SCOTTSDALE, Ariz., Dec. 14, 2017 (GLOBE NEWSWIRE) -- TriStar Gold Inc. (the “Company” or “TriStar”) is pleased to announce that it will undertake a non-brokered private placement offering (the “Offering”) of units (the “Units”) of the Company. The Offering is being undertaken in cooperation with one of its large, existing institutional shareholders, which has indicated that it will provide the lead order. TriStar will offer for sale up to 13.64 million Units pursuant to the Offering, priced at $0.22 per Unit, for aggregate gross proceeds to the Company of up to $3.0 million.

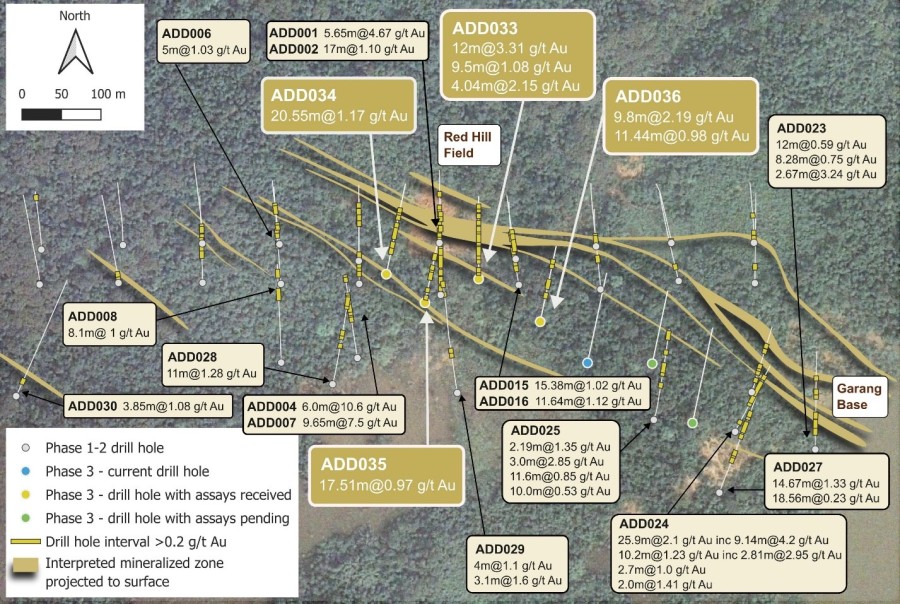

Nick Appleyard, TriStar’s President and CEO, stated “We are very happy that one of our existing institutional shareholders recognizes the exceptional value that this current market brings and is using the opportunity to increase its position to nearly 10%. The best thing we can do is to keep drilling at CDS and allow this project to grow to its full potential.”

Each Unit will be comprised of one common share (a “Common Share”) of the Company and one-half of a common share purchase warrant (each full common share purchase warrant being a “Warrant”). Each Warrant will entitle the holder thereof to acquire one additional Common Share at an exercise price of $0.35 for a period of 30 months following the closing date of the Offering (the “Closing Date”). The net proceeds from the Offering are intended to be used for advancing the Castelo de Sonhos project, working capital and general corporate purposes.

Closing of the Offering is expected to occur on or about the week of January 8, 2018, and is subject to receipt of all necessary regulatory approvals, including approval of the TSX Venture Exchange (the “TSX‑V”). The Offering will be completed pursuant to exemptions from prospectus requirements of applicable securities laws, and all securities issued in connection with the Offering will be subject to a four month hold period in accordance with applicable Canadian securities laws, commencing on the Closing Date.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

The Company may pay finders’ fees in connection with the Financing in accordance with the rules and policies of the TSX-V.

About TriStar:

TriStar Gold is an exploration and development company focused on precious metals properties in the Americas that have potential to become significant producing mines. The Company’s current flagship property is Castelo de Sonhos in Pará State, Brazil. The Company’s shares are listed on the TSX‑V under the symbol TSG. Further information is available at www.tristargold.com.