New Gold Provides Rainy River Development Update; Project Schedule and Cost Remain in Line with January 2017 Plan

TORONTO, June 27, 2017 /CNW/ - New Gold Inc. ("New Gold") (TSX:NGD) (NYSE MKT:NGD) today provides an update on the construction of the company's Rainy River project, located in northwestern Ontario. Both the project schedule and capital cost estimate remain in line with New Gold's updated plan announced in late January 2017. The company continues to target first gold production in September 2017, and the estimated development capital cost from the beginning of this year to the targeted November 2017 commercial production remains $515 million.

Rainy River - Second Quarter 2017 Highlights

- Project spending in the second quarter expected to be approximately $170 million, with estimated remaining capital to achieve November commercial production of approximately $220 million

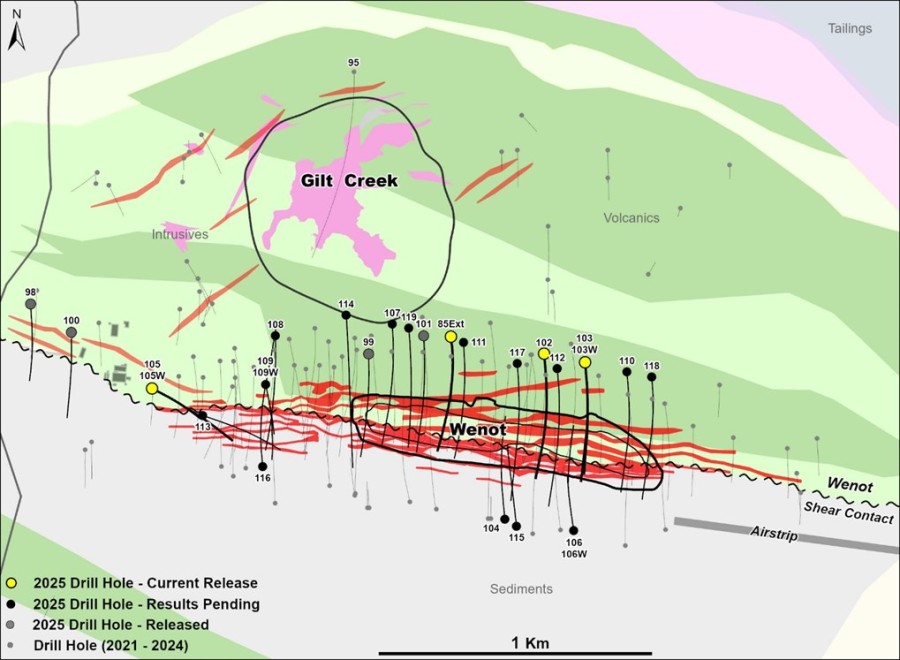

- The mining rate during the second quarter averaged approximately 115,000 tonnes per day despite impact of spring thaw

- Public comment period for Schedule 2 amendment concluded on June 12th; amendment timeline accelerated to fourth quarter of 2017

- Commissioning of primary crusher and conveyor system complete, with first crush completed on May 11, 2017 as planned

- Installation of mechanical, piping, electrical and instrumentation in processing facilities over 95% complete

- Ball and SAG mill achieved mechanical completion and hand over to operations for commissioning

- Energization of all key site power lines completed on schedule

- Overall earthworks over 85% complete

Figure 1. Rainy River open pit

Figure 2. Rainy River water management pond

Figure 3. Rainy River primary crusher and conveyor system successfully commissioned

Figure 4. Rainy River aerial view of process plant

Financial Update

- Entered into gold price option contracts covering 120,000 ounces of second half 2017 production (20,000 ounces per month) ensuring a guaranteed floor price of $1,250 per ounce while providing continued exposure to increases in the gold price up to $1,400 per ounce

- June 30, 2017 cash and cash equivalents expected to be approximately $175 million, with approximately $175 million also available under the revolving credit facility

"We are pleased with the solid progress we have made at Rainy River over the last five months," stated Hannes Portmann, President and Chief Executive Officer. "Through the second quarter, our team has both successfully commenced the staged commissioning of our process facility and delivered on our mining plan. As the pit has opened up, our operations team has recently delivered further increases in the mining rate, including several days over 130,000 tonnes per day."

Overall earthworks are over 85% complete and are tracking in line with New Gold's updated plan. Starter cell rock deliveries are scheduled for completion in late August 2017. Energization of all key site overhead power lines and construction of the tailings pipeline corridor have been completed.

All of the key structural components of the process facilities have been finalized and the setting of mechanical equipment and installation of piping, electrical and instrumentation services is close to completion. The primary crusher and conveyor system was successfully commissioned on schedule, and the first crush occurred on May 11, 2017. Commissioning of the ball mill and SAG mill has started and is scheduled to be completed in August 2017. The refining portion of the circuit should be ready to begin commissioning in July 2017. Dry and wet commissioning of the full process circuit is scheduled for August 2017.

The company requires an amendment to Schedule 2 of the Metal Mining Effluent Regulations to close two small creeks and deposit tailings. The proposed amendment was published in Canada Gazette I on May 13, 2017 and was followed by a 30-day public comment period which concluded on June 12, 2017. It is the company's understanding that the comments received during the comment period were all in support of the project proceeding as proposed. In light of the positive comments, the company has revisited the proposed timeline with Environment and Climate Change Canada and expects that adoption of the Schedule 2 amendment will be accelerated to the fourth quarter of 2017.

As previously disclosed, New Gold is presently constructing a starter tailings cell, located within the broader tailings management area, that does not require a Schedule 2 amendment. This will allow New Gold to commence operations prior to completion of the Schedule 2 amendment. Based on its location and scale, the starter cell would provide capacity for approximately six months of production tailings when the mill is operating at full capacity.

In addition, New Gold has finalized the engineering design to construct the creek closures using sheet pile at the centre of the portion of the dam which will cover the creeks. The purpose of this approach is both to reduce the construction time after receipt of the Schedule 2 amendment, and most importantly, to be able to complete the work regardless of weather conditions. New Gold has met with the Ontario Ministry of Natural Resources and Forestry (MNRF) to review the design and has also filed its application for the required permit amendment in support of the design. It is expected that the Ontario MNRF will complete its review of the application during the third quarter of 2017.

Project spending at Rainy River during the second quarter is expected to be approximately $170 million, which would bring the total year-to-date project spending to approximately $295 million. The remaining capital cost to the targeted November commercial production is estimated to be approximately $220 million. Of the remaining expenditure, approximately 45% is related to mining and owner's costs, 45% is related to earthworks, including completion of the starter tailings cell, with the balance of the remaining expenditure related to the completion and commissioning of the process plant.

New Gold continues to look forward to the expected growth in the company's production and cash flow once Rainy River transitions into operation later this year. Rainy River has multiple important asset qualities including its great jurisdiction, significant annual production potential, long estimated reserve life and continued exploration potential.

Financial Update

Earlier this month, New Gold entered into gold price option contracts covering 120,000 ounces of its second half 2017 production (20,000 ounces per month). The company purchased put options at a strike price of $1,250 per ounce which were largely funded by selling call options at a strike price of $1,400 per ounce. The net cost to the company of the gold option contracts was less than $1 million. As announced on April 26, 2017, the company also fixed the price for 43.7 million pounds of the company's second half 2017 copper production at $2.73 per pound. These initiatives increase the company's cash flow certainty during the remaining Rainy River development period and through to its scheduled commercial production later this year.

About New Gold Inc.

New Gold is an intermediate gold mining company. The company has a portfolio of four producing assets and two significant development projects. The New Afton Mine in Canada, the Mesquite Mine in the United States, the Peak Mines in Australia and the Cerro San Pedro Mine in Mexico (which transitioned to residual leaching in 2016), provide the company with its current production base. In addition, New Gold owns 100% of the Rainy River and Blackwater projects located in Canada. New Gold's objective is to be the leading intermediate gold producer, focused on the environment and social responsibility. For further information on the company, please visit www.newgold.com.