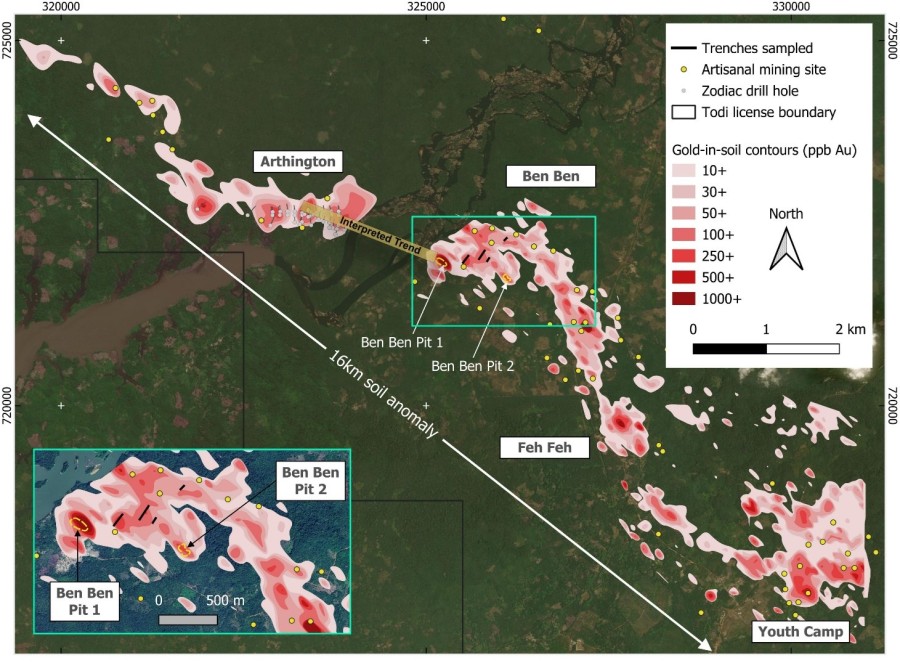

Vancouver, British Columbia – TheNewswire - June 25, 2025 – Dixie Gold Inc. (TSX VENTURE: DG)(“Dixie Gold” or the “Corporation” or the “Issuer”) is pleased to provide a further update to its prior disclosures related to the Preston Uranium Project JV. The Corporation reports that as of June 20, 2025 it has received confirmation that the planned 6,000m to 7,000m summer 2025 drill program at the Preston Uranium Project JV has commenced, with the drill program being managed by the project’s operator, Orano Canada Inc. (the “Operator”). The Preston Uranium Project JV is a tripartite joint-venture among Orano Canada Inc., Skyharbour Resources Ltd. and Dixie Gold. The drilling underway at the Preston Uranium Project JV - in which Dixie Gold is a management committee member of and minority JV interest holder in - is expected to drill test multiple high-priority uranium targets during this summer. As background, the Preston Uranium Project JV holds project area of approximately 49,635 ha, including dispositions that are adjacent to NexGen Energy Ltd.’s Rook-1 project

Consistent with the Issuer’s prior guidance, the current drill program has a planned all-in budget of approx. C$3,500,000.

Figure 1 – Disposition Map of the Preston Uranium Project JV

Parties with an interest in the Preston Uranium Project are also referred to the recent news release - in which the Issuer is named - by Skyharbour Resources Ltd. (see Skyharbour Resources Ltd. news release, Skyharbour and JV Partner Orano to Commence Extensive Summer 2025 Drilling Program at Preston Uranium Project, dated May, 15, 2025). Skyharbour Resources Ltd. was the Issuer’s first project co-partner as relates to the Preston Uranium Project, with Orano Canada Inc. later completing its earn-in to form the joint venture (see Dixie Gold news release, Orano Canada Inc. Completes First Earn-In Option and Forms Joint Venture with Dixie Gold Inc. at the Preston Uranium Project, dated March 26, 2021).

As at December 31, 2024, Dixie Gold held an approximate 21% interest in the Preston Uranium Project JV, although this interest level is expected to materially decline upon completion of the commenced drill program. The Issuer – cognizant of its portfolio of interests and capital constraints - undertook its approval of the multi-million-dollar drill program expense through project-level dilution as opposed to company-level equity dilution (which would have diluted across all project interests).

The Issuer presently expects that the drill program should be completed by late-summer 2025, with results likely known by late-fall. Dixie Gold will issue further public disclosure upon receipt of results from the Operator if a discovery is made or if other material-development occurs. A discovery would be expected to be materially positive to the Issuer, despite interest dilution anticipated as a result of the approx. C$3,500,000 drill program budget. If the results of the high-priority targets to be tested during the summer 2025 drill program at the Preston Uranium Project do not result in a discovery or are not material, the Issuer does not anticipate issuing further public disclosure thereon. In such an event, the Issuer would also re-assess its forward-interest in the Preston Uranium Project JV, recognizing that dilution provisions ultimately extinguish working interests absent material ongoing capital contributions. The Issuer notes that such future funding requirements, inclusive of the current drill program, are expected to be and/or remain above the Issuer funding capacity based upon the Issuer’s reported working capital and the funding market surrounding its market-based capitalization. With the drill program targeting high priority targets, the Issuer believes that the current program represents an appropriate program of scale and point-in-time to after-evaluate its continued interest.

Dixie Gold looks forward to the results of the multiple high-priority uranium targets expected to be drill tested this summer by way of the underway drilling and extends its appreciation to Orano Canada Inc. for their efforts and expertise in managing the program.

Update Regarding Other Portfolio Project Interests & Management Commentary

Management of the Issuer also wishes to highlight certain regional activity and provide project commentary related to other portfolio interests held by Dixie Gold, as well as discuss its approach to managing its current project pipeline against funding conditions/levels.

Dixie Gold has and continues to aim to have a portfolio of at-scale exploration interests that provide it with opportunities and importantly, even-driven optionality for the Issuer’s shareholders. This process has been assisted, in material amount, by past funding investments made into the Issuer by current management. The Issuer looks to undertake its activities with prudence to the high-risk, low-success nature of early-stage mineral exploration, the obligatory costs of running a publicly traded corporation, as well as to the Issuer’s capital structure and market conditions. Exploration work undertaken by Dixie Gold is, by definition, within the confines of the Issuer’s limited market capitalization and any partnerships on specific assets that would generally also relate to and reflect that arm’s-length metric. Management of the Issuer has successfully facilitated significant exploration work at the Issuer’s projects and interests over time, including - as the most recent example - the current 6,000m+ drill program at the Preston Uranium Project (as discussed above and prior thereto within its publicly filed materials).

The Corporation has 31,737,188 common shares issued and outstanding, which Dixie Gold believes represents compelling exposure, on a per share basis, to its various interests.

In tandem with its sector, the Issuer needs to raise capital and/or divest project interests to fund both project exploration and expenses associated with being a listed entity. Depending upon Issuer and/or sector valuations, dilution may be material. The Corporation notes that it provides public updates where material and when appropriate, and not on a preset schedule (apart from ordinary course prescribed financial reporting obligations). The frequency of event-related updates may be intermittent in nature due to activity levels that the limited working capital position of the Issuer permits. The Corporation’s view towards its share structure has been (and remains) an internal priority. Where dilution necessarily occurs to meet the capital costs of adding new projects, advance/explore existing projects and fund its required and ordinary-course public company costs, the Issuer has generally sought to place such equity with parties who are more likely to align with longer-term shareholdings versus those who may be seeking to engage in short-term placement flipping to the detriment of remaining shareholders.

Rottenstone Area Update (Saskatchewan)

As corresponds to other interests held by Dixie Gold in Saskatchewan beyond the Preston Uranium Project JV, the Issuer is monitoring for awaited results of the recently completed drill program by Ramp Metals Inc. (see Ramp Metals Inc. news release, Ramp Metals Completes Spring Drill Program and Announces Additional Mineralization at Rush Target, dated June 6, 2025), which Dixie Gold expects may assist with helping to determine next steps, if any, as relates to the various dispositions it cost-effectively acquired near the Rottenstone area during the course of 2025 (see also news releases by the Issuer dated January 17, 2025 and January 20, 2025). The Issuer notes that this emerging exploration camp may represent an area of sustained investment community interest going-forward, subject to favourable results from the spring 2025 follow-up drill program by Ramp Metals Inc.

In regards to the region, the dispositions held by the Issuer principally relate to the Hickson Lake Pluton, including its mapped quartz diorite unit, which is of interest to the Issuer given that Ramp Metals Inc. intersected 73.55 g/t Au over 7m within quartz diorite (see Ramp Metals Inc. news release, Ramp Metals Initiates Drill Program for the Rottenstone SW Gold Property, dated April 2, 2025). A successful drill campaign by Ramp Metals Inc. within their quartz diorite would be expected to increase the Issuer’s interest in examining its quartz diorite coverage, where applicable, although the Issuer cautions that current geological models for the area are early stage given limited exploration history of the region and the recency of the original Ramp Metals Inc. gold discovery in 2024 (see Ramp Metals Inc. news release, Ramp Metals Announces New High-Grade Gold Discovery of 73.55 g/t Au over 7.5m at its Rottenstone SW Project, dated June 17, 2024).

Among the dispositions of Dixie Gold are those highlighted by Figure 2 below:

Figure 2 – Highlight Map of Rottenstone Area Dispositions

As reported by the Issuer in its Management Discussion & Analysis for the period ended March 31, 2025, as dated May 25, 2025 (available on sedarplus.ca), the Issuer paid the Crown $44,917 in fees during the first quarter of 2025 to establish an inaugural mining claim position in the area, which in turn provides the Issuer with favourable risk-reward optionality to participate in regional developments (if and as warranted). During the second quarter of 2025, the Issuer has supplemented its dispositions in the area, consistent with its prior guidance (see Dixie Gold news release dated January 20, 2025). Most recently, the Issuer – by way of management’s expertise and proficiency - was successful in acquiring certain incremental grass-roots areas (including areas adjacent to prior dispositions held by the Issuer) during a public Crown re-opening event on June 3, 2025, with that re-opening having competitive conditions amongst various parties. In conjunction with said Crown re-opening, the Issuer remitted aggregate Crown fees of approx. $13,072 entitling it to additional disposition area of approx. 21,786 ha (Figure 2 above is updated with inclusion of such area, where applicable).

Determination of forward project materiality, if any, will be made in conjunction with the factors and future third-party results discussed above. The Issuer looks forward to seeing if the additional drilling by Ramp Metals Inc. is able to successfully follow-up on their 2024 discovery intercept.

Red Lake Project (Ontario)

The Issuer and its management team is also concurrently monitoring for results of an in-progress drill program by Kinross Gold Corporation with respect to their earn-in on BTU Metals Corp.’s Dixie Halo Project (see BTU Metals Corp. news release, Kinross Commences 8,000m Drilling Program on BTU's Dixie Halo Property Adjacent To Kinross' Great Bear Project, dated May 20, 2025), which Dixie Gold believes may, if near-term future results are favourable, draw more investor interest back to the area. Kinross Gold Corporation acquired its interest in the adjoining Great Bear Project through its acquisition of Great Bear Resources Ltd. in February 2022 (see Kinross Gold Corporation news release, Kinross completes acquisition of Great Bear Resources, dated February 24, 2022); the project area of which was later supplemented through a transaction with BTU Metals Corp. (see BTU Metals Corp. news release, BTU Announces Agreements with Kinross Gold Corporation: Private Placement, Asset Purchase Agreement and Option Agreement, dated February 23, 2023).

Through various efforts led by the Issuer’s experienced management, Dixie Gold has to-date been successful in maintaining a significant project in this exploration camp, while simultaneously being successful in retaining a compelling share structure, factors of which have so far kept open favourable per-share metrics around this project.

Last year, during the summer of 2024, Dixie Gold announced a transaction with Kinross Gold Corporation, which involved four claims from the Issuer’s broader Red Lake Project (see Dixie Gold news release, Dixie Gold Inc. - Red Lake Gold Project Update, dated July 10, 2024). Consideration and terms were detailed in the aforementioned news release, and the Issuer continues to hold a 2.5% NSR on the four claims that it vended to Kinross Gold Corporation.

Management is currently working on efforts to allocate and distribute the Issuer’s remaining banked assessment credits – obtained to-date through previous exploration work – to meet upcoming anniversary assessment requirements of certain core mining claims underpinning its Red Lake Project. The Issuer notes generally that mining claims in Ontario have annual assessment review periods. Dixie Gold expects that in conjunction with this process and its project goals, that non-core portions of the project area may be reverted to the Crown in the due course of time. The Issuer is required to balance its limited market capitalization and constrained junior mining funding conditions against substantial funding requirements of its wide-scale project portfolio, which in turn necessitates rationalization and prioritization. To-date, the Issuer has successfully maintained both its Red Lake Project and share structure, although future outcomes to either cannot be assured. Crown-imposed assessment demands across the Issuer’s portfolio materially exceed the Issuer’s reported on-hand capital, which places capital-based limitations on the amount of activity (e.g. exploration) that the Issuer can directly and financially undertake at the current time - particularly void of large-scale equity dilution - and which in turn is expected to contribute to rationalization of project interests to those deemed of highest priority, and/or to obtain additional or new project interests with improved forward-dated assessment requirements and/or jurisdictional characteristics.

Dixie Gold aims to balance the pace of exploration within its project portfolio against the pace of equity dilution to its capital table, there being related trade-offs at all times.

Among a range of other ongoing work and regulatory duties associated with the Issuer, management also continues to evaluate various matters corresponding to the Red Lake Project, including – as contextually set within the market capitalization and fiscal limitations of the Issuer - those reported by the Issuer in recent news release (see Dixie Gold news release, Dixie Gold Inc. Reports Additional Asubpeeschoseewagong Anishinabek Correspondence, dated April 16, 2025).

The outlined claim area of the Issuer’s Red Lake Project, which is subject to forward-variance, is highlighted in Figure 3 below.

Figure 3 – Map of the Issuer’s Red Lake Project Mining Claims

Phoenix Lithium Project

The Corporation also presently holds mining leases in the Northwest Territories related to its Phoenix Lithium Project, which are satisfied through annual rent payments to the Crown. The Issuer intends to prioritize (and soon allocate) a portion of its existing working capital to make the next series of Crown rent payments due later this summer for certain of said aforementioned Crown leases. Successful past work by management to facilitate the restructuring of this mining project into long-duration mining leases (from initial mining claims) enables the Issuer to cost-effectively extend its entitlements during lithium market cycles, with present conditions representing a period of lowered sentiment towards lithium.

Disclaimer Regarding Third-Party News Releases

The Issuer is not responsible for the content, technical or otherwise, of any third-party news releases.

Disclaimer Regarding Adjacent Projects

The Issuer cautions that past results or discoveries on proximate or adjacent projects are not necessarily indicative of the results that may be achieved on projects or project interests held or operated by the Issuer.

Qualified Person

Antonio Carteri, P.Geo., and a “Qualified Person” as defined by NI 43-101, has reviewed and approved the technical information contained in this news release.

About Dixie Gold Inc.

Dixie Gold Inc. (TSXV: DG) is a publicly traded junior exploration company holding a portfolio of mining-related interests in Canada. For more information, please visit www.dixiegold.ca

On Behalf of the Board of Directors

Ryan Kalt

Chief Executive Officer

Dixie Gold Inc.

T: 604.687.2038

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Canadian securities laws. Some of the forward-looking statements may be identified by the use of forward-looking words. Statements that are not historical in nature, including the words "anticipate," "expect," "suggest," "plan," "believe," "intend,", “intention” "estimate," "target," "project," "should," "could," "would," "may," "will," "forecast" and/or other similar expressions are intended to identify forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties, including but not limited to plans, activities and results related to the Issuer’s exploration projects, as well as with regards to certain uncertainties and risks as pertains to any and all exploration work, including exploratory drilling, without limitation, at the Issuer’s Preston Uranium Project JV and/or other work, plans or claim composition of the Issuer’s other projects, which include, without limitation but with reference to this news release, the Red Lake Project, the Phoenix Lithium Project and those mining dispositions held by the Issuer in Saskatchewan by way of the referenced Rottenstone region, as well as forward-statements to any corporate developments and/or strategies, which may include capital plans and/or expenditure plans and/or other matters related to any future capital sourcing and/or capital allocation. Actual results may differ materially from those currently expected or forecast in such statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.