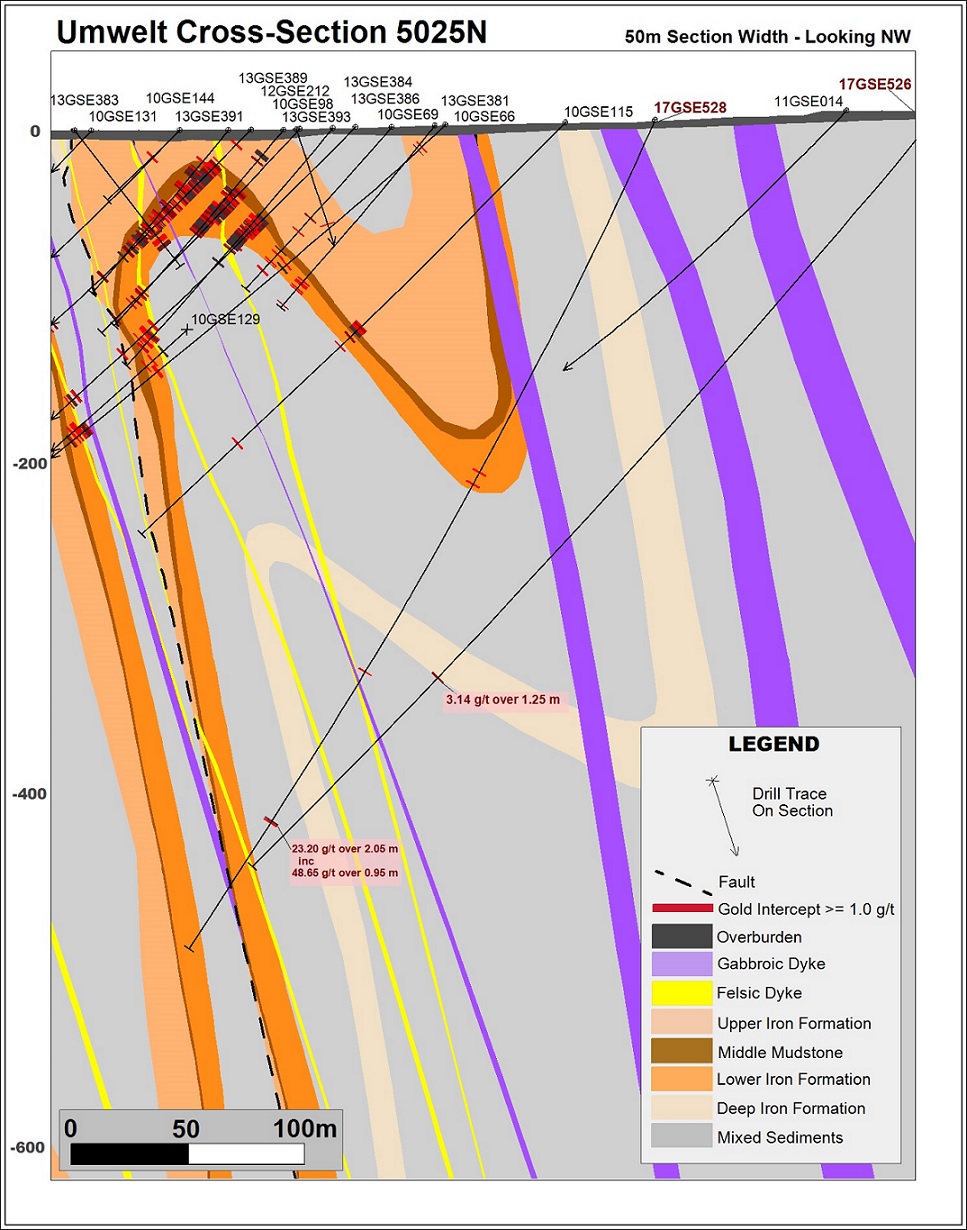

- The central fold limbs of the Umwelt DIF was targeted immediately below the Umwelt deposit open pit resources, with two drill holes (17GSE526 and 17GSE528), at an intermediate depth level of 290m-450m (Figure 2). Drill hole 17GSE526 intersected 3.14g/t over 1.25m from 444.95-446.20m within eastern limb of the central antiform and a high grade zone running 23.20g/t Au over 2.05m including 48.65g/t Au over 0.95m from 470-472.05m within mineralized and veined lower sediments was intersected by drill hole 17GSE528.

- The east fold limb of the Umwelt DIF immediately below the Umwelt deposit Vault Zone was intersected by drill hole 17GSE525 from 940.2-975.1m. This zone had minor arsenopyrite and pyrrhotite mineralization but returned no significant gold values.

Table 1.0 – Table of Significant Drill Intersections

| Hole Id | Area | Azimuth | Dip | Easting | Northing | Depth | From (m) |

To (m) |

Length (m) |

Au (g/t) |

Lithology |

| 17GSE521 | LL | 223 | -70 | 429847 | 7271379 | 797 | 207.00 | 208.13 | 1.13 | 98.31 | Silicate Iron Formation |

| 221.84 | 224.45 | 2.61 | 3.88 | Silicate Iron Formation | |||||||

| 17GSE526 | UM | 224 | -51 | 430051 | 7271237 | 602 | 444.95 | 446.20 | 1.25 | 3.14 | Silicate Iron Formation |

| 17GSE528 | UM | 218 | -67 | 429911 | 7271144 | 310 | 366.40 | 367.15 | 0.75 | 1.37 | Silicate Iron Formation |

| 470.00 | 472.05 | 2.05 | 23.20 | Greywacke | |||||||

| inc | 470.00 | 470.95 | 0.95 | 48.65 | Greywacke |

True widths of the intervals are unknown at this time.

DIF Target

Mineralization within the DIF zone is focused within a folded, interbedded sequence of silicate iron formation and turbidite sediments where the units are coincident with gold bearing structures. Arsenopyrite, pyrrhotite, and pyrite occur in variable concentrations within the DIF horizon where a portion of high grade mineralization is recognized to occur in association with localized quartz veining. Recognition of this broad new stratigraphic zone with structural elements common to other Goose Property deposits is a technical success. Concurrently developing the geological and mineralization framework, testing of the DIF target is considered preliminary therefore additional modelling and future exploration targeting will focus to best understand and evaluate for resource additions.

Summer Drilling Summary

Sabina completed 9,869 meters of drilling in 17 drill holes during the summer program with significant success demonstrated at the Umwelt Vault and Llama extension targets (news releases Sept 5, 2017; Oct 19, 2017; Nov 2, 2017). Exploration efforts focused on the continued advancement of key mineralization settings that are analogous to current Back River resources.

Testing of prominent gold trends at the Goose Property included drilling at the GNS and Kogoyok targets. At GNS, favourable structure and stratigraphy coincident with mineralization is interpreted to be a shallow limb expression linked to the larger Llama-Umwelt trend. Drill hole 17GSE529 was completed during the summer program, testing open plunge controls in an effort to establish orientation of the mineralizing structure. At Kogoyok two drill holes systematically and successfully tested a favourable intersection lineation of lower iron formation and a felsic intrusion within a controlled plunge orientation over a strike length of approximately 120m. The second drill hole, 17GSE527, returned no significant results.

Exploration at the GNS and Kogoyok targets continues to advance and remains fundamental in the development of the geological framework that is a key tool in vectoring towards further resource potential at the Goose property.

All additional results not previously released from the summer 2017 drill program are summarized in Table 2.

Sabina will integrate the 2017 drill results and findings to further enhance the current geological model, and together with new geophysical surveys and renewed prospecting and mapping efforts Sabina will continue to pursue and focus on high impact greenfield and resource extension opportunities through 2018.

Qualified Persons

The Qualified Person as defined by NI 43-101 as pertains to the Back River Project, is James Maxwell P.Geo, Exploration Manager, for the Company. All drill core samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs which include the insertion of certified reference materials, blank materials and duplicates analysis. All samples are sent to SGS Canada Inc. located in Burnaby, British Columbia where they are processed for gold analysis by 50 gram fire assay with finish by a combination of atomic absorption and gravimetric methods. Additionally, analysis by screen metallic processes is performed on select samples.

Sabina Gold & Silver Corp

Sabina Gold & Silver Corp. is a well-financed, emerging precious metals company with district scale, advanced, high grade gold assets in one of the world’s newest, politically stable mining jurisdictions: Nunavut, Canada.

Sabina released a Feasibility Study on its 100% owned Back River Gold Project which presents a project that has been designed on a fit-for purpose basis, with the potential to produce ~200,000 ounces a year for ~11 years with a rapid payback of 2.9 years (see “Technical Report for the Initial Project Feasibility Study on the Back River Gold Property, Nunavut, Canada” dated October 28, 2015). At a US$1,150 gold price and a 0.80 (US$:C$) exchange rate, the Study delivers a potential after tax internal rate of return of approximately 24.2% with an initial CAPEX of $415 million.

In addition to Back River, Sabina also owns a significant silver royalty on Glencore’s Hackett River Project. The silver royalty on Hackett River’s silver production is comprised of 22.5% of the first 190 million ounces produced and 12.5% of all silver produced thereafter.

The Company had approximately C$38 million in cash and equivalents on September 30, 2017.

Table 2.0 – Table of Remaining Significant Drill Intersections

| Hole Id | Area | Azimuth | Dip | Easting | Northing | Depth | From (m) | To (m) |

Length (m) |

Au (g/t) |

Lithology |

| 17GSE516 | LL | 225 | -70 | 429801 | 7271428 | 137 | Abandoned - NSV | ||||

| 17GSE516B | LL | 225 | -69 | 429791 | 7271437 | 737 | 165.70 | 166.75 | 1.05 | 1.50 | Silicate Iron Formation |

| 178.30 | 179.20 | 0.90 | 1.06 | Silicate Iron Formation | |||||||

| 461.80 | 462.25 | 0.45 | 4.61 | Silicate Iron Formation | |||||||

| 619.60 | 620.90 | 1.30 | 1.05 | Oxide Iron Formation | |||||||

| 622.90 | 625.10 | 2.20 | 1.14 | Oxide Iron Formation | |||||||

| 653.75 | 654.70 | 0.95 | 1.40 | Silicate Iron Formation | |||||||

| 658.60 | 659.70 | 1.10 | 1.31 | Silicate Iron Formation | |||||||

| 720.75 | 722.25 | 1.50 | 1.74 | QV in Greywacke | |||||||

| 17GSE521 | LL | 223 | -70 | 429847 | 7271379 | 797 | 207.00 | 208.13 | 1.13 | 98.31 | Silicate Iron Formation |

| 221.84 | 224.45 | 2.61 | 3.88 | Silicate Iron Formation | |||||||

| 17GSE522B | UM | 216 | -72 | 430860 | 7270487 | 863 | 612.15 | 615.85 | 3.70 | 5.27 | Mixed Greywacke & Iron Formation |

| inc | 614.70 | 615.85 | 1.15 | 14.94 | Iron Formation | ||||||

| 633.05 | 633.95 | 0.90 | 4.05 | Silicate Iron Formation | |||||||

| 17GSE523 | UM | 214 | -73 | 430573 | 7270560 | 266 | Abandoned - NSV | ||||

| 17GSE524 | LL | 217 | -72 | 429770 | 7271350 | 752 | 66.40 | 66.95 | 0.55 | 2.40 | Silicate Iron Formation |

| 294.65 | 295.70 | 1.05 | 1.07 | Silicate Iron Formation | |||||||

| 636.30 | 636.90 | 0.60 | 9.53 | Oxide Iron Formation | |||||||

| 17GSE525 | UM | 214 | -70 | 430850 | 7270580 | 1010 | 665.30 | 666.45 | 1.15 | 2.34 | Oxide Iron Formation |

| 721.60 | 723.00 | 1.40 | 1.79 | Oxide Iron Formation | |||||||

| 805.85 | 807.85 | 2.00 | 1.14 | Oxide Iron Formation | |||||||

| 810.00 | 811.00 | 1.00 | 1.18 | Oxide Iron Formation | |||||||

| 816.40 | 817.00 | 0.60 | 11.67 | Greywacke | |||||||

| 17GSE526 | UM | 224 | -51 | 430051 | 7271237 | 602 | 444.95 | 446.20 | 1.25 | 3.14 | Silicate Iron Formation |

| 17GSE527 | Kog | 179 | -58 | 431269 | 7269128 | 419 | NSV | ||||

| 17GSE528 | UM | 218 | -67 | 429911 | 7271144 | 310 | 231.40 | 232.40 | 1.00 | 1.21 | Oxide Iron Formation |

| 239.00 | 240.15 | 1.15 | 2.59 | Oxide Iron Formation | |||||||

| 366.40 | 367.15 | 0.75 | 1.37 | Silicate Iron Formation | |||||||

| 470.00 | 472.05 | 2.05 | 23.20 | Greywacke | |||||||

| inc | 470.00 | 470.95 | 0.95 | 48.65 | Greywacke | ||||||

| 17GSE529 | GNS | 42 | -60 | 431490 | 7269560 | 344 | 313.45 | 320.45 | 7.00 | 1.38 | Oxide Iron Formation |