VANCOUVER, British Columbia, Sept. 05, 2017 (GLOBE NEWSWIRE) -- Sabina Gold & Silver Corp. (“Sabina”) or (the “Company”) (TSX:SBB) is pleased to announce the first results from the summer exploration diamond drilling program at its 100% owned Back River Gold Project in Nunavut, Canada. Approximately 10,000 m of planned drilling with three drill rigs is progressing well with the objective of testing high impact targets in and around existing resources at the Goose Property.

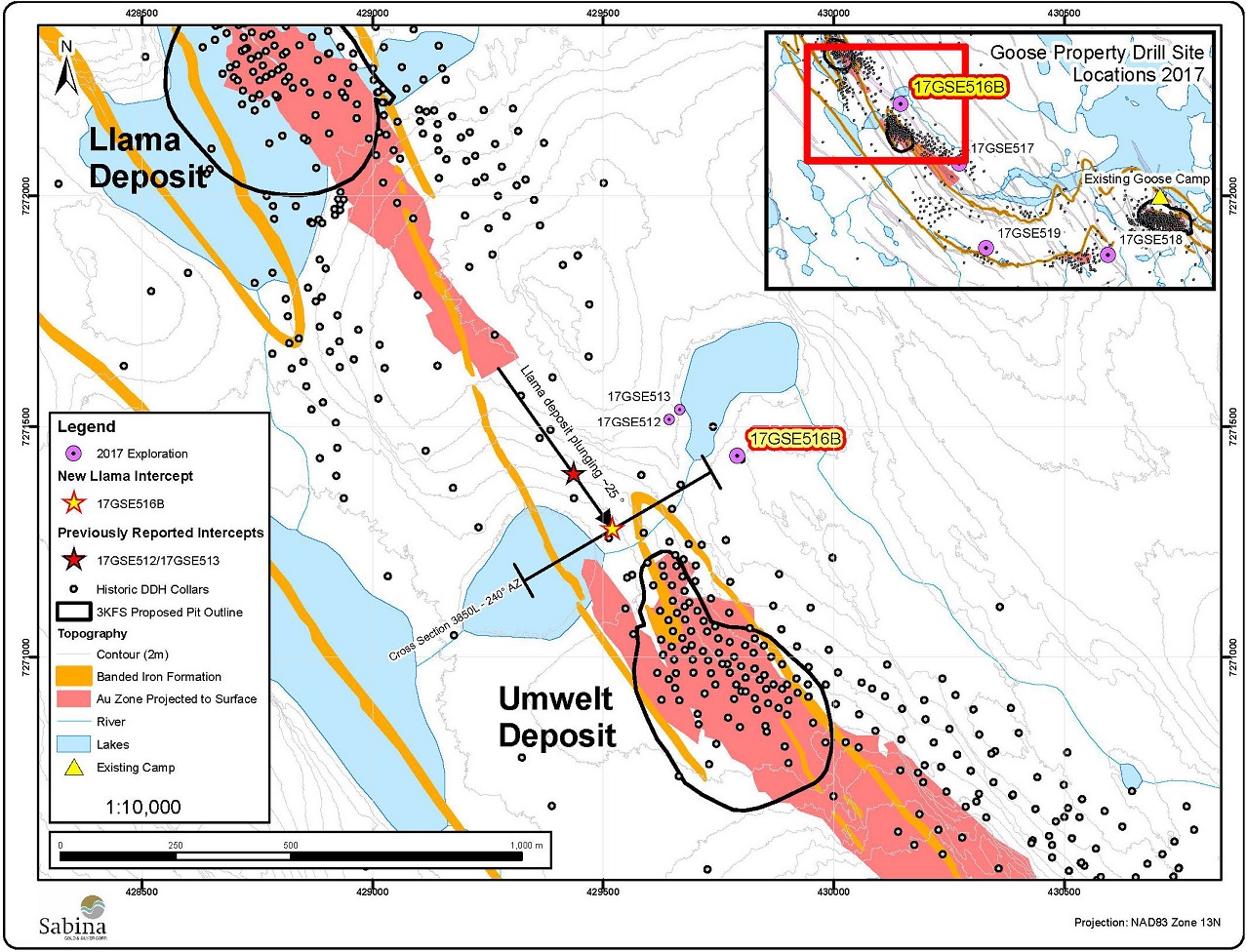

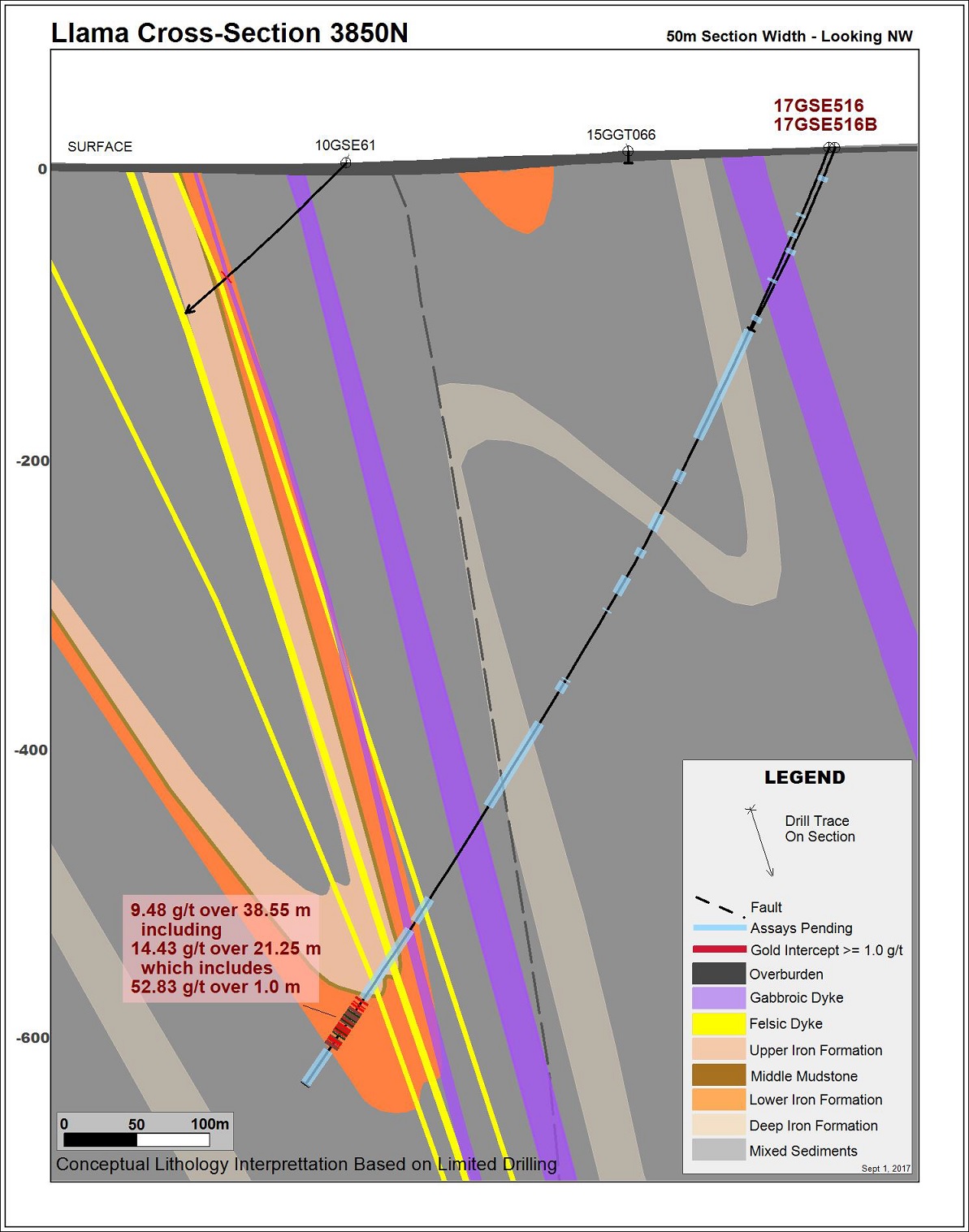

Drill hole 17GSE516B intersected 9.48 g/t Au over 38.55 m within a strongly altered and mineralized lower iron formation package that is part of the continuation of the highly prospective, mineralized, Llama structure. This intercept is approximately 160 m down plunge from previously reported drill hole 17GS513 (see news release June 13, 2017) which intersected over 40 meters of altered and mineralized lower iron formation that included 6.52 g/t Au over 8.3 meters from 618.9 m to 627.2 m. This new zone represents a significant increase in sulphide mineralization along the structure, is open in all directions and demonstrates that the Llama gold structure is robust for a continued distance along strike of over 1,500 m from surface to a vertical depth of 595 m. Drilling will continue to test this new zone, in both the up and down plunge directions.

In addition to the drilling at Llama, drill holes have been completed at the Umwelt Vault zone, Kogoyok and Echo where results will be released as assays are received.

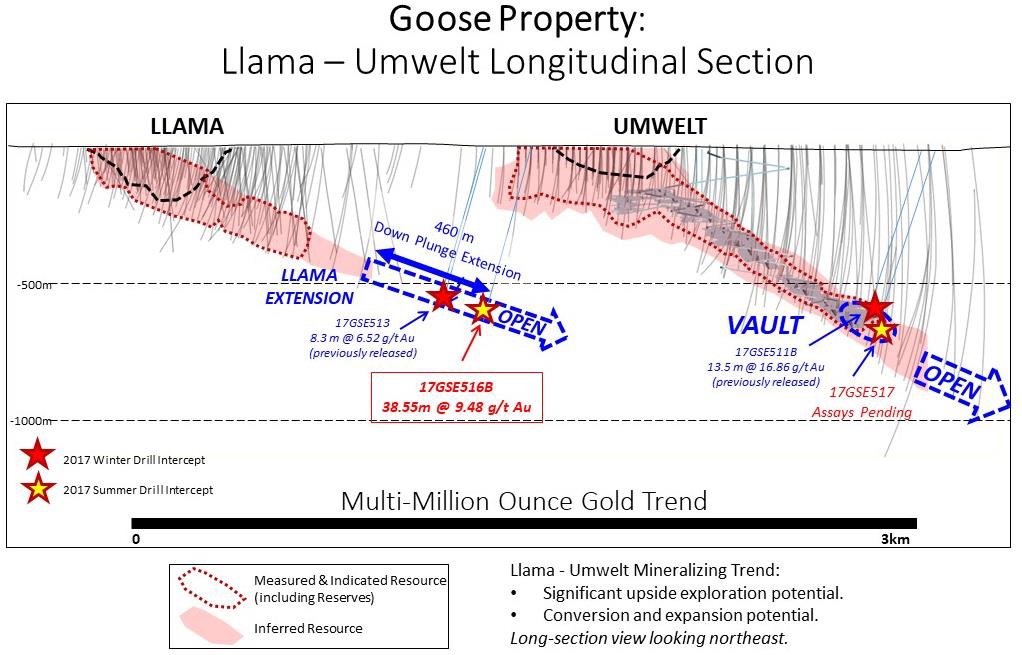

Figure 1: Plan map of 2017 drilling with detail for the Llama-Umwelt mineralization trend

Figure 2: Llama cross section at 3850N

Bruce McLeod, President and CEO, stated, “The results from this hole are outstanding and represent some of the best intercepts completed by the company since the discoveries of the Llama and Umwelt deposits in 2010. Our team has continued to vector in on concept targets that can add grade and tonnes by evaluating a set of geological controls that occur at several high grade areas on the Back River claim blocks. These exploration concepts have been proven at this new Llama Zone and the Umwelt Vault zone with grades that are significantly higher than the Back River average resource grade. These new zones not only present opportunity for extended mine life, but could also positively impact project economics. I believe that further results will continue to demonstrate the tremendous blue-sky potential at Back River and the ability of our exploration team to prove their target concepts.”

Llama Extension and New High Grade Zone

At Llama Extension, the newly discovered high-grade zone is hosted within a tightly folded sequence of the Back River lower iron formation stratigraphy. This unit is identified as hosting the majority of the current resources at the Back River Project and is widely distributed across the Goose Property. Mineralization consists of significant arsenopyrite, pyrrhotite and abundant visible gold over a broad intercept that is associated with significant quartz veining and strong amphibole and chlorite alteration. Initial samples from the drill hole have been prioritized to focus on the strongest mineralization within the zone with additional assays pending for further samples adjacent to the interval and throughout the drill hole.

Drill hole 17GSE516B represents the deepest hole, vertically and down plunge, to date in the Llama gold structure approximately 460m down plunge beyond the current resource limit. This intercept projects the structure parallel to the area vertically below the Umwelt deposit (43-101 compliant resource: 9,050,000 tonnes of 6.99 g/t Au for 2,034,275 oz of Measured and Indicated resources, 1,909,000 tonnes of 11.01 g/t Au for 676,000 oz of Inferred resources) and remains as an exceptional exploration environment.

Sabina believes that the robust continuity of gold deposits hosted within the Llama to Umwelt trend, coupled with the potential for new discoveries in a parallel setting could establish an increasing gold endowment for each kilometer of strike where iron formation stratigraphy volumes increase in a down plunge setting.

Table 1.0 - Table of Significant Drill Intersections

| Hole Id | Area | Azimuth | Dip | Easting | Northing | Depth | From (m) |

To (m) |

Length (m) |

Au (g/t) |

Lithology |

| 17GSE516B | LL | 225 | -69 | 429791 | 7271437 | 737 | 667.40 | 705.95 | 38.55 | 9.48 | Oxide Iron Formation |

| including | 675.75 | 697.00 | 21.25 | 14.43 | Oxide Iron Formation | ||||||

| including | 693.05 | 694.05 | 1.00 | 52.83 | Oxide Iron Formation |

True widths unknown

Qualified Persons

The Qualified Person as defined by NI 43-101 as pertains to the Back River Project, is James Maxwell P.Geo, Exploration Manager, for the Company. All drill core samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs which include the insertion of certified reference materials, blank materials and duplicates analysis. All samples are sent to SGS Canada Inc. located in Burnaby, British Columbia where they are processed for gold analysis by 50 gram fire assay with finish by a combination of atomic absorption and gravimetric methods. Additionally, analysis by screen metallic processes is performed on select samples.

Sabina Gold & Silver Corp.

Sabina Gold & Silver Corp. is a well-financed, emerging precious metals company with district scale, world class undeveloped assets in one of the world’s newest, politically stable mining jurisdictions: Nunavut, Canada.

In September, 2015, Sabina released a Feasibility Study on its 100% owned Back River Gold Project which presents a project that has been designed on a fit-for purpose basis, with the potential to produce ~200,000 ounces a year for ~11 years with a rapid payback of 2.9 years. At a US$1,150 gold price and a 0.80 exchange rate, the Study delivers a potential after tax internal rate of return of approximately 24.2% with an initial CAPEX of $415 million.

The Project is advancing through the environmental assessment process with a positive recommendation to the Minister of Indigenous and Northern Affairs Canada from the Nunavut Impact Review Board in July 2017. The Minister is now reviewing the file and we expect a decision in Q4, 2017.

In addition to Back River, Sabina also owns a significant silver royalty on Glencore’s Hackett River Project. The silver royalty on Hackett River’s silver production is comprised of 22.5% of the first 190 million ounces produced and 12.5% of all silver produced thereafter.

The Company had cash and equivalents of C$36.6m at June 30, 2017 (not including the proceeds of the recently announced $6 million flow through financing).